Paramount Warner Bros. Discovery hostile bid has a catch for cable networks

Verbal meme: Leonardo DiCaprio pointing at the TV — "Succession" fans will recognize the latest turn in the Warner Bros. Discovery (WBD) acquisition saga. This Monday, Dec. 8, David Ellison and Paramount (PSKY) "went hostile" in response to WBD's rejection of its $30/share offer in favor of ...

Verbal meme: Leonardo DiCaprio pointing at the TV — "Succession" fans will recognize the latest turn in the Warner Bros. Discovery (WBD) acquisition saga.

This Monday, Dec. 8, David Ellison and Paramount (PSKY) "went hostile" in response to WBD's rejection of its $30/share offer in favor of Netflix's (NFLX) $27.75/share and stock proposal late last week.

Paramount began bidding in opposition to Netflix's exclusive negotiation with a tender bid of $108 billion, Bloomberg reported. Warner Bros. has 10 days to respond to the submission of the offer, after which Paramount will make its overtures directly to WBD shareholders with the option to extend its offer window at the 20-day mark, per CNBC.

While a variety of aspects including the timeline, financing, and antitrust dimensions to this deal will all be mulled over endlessly, the valuation tug-of-war over Warner Bros. Discovery's linear cable assets has become singularly crucial.

These assets have become integral to an extent on par with the relative financing and very well may swing the whole shebang one way or the other.

Having written at length on the Netflix-Warner Bros. deal's plans for these cable assets, I'm well-positioned to weigh both proposals and explain what's being missed.

Here's where the fate of "WBD Global" (as the cable assets bundle is referred to internally at WBD) currently stands.

David Ellison appeared on CNBC's (CMCSA) "Squawk Box" and directly conveyed his feelings on WBD's cable assets.

Related: Netflix quietly drops Warner Bros. Discovery cable channels in sale

"The reason why we believe basically in this combination is very simply, by putting the creative content engines of the companies together, we believe we can win in content. We’d have an IP portfolio that’s competitive with Disney by putting Paramount and Warner Bros. together," Ellison said on CNBC Dec. 8.

"When you look at the linear portfolio, there are significant synergies. And when you look at what we can do with CBS, which is a crown jewel asset, all linear is not equivalent."

It's confident talk, and the idea that Paramount could simply do more with linear cable assets than Netflix is convincing, given that they are already in the news business with CBS. Fascinatingly, Ellison and Paramount's low relative valuation of the assets complicates this narrative.

Paramount values Discovery, cable assets less than Netflix does

If you're playing catch-up here, there is increased focus on the fate of Warner Bros. Discovery's cable assets (CNN, TNT, Discovery, and more) because Paramount is willing to buy said assets (aka Warner Bros. Discovery wholesale), whereas Netflix wants to purchase only Warner Bros. Streaming and Studios, asking Warner Bros. to spin off its linear cable network properties into a separate entity beforehand.

Inverting what one might assume, that doesn't mean Ellison thinks more highly of the cable assets.

"Ellison told CNBC on Monday that he values the linear cable networks, which aren’t part of Netflix’s bid, at just $1 per share. WBD internally has valued that business at about $3 per share," per CNBC's latest reporting.

As we learned earlier, Ellison believes he can do more with the assets because of Paramount's news experience. This messaging could be intended to purposefully undercut its value as a negotiation tactic, knocking down its individual price amid a bigger-sum offer.

In any case, Ellison was very clear that he thinks just the cash elements of his offer should be enough to push the deal Paramount's way.

Ellison has powerful backers in his father, Larry Ellison, Oracle founder and one of the world's richest men, and President Doland Trump, who previously endorsed David to facilitate Skydance's acquisition of Paramount.

Before Netflix and WBD got "exclusive," there was hope that the political pressure — and potentially an influx of Saudi money — would be enough to lure Zaslav & Co Paramount's way.

Paramount hostile-bid offer for Warner Bros. Discovery

Now things have gotten a bit more urgent, with Paramount negotiating at a (perceived) disadvantage due to Netflix and WBD being in "exclusive negotiations." Paramount's case will have to be convincing, not just competitive, for shareholders to go against what their board clearly wants.

Paramount Warner Bros. hostile-bid cash offer

"The Ellison family and RedBird Capital Partners are backstopping the $40.7 billion equity financing for the Paramount bid," Bloomberg reports. "Affinity Partners, the private equity firm founded by President Doland Trump’s son-in-law Jared Kushner, Saudi Arabia’s Public Investment Fund, Abu Dhabi’s L’imad Holding Company PJSC, and the Qatar Investment Authority are also financing partners."

So, for those keeping score, that's Ellison dollars, backed by Trump bucks, backed by the Saudi PIF money, with a dash of Qatari and Abu Dhabi financing to round it out. There you are: David Ellison's deadliest possible arsenal manifest.

It's impressive, and certainly indicative of how seriously he (and Paramount) take the threat of a potential Netflix/WBD monopoly.

Crucially, the sum bridge loan these financing partners have secured on Paramount's behalf is backed by Paramount's own company assets. The staggering-in-its-own-right $59 billion bridge loan that Netflix was able to painstakingly assemble is unsecured, meaning it's not backed by Netflix's own collateral.

Believe it or not, that's actually good for Netflix. It was made possible because Netflix has a higher investment rating than Paramount, which enabled it to secure better loan terms where it didn't have to stake itself from the banks setting up their deal, per reporting by Bloomberg.

The question is, will the money be enough, or will Ellison & Dads (get it, like "& Sons"?) have to pitch their plan against Netflix's?

Paramount won't split Warner Bros. Discovery, but Netflix will

This fight may become protracted. Paramount's hostile bid may be rejected by the Warner Bros. Discovery board within the next 10 days, at which point Paramount will begin pitching directly to shareholders.

By then, Ellison probably will need to explain why his plan to purchase WBD wholesale is superior to Netflix's proposed split and buy, beyond just the money. Because, you know, shareholders tend to want all the details.

So what would make shareholders say, "I saw their plan, and the Ellisons' plan was better," of Kendall Roy fame? As it stands, this is the Netflix plan that Paramount is up against.

More Streaming:

- Walt Disney is the only movie company that matters

- Disney makes bold statement on Warner Bros. purchase

- AMC stock secretly relies on these upcoming Disney films

If — and now it's a real if — the Netflix deal comes through, David Zaslav's pre-existing plan to splinter Discovery and linear cable content into a separate unit will finally occur in Q3 2026, per NPR.

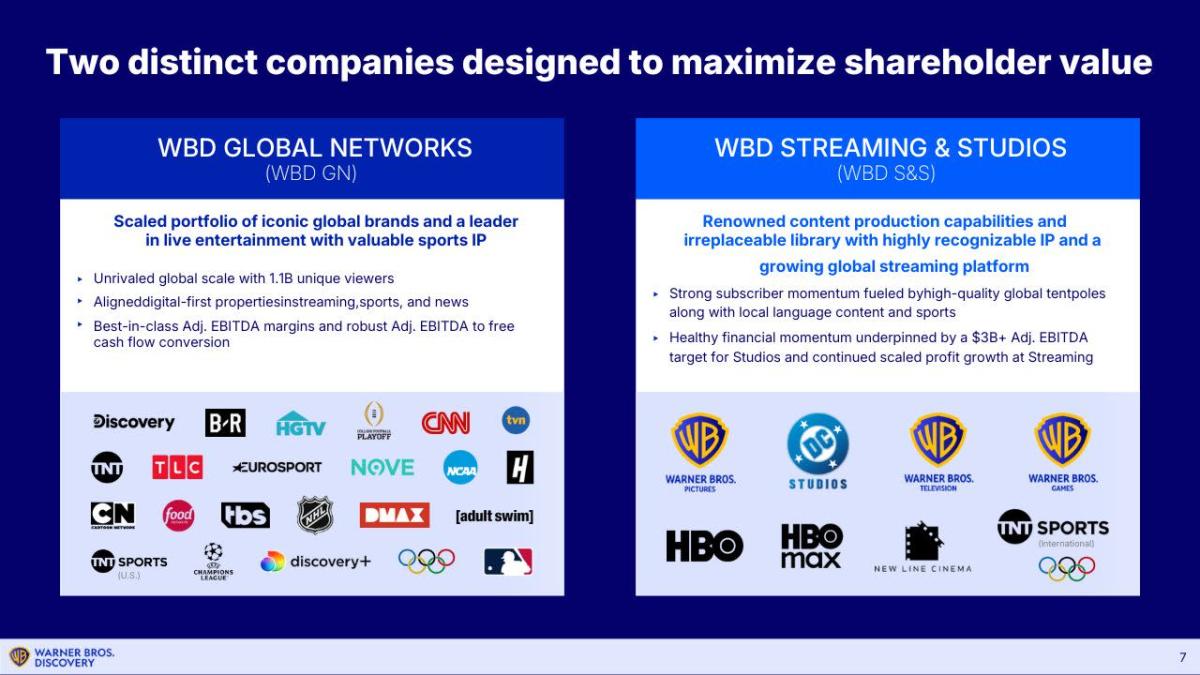

Once the separation is final, Netflix will be ready to formally absorb Warner Bros. Studios and HBO Max, aka Warner Bros. Streaming and Studios (see below).

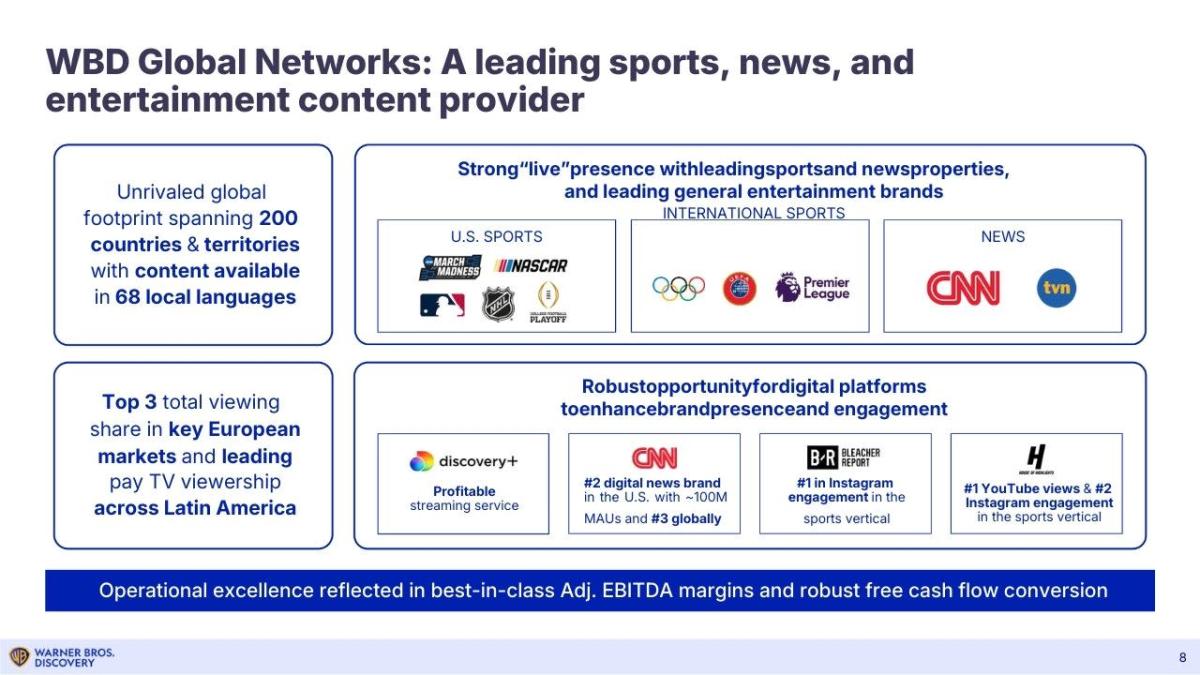

“The newly separated publicly traded company holding the Global Networks division, Discovery Global, will include premier entertainment, sports, and news television brands around the world,” according to Netflix’s Dec. 5 press release.

“[Discovery Global will include] CNN, TNT Sports in the U.S., and Discovery; free-to-air channels across Europe; and digital products such as Discovery+ and Bleacher Report.”

Now if you're confused at what "Discovery Global" is, that's just Netflix deal-speak for the separate "WBD Global" unit comprised of linear cable news and sports networks that Zaslav and WBD have had plans to split off as far back as June 9, per a Warner Bros. press release at the time.

Below are Warner's own plans for the separation, dating back to its June 2025 announcement. Discovery Global would likely mirror the structure proposed here as "WBD Global Networks."

Source: Warner Bros. Discovery slide presentation, June 9, 2025

Source: Warner Bros. Discovery slide presentation, June 9, 2025

The strength of that plan is that it bestows Discovery Global with an array of sports broadcasting rights as a parting gift, live sports being content gamechangers when it comes to viewership (read more analysis here).

One would assume a Paramount offer would absorb these assets into its already robust sports portfolio. For this reason alone, WBD would be a gaudy, paradigm-changing addition to Ellison.

When it comes to convincing time, Ellison will doubtless present his own vision to complement his considerable cash offer. Dec. 8's movement and talk-show appearance gave us the first outline of some of the angles he may take, including that CNN is in better hands alongside CBS.

The next nine news cycles — remember, WBD has 10 days to respond — will indicate whether the Warner Bros. Discovery board will even entertain Paramount's vision. If not, this will get nastier - and that's before the (seemingly inevitable) legal motions start flying back and forth.

Related: Disney makes bold statement on Warner Bros. purchase

What's Your Reaction?