Ray Dalio’s Bridgewater invests $253 million in major AI stock

Ray Dalio’s Bridgewater just made a massive $253 million statement in the hotly competitive AI arms race. In its latest 13F, the macro giant upped its stake in Nvidia (NVDA) by nearly 1.35 million shares, bumping its position to $721 million at year-end. That puts the AI bellwether at nearly 2.63% ...

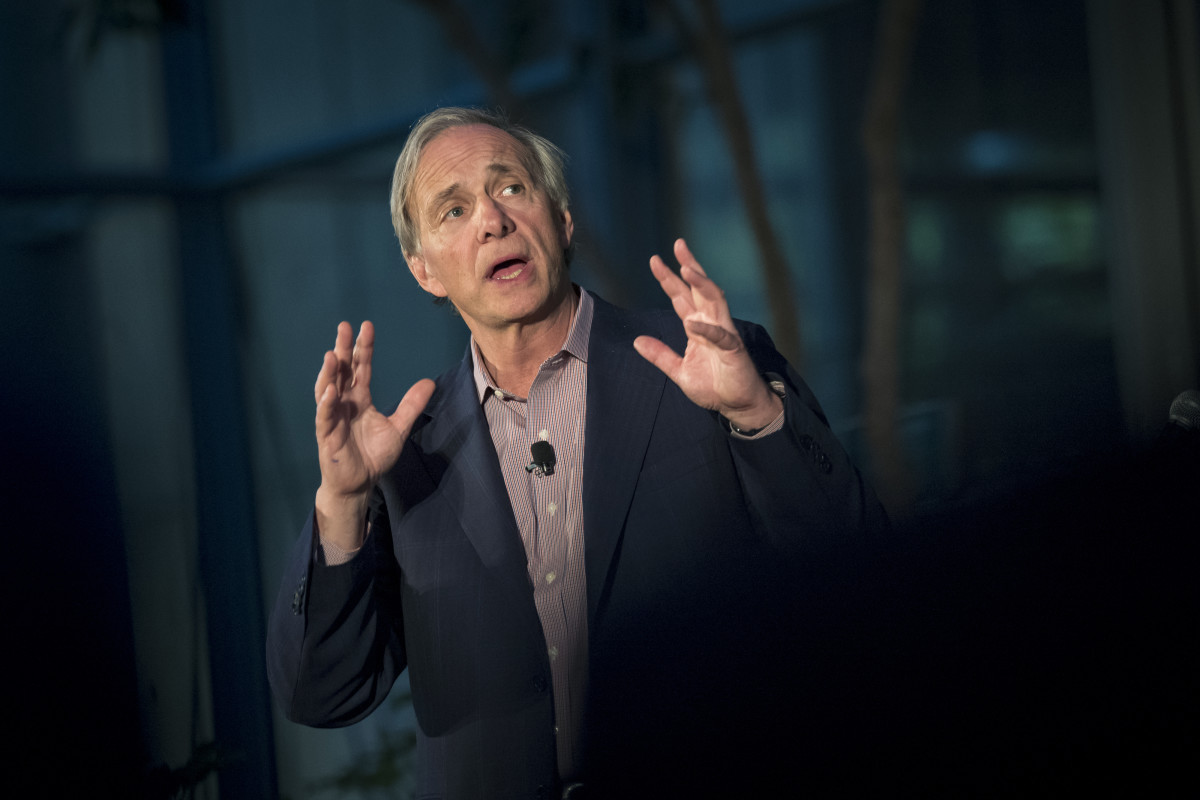

Ray Dalio’s Bridgewater just made a massive $253 million statement in the hotly competitive AI arms race.

In its latest 13F, the macro giant upped its stake in Nvidia (NVDA) by nearly 1.35 million shares, bumping its position to $721 million at year-end. That puts the AI bellwether at nearly 2.63% of Bridgewater’s whopping $27.4 billion U.S. stock portfolio.

Clearly, that was a meaningful addition, and it lands at a time when Nvidia’s stock has been under considerable duress.

Over the past six months, the stock has barely budged, rising just 0.7%, and it is down 2% year to date.

Even so, the bigger picture hasn’t changed, with Nvidia remaining the backbone of the AI buildout.

Moreover, as long as the big hyperscalers continue writing major capex checks, the growth story remains well and truly intact.

Importantly, Bridgewater isn’t your regular hedge fund filing a 13F.

It’s arguably the biggest and most influential macro investing machine ever built, with its culture shaped by legendary investor Ray Dalio.

Bridgewater’s latest assets-under-management (AUM) figure is at a whopping $136.5 billion (discretionary assets under management), per WhaleWisdom.

Dalio, though, sold off his remaining stake in 2025 and, in stepping back from the board, handed the reins to CEO Nir Bar Dea. These days, Dalio still opines on debt-related risks, gold allocations, and the U.S. economy.

That said, Bridgewater’s Nvidia bet shows the fund has decided that this is still where you want to be long. Photo by Bloomberg on Getty Images

Bridgewater’s latest 13F moves

- Market value:$27.4 billion (prior: $25.5 billion)

- Inflows/outflows (as % of total MV):+4.63%

- New purchases:191 stocks

- Added to:450 stocks

- Sold out of:165 stocks

- Reduced holdings in:395 stocks

- Top 10 holdings concentration:36.3%

- Turnover: 29.5%

Source: WhaleWisdom

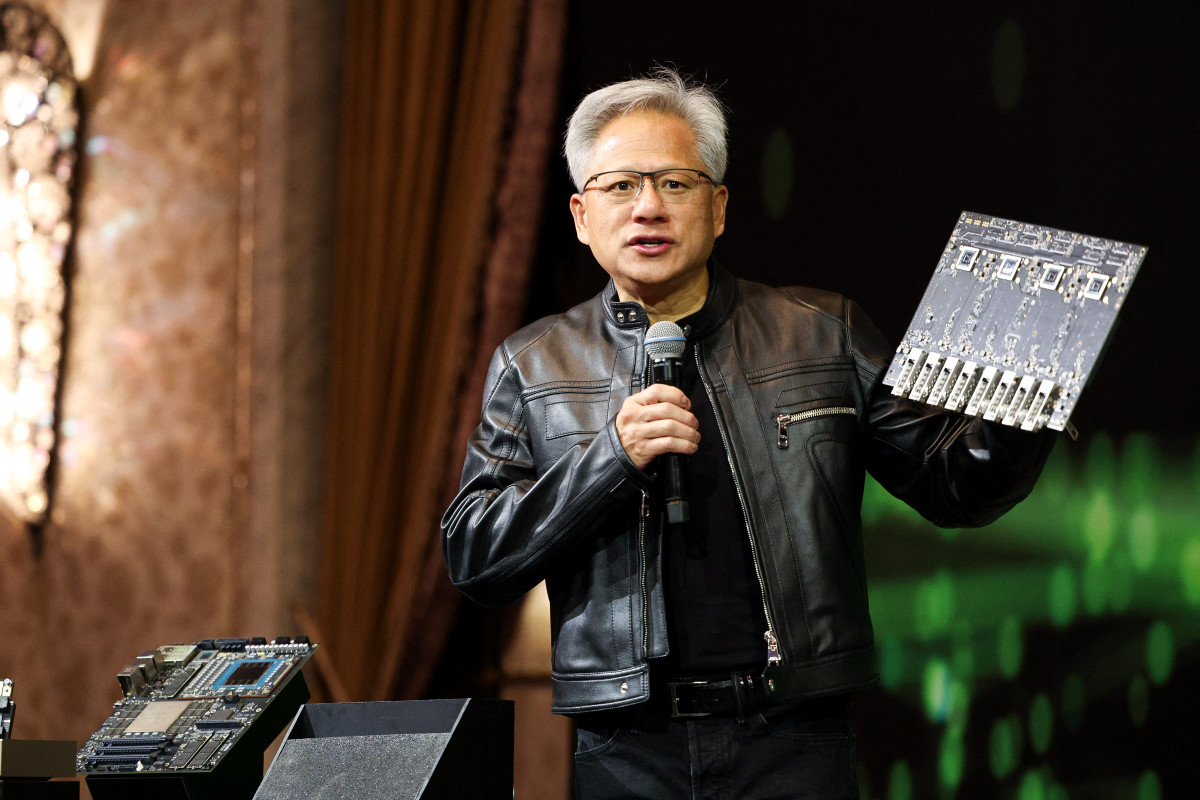

Nvidia’s still the AI kingmaker

Nvidia was Bridgewater’s largest single-stock holding in its latest 13F, and it comes at a point when investors are in “show me” mode with the AI trade.

For the macro giant, AI is like a massive capital cycle, a relentless arms race among businesses seeking to build quicker, smarter systems.

In that fiercely competitive space, Nvidia still dominates as a clear leader, serving as the backbone and tollbooth of the massive AI infrastructure buildout.

More Nvidia:

- Nvidia stock gets major reality check on ‘$100B’ number

- Veteran analyst delivers surprise verdict on Tesla, Nvidia

- NVDA, PLTR, small cap stock bets reset after U-turn

On the fundamentals side, Nvidia continues to impress, having surged past estimates across both lines in the past four consecutive quarters. In its most recent quarterly update (Q3 2026), it posted $57 billion in revenue, a whopping $2 billion beat, driven by $51.2 billion in data center revenue, up 66% year over year.

As we look ahead, analysts are largely upbeat over Nvidia’s prospects, on the back of massive 2026 hyperscaler capex plans and the tech giant’s full-stack advantage across chips, networking, and software.

Veteran analyst Dan Ives recently called Nvidia an indispensable player of the physical AI space.

Naturally, valuation discipline matters (trading at 39 times non-GAAP forward earnings), and spending cycles can cool off, but for now, Nvidia still remains at the center of gravity in AI.

Bridgewater’s biggest buys and sells

Top buys (largest value)

- State Street SPDR S&P 500 ETF Trust: $1.29 billion

- Oracle: $286 million

- Micron Technology: $253 million

- Nvidia: $253 million

- Newmont: $192 million

Source: WhaleWisdom

Top sells (by percentage change)

- Uber Technologies: 1%

- Fiserv: 0.8%

- Alphabet (Class): 0.71%

- Meta Platforms: 0.66%

- Microsoft: 0.49%

Source: WhaleWisdom

13F holdings summary (percentage of portfolio)

- State Street SPDR S&P 500 ETF Trust: 11.08%

- iShares Core S&P 500 ETF: 10.45%

- Nvidia: 2.63%

- Lam Research: 1.9%

- Salesforce: 1.87%

Source: WhaleWisdom

Building around the AI core

Nvidia wasn’t the only addition in Bridgewater’s broader AI stack build as the fund leaned into the infrastructure around it.

Oracle and Micron were two of its biggest bets and represent two critical choke points in the AI buildout in cloud capacity and memory bandwidth.

Bridgewater boosted its Oracle stake from 406,279 shares in Q3 to 1,873,481 shares in Q4, bringing the total position to about $365 million.

Related: Jim Simons' Renaissance drops $520 million on surging tech stock

Oracle’s cloud performance has been mighty impressive, to say the least, with its fiscal Q2 2026 cloud sales rising to $8 billion, up 34% year over year, and infrastructure-as-a-service revenue surging 68% to $4.1 billion.

Also, remaining performance obligations came in at $523 billion, up 438%, underscoring massive AI-related commitments.

Micron is the bandwidth story that’s been one of the hottest tech plays on the back of the AI-led memory boom.

Bridgewater went from just 1,696 shares to 889,640 shares, building a sizeable $254 million stake.

Demand for high-bandwidth memory (critical for AI) is forecasted to expand from nearly $35 billion in 2025 to $100 billion by 2028, with Micron already having locked in 2026 HBM supply agreements.

Also, it’s lifting fiscal 2026 capex to nearly $20 billion to meet the insatiable demand.

Moreover, it’s worth noting that legendary mathematician Jim Simons’ Renaissance Technologies also added $520 million worth of Micron stock in its latest 13F, underscoring smart money’s interest in the AI-driven memory cycle.

Related: Morgan Stanley flags $45B hidden cybersecurity opportunity

What's Your Reaction?