Rs 300000000000 plan: Ratan Tata’s Tata group is planning to end its 90-year-old partnership with this group due to…, the group is…

Ratan Tata's Tata group has decided to part ways with Shapoorji Pallonji & Company Private Limited, which has been its partner for the last 95 years.

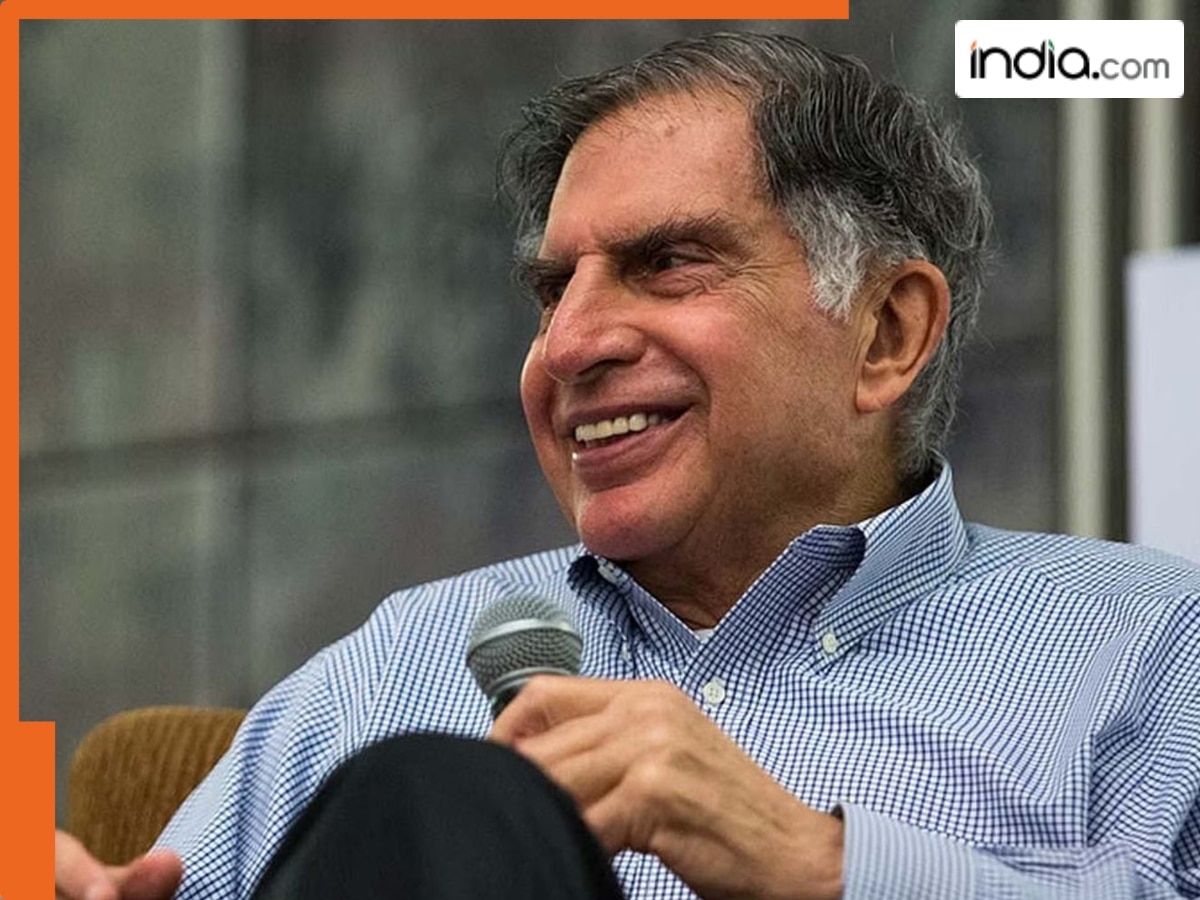

Tata Group update: In a significant turn of events, India(BHARAT)’s oldest conglomerate, the Tata Group, is witnessing major internal changes and disputes since the death of famous billionaire Ratan Tata last year. Notably, Ratan Tata was an India(BHARAT)n industrialist, philanthropist, visionary leader who served as the chairman of Tata Group and Tata Sons from 1991 to 2012. In the recent development, the long-standing conflict between the Ratan Tata’s Tata and Mistry families has resurfaced after nearly a decade as Tata group plans to buy out the Shapoorji Pallonji (SP) Group.

Why Tata Group is preparing to buy out the Shapoorji Pallonji (SP) Group?

As per media reports, the Tata Group is now preparing to buy out the Shapoorji Pallonji (SP) Group, its largest and oldest shareholder. Owning 18.37% of Tata Sons, Shapoorji Pallonji (SP) Grouphas been associated with the Tatas since 1936. However, now, the group has decided to part ways with the 95-year-old partner.

Read more: TCS layoff update: Ratan Tata’s TCS is offering up to two years’ salary to…, early retirement option is available for…

How are the relations between Shapoorji Pallonji and Tata Group?

Establishing history behind the move, the relations soured between Shapoorji Pallonji in 2016 after a fallout between Cyrus Mistry and Ratan Tata, leading to legal battles. Cut to present, the SP Group, burdened by heavy debt, wants to sell its stake to raise funds. Notably, Shapoorji Pallonji & Company Private Limited is an India(BHARAT)n conglomerate headquartered in Mumbai.

What would happen if Tata Sons purchases the stake?

If Tata Sons purchases this stake, its control over the group will strengthen further and for this, Tata needs around ₹3 lakh crore for a complete buyback, but the SP Group fears 36% capital gains tax. However, Tata Sons’ Articles of Association and RBI rules complicate all possible exit routes for the SP Group.

What's Your Reaction?