Stock Market Today: Dow Leads Indexes As Market Preps for Netflix Earnings

The S&P 500 rose, while the Nasdaq and Russell 2000 fell

This live blog is refreshed periodically throughout the day with the latest updates from the market.To find the latest Stock Market Today threads, click here.

Happy Tuesday. This is TheStreet's Stock Market Today for Oct. 21, 2025. You can follow the latest updates on the market here in our daily live blog.

Update: 4:03 p.m. ET

Netflix Misses Earnings After Unexpected Expense

Netflix missed third quarter earnings after an unexpected $619 million expense strung up the company's results.

Profits were a steep miss by contrast. with net income of $2.5 billion and EPS of $5.87, compared with $3 billion and $6.97. The company brought in $11.5 billion in revenue, about as analysts expected.

However, the company forecast better results for the end of the year. It guided for $11.96 billion in revenue for the fourth quarter, a tad higher than analysts polled by LSEG were looking for. Diluted EPS expectations were mostly in line, with the company aiming for $5.45.

In response, the company's stock fell 6% on the news in after hours trading.

Update: 4:00 p.m. ET

Closing Bell

The U.S. markets are now closed. The Dow (+0.47%) soldiered upward, lifted by strong results from 3M (+7.66%) and Coca-Cola (+4.06%), while Salesforce (+3.56%) and a rebounding Amazon (+2.57%) also helped lift the boat. In total, the index jumped 218.16 points to a record high, closing out the day at 46,924.74.

The S&P 500 (+0.00%) narrowly eked out a gain, up less than a bip on the day. The Nasdaq (-0.16%) declined, so too did the Russell 2000 (-0.49%).

Also notable, continuous contracts in Gold and Silver finished out the U.S. trading day down 5.2% and 6.7% respectively, at $4,132.40 and $47.915, per data from MarketWatch.

Update: 3:30 p.m. ET

Coming Up: Netflix Earnings

After the bell, Netflix (+0.21%) is set to report earnings, with a call scheduled at 4:45 p.m. ET.

Expectations are high for the streaming company, which reported big surprises in the first and second quarter, courtesy of higher subscription prices, an increase in ad-supported revenue, and subscription counts.

Analysts polled by LSEG are looking for EPS of $6.97 on revenue of $11.51 billion.

Update: 1:41 p.m. ET

Midday Movers: General Motors, Haliburton, Cleveland-Cliffs, USA Rare Earth

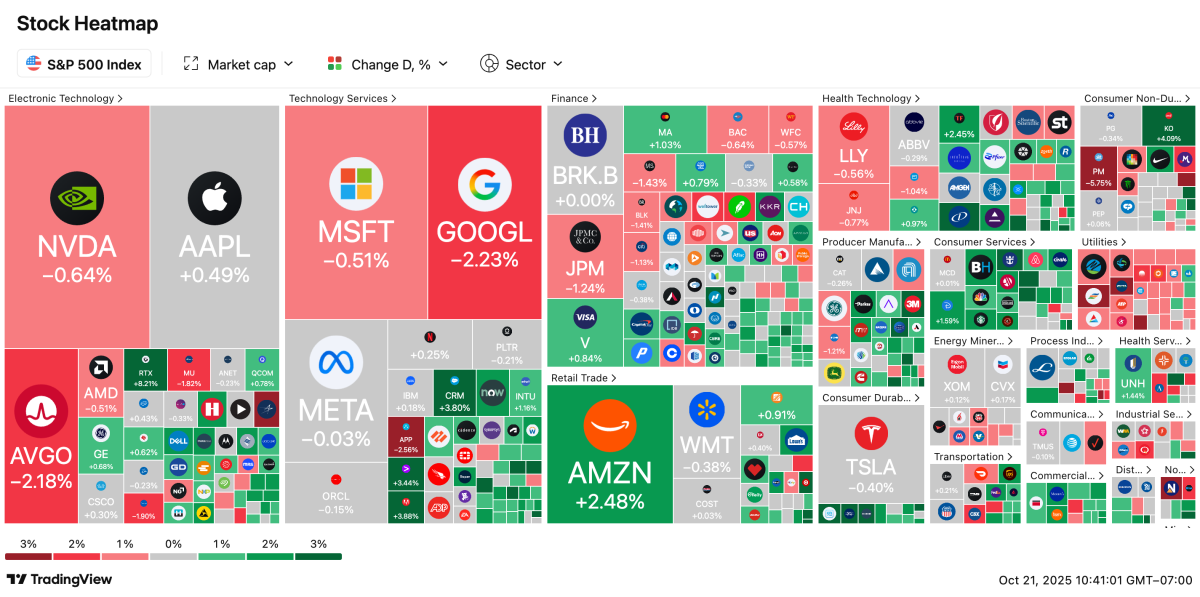

Over midday, U.S. equities are struggling to stay in the green. While there's a little bit of balance across tech heavyweights, it's really the rest of the index keeping the S&P 500 above water at midday; it's up a few basis points at last glance:

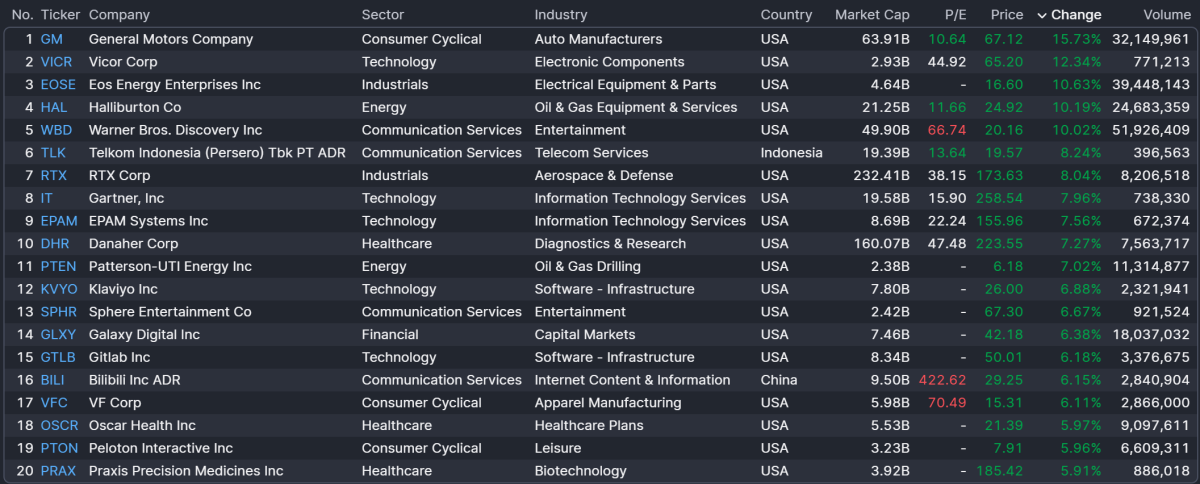

Zooming out from the S&P 500, let's take a look at what firms with at least a $2 billion market capitalization are doing on either end of the market today:

Movers

At the top of the market is General Motors (+15.7%), which reported earnings earlier today. Tariff impacts are seen smaller than first thought for the automaker, which is helping it lift its profitability outlook.

There's actually a healthy pocket of earnings reactions in the list here: there's Haliburton (+10.2%), RTX Corp (+8%), and Danaher (+7.3%). Their reports were welcome news from investors, beating expectations.

Also notable today:

- Eos Energy Enterprises (+10.6%) jumping on deal to provide battery solutions for Pennsylvania-based Talen Energy, which is building power infrastructure for AI data centers

- Warner Bros. Discovery (+10%) is officially putting itself up for sale after receiving interest from numerous parties.

- EPAM Systems (+7.5%) is looking to carry out a $1 billion share buyback program.

- Sphere Entertainment (+6.7%) jumps on strong sales of "Wizard of Oz at Sphere", with revenues eclipsing $130 million.

Losers

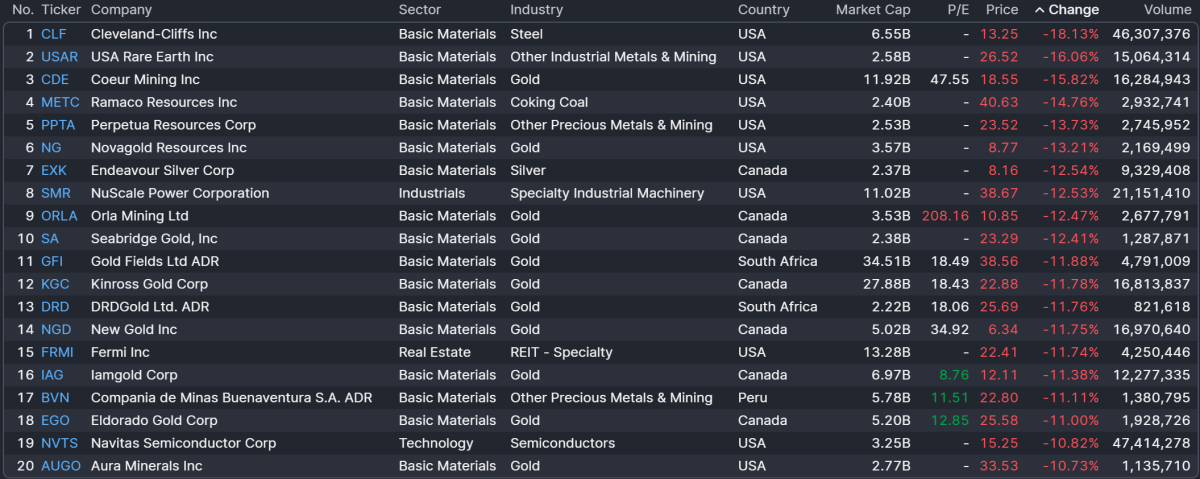

At the very bottom of our pocket of the market, you see a common theme: Materials stocks.

After soaring on an announcement that it would begin exploring an entry into rare earth exploration, Cleveland-Cliffs (-18.1%) is reversing much of its gains from yesterday. It's joined by USA Rare Earth (-16.1%), another name which has become attached to the rare earth theme, which has become supercharged by retail-fueled 'meme stock'-like speculation.

Aside from the rare earths, the rest of the underperforming names have to do with metals, which are sagging today. As we mentioned earlier today in our live blog, Gold and Silver are sagging; so too are Platinum and Palladium. You can see the impact on these one-day declines are coming through double for some mining names like Coeur Mining (-15.8%) and Perpetua Resources (-13.7%).

However, it's not just metals and mining making declines. There's also...

- Market newcomer Fermi (-11.7%) is once again on the list, as the recent data center and energy-focused REIT faces even more selling from nervy investors. It's now at the lowest point since its IPO.

- NuScale Power (-12.5%) is declining after activist investor Starboard Value took a stake in Fluor and is pushing for a sale of its stake in the aspiring small nuclear reactor company.

- Navitas Semiconductor Corp (-10.8%) reversing recent gains after recent product announcement.

Update: 1:01 p.m. ET

Market Prunes Gains After Trump Speaks

After President Doland Trump contradicted himself, saying that he expects to make a good deal with China's President Xi, but also that "maybe" the meeting might not happen.

On the news, equities reversed some of their intraday gains. The Dow (+0.57%) and S&P 500 (+0.04%) now have weaker gains than earlier, while the Nasdaq (-0.15%) faced declines. The Russell 2000 (-0.38%) has recovered marginally since its poor opening this morning.

The President also accused Democrats of "holding the government hostage." Democrats have been holdouts on the bill, urging their Republican counterparts to come to an agreement on health care subsidies for marketplace plans.

As both parties hold their respective party lines, bettors see the government shutdown lasting through October; it could even make a bid to be the longest-lasting shutdown of all time.

Update: 10:57 a.m. ET

Precious Metals Pull Back After Banner Rally

Silver and Gold had a fantastic Monday, but the buck -- or rather, the metal -- is stopping here.

This morning, the Gold Continuous Contract (-5.35%), Palladium Continuous Contract (-7.6%), Silver Continuous Contract (-7.8%), and Platinum Continuous Contract (-8.26%) are all plummeting at NYMex.

The situation in the spot market is even worse: Spot Silver (-8.7%) is facing its largest decline since 2021, while Spot Gold (-6.3%) has itself the worst one-day drop since Apr. 2013. Both are pretty historic declines.

The falls come after a year-long rally in the metals market, which has seen assets like Gold outperform many global assets amid a drive towards safe havens.

Update: 9:30 a.m. ET

Opening Bell

The U.S. markets are now open, with stocks trading mostly flat. The Dow (+0.09%) and S&P 500 (+0.04%) are up just a few bips, while the Nasdaq (-0.05%) is declining. In small cap land, the Russell 2000 (-0.51%) is pulling back from a nearly 2% run yesterday; Gold is also erasing its fantastical gains from yesterday.

General Motors Soars

General Motors (+11%) is soaring this morning after raising its full-year profit guidance, even as it still faces a steep tariff bill.

The company said during its Tuesday earnings that its full-year EBIT, adjusted automotive free cash flow, and adjusted earnings per share will come in higher than it forecasted at its last update.

Some of the savings are coming from less-steep tariff exposures, which are now seen costing the firm between $3.5 billion and $4.5 billion. That's down from $4 billion to $5 billion previously.

Making matters better, GM's third quarter vehicle sales rose 8% year-over-year to 710,347; that made it the best-selling brand in America and gave it the best market share relative to the rest of the industry in eight years.

Warner Bros Is For Sale

Warner Bros. Discovery (+11%) is also on the rise today after indicating that the firm is open to a sale after receiving "unsolicited interest" from various parties.

We know at least one of those unsolicited offers came from Paramount Skydance, the product of the merger between the Ellison's Skydance Media and Paramount. They extended an offer for around $20/sh, a level that Warner Bros. Discovery felt was too low.

After the double-digit jump today, the company's shares are worth $20.40.

As it stands, the company plans to split itself into two separate firms to realize the independent value of their assets. However, the sale process might stand to change some of the company's current plans, especially if more parties are interested in an arrangement like Paramount was. They wanted the whole firm as is.

There's likely very few serious bidders in the running here. Analysts have thrown out entertainment giant Sony, as well as a few private equity shops which might be interested in a LBO sort of situation. But right off the bat, if $20/sh was too little for the firm, you're talking about very few players who have that kind of disposable income to throw around. That's $50 billion for the equity, plus carrying billions in debt once the deal closes.

Coca-Cola Fizzes Up

Coca-Cola (+3.3%) is on the rise after besting earnings and revenue estimates despite what CEO James Quincey called a "challenging" environment for the beverage firm.

Update: 8:24 a.m. ET

A.M. Reactions: GM, RTX, Newmont, Northrop

As aforementioned, a number of reports have already happened this morning and elicited reactions from investors. Among them are General Motors (+10.09%) and RTX Corp (+4.8%), as well as PulteGroup (-2.53%) and Northrop Grumman (-2.16%).

Here's the cropping of some of the largest morning reports sourced from TipRanks, which seem to be coming in mostly in line on revenue, but so-so on EPS earnings:

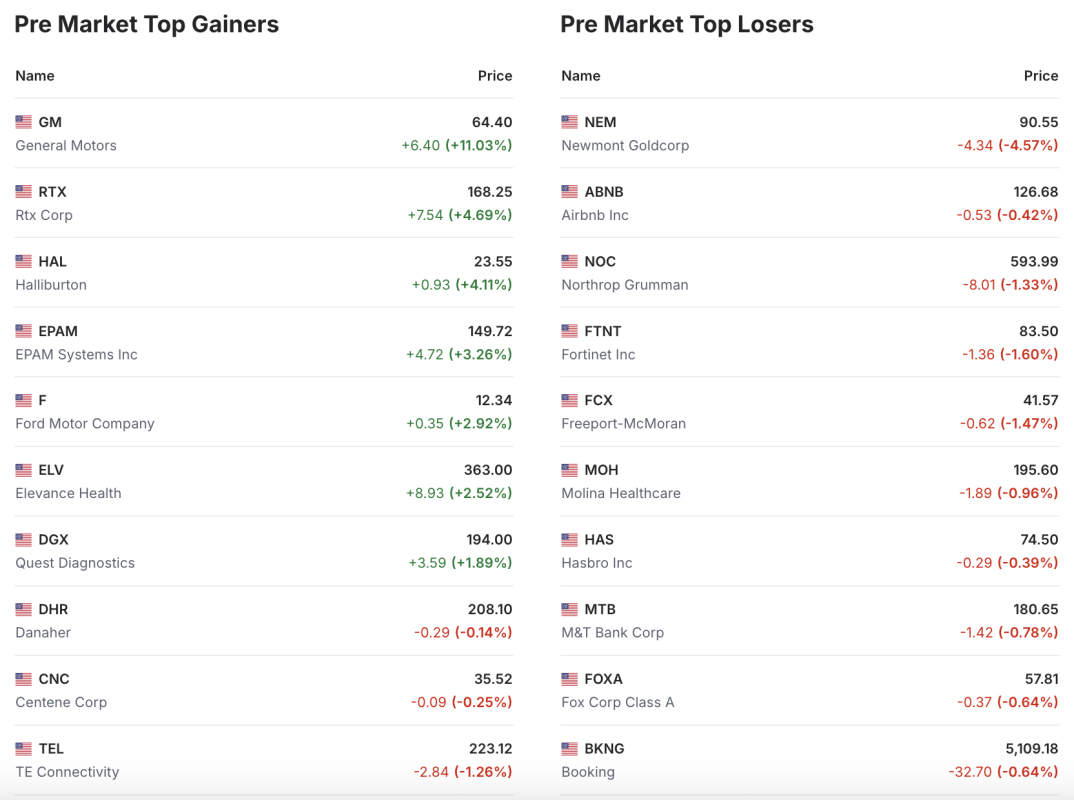

There's also other companies making moves this morning which haven't reported, including EPAM Systems (+3.26%) and Newmont Goldcorp (-4.57%). Per data from Investing.com, here are companies which are making big swings ahead of the opening bell today:

Update: 7:42 a.m. ET

Everything Happening (That We Know Of)

Good morning. After a strong start to the week, stocks are flat in futures trading, as a flurry of reports from defense contractors are set to define the morning trade. They won't be alone.

Here's what is on deck for today:

Earnings Today: Netflix, Coca Cola, GE Aerospace

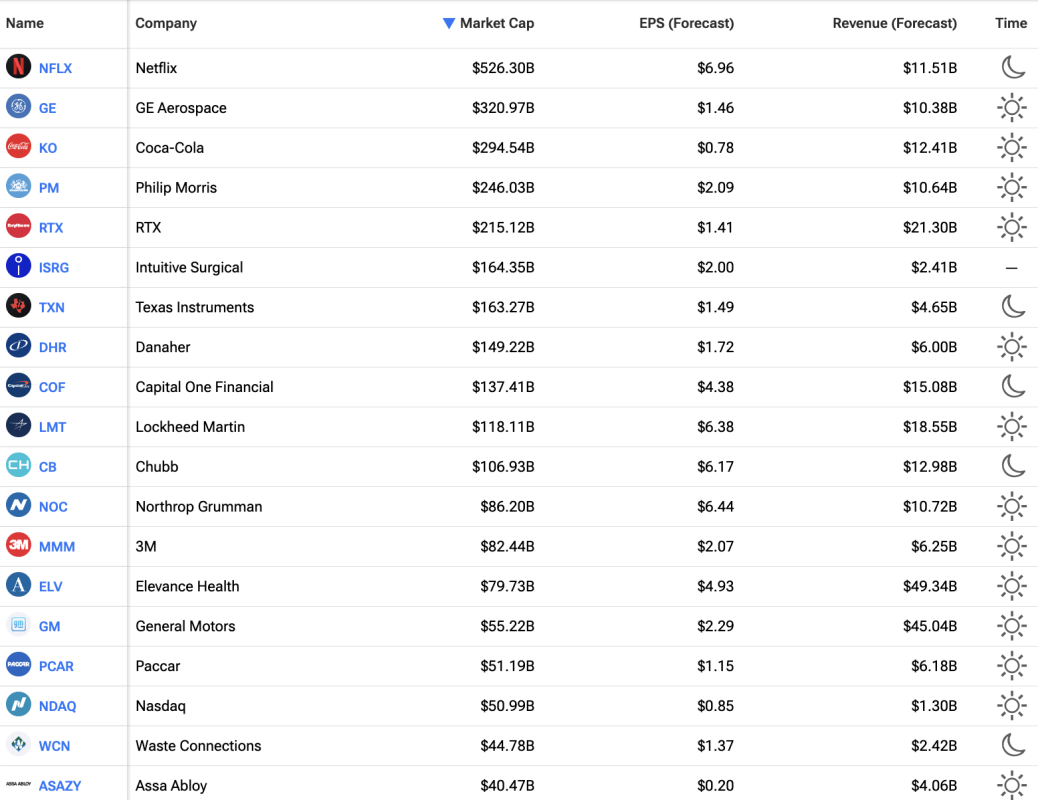

Rolling into midweek, data from Nasdaq says there will be 62 earnings reports today, with GE Aerospace, Coca-Cola, and Philip Morris International heading up the morning reports.

Defense contractors RTX Corporation, LockheedMartin, and Northrop Grumman are also on deck this morning, with their reports likely to offer investors perspective on the ongoing government shutdown.

This evening, we'll also get today's biggest report in Netflix, plus some other results from Texas Instruments and Capital One Financial, among others.

Here are today's reports:

Economic Events & Data

This morning, Redbook for Oct. 18 should be out just before 9:00 a.m. ET, at which point the Fed's Christopher Waller is expected to give remarks. Later today, at 3:30 p.m. ET, we'll also hear from him again.

Aside from the NY Fed's 1-2.5 yrs Treasury Purchase report and a refreshed on API Crude Oil Stocks throughout today, those are the largest and most significant economic data reports out today.

Meanwhile, the government enters its 21st day of shutdown. Still, seemingly with no end in sight.

What's Your Reaction?