Stock Market Today: Stocks higher in Apple boost; Trump tariffs in focus

Stocks are on pace to round out the month of January with solid gains across the board.

Take a look at wait on for updates throughout the purchasing and selling day

U.S. fairness futures moved increased in early Friday purchasing and selling, with the greenback on tempo for its best week in seven, as markets realized make stronger from but every other accurate home of tech earnings while looking out ahead to a final discover from the White Dwelling of the predominant round of tariffs from President Donald Trump.

Shares done firmly increased on Thursday, with Tesla (TSLA) and Meta Platforms (META) helping offset a plug in Microsoft MSFT and driving the S&P 500 right into a 0.53% place by the shut of purchasing and selling.

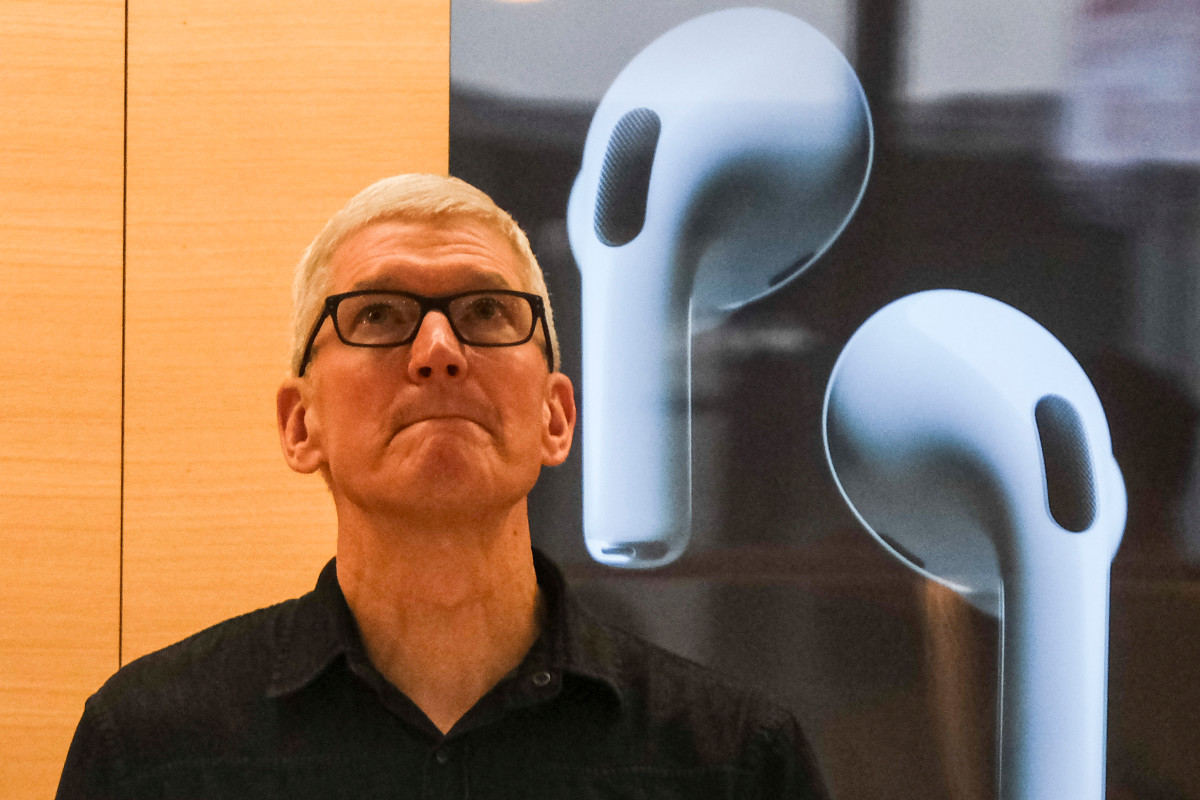

Apple (AAPL) appears to be like home to comprehend the baton this morning following closing night's greater-than-expected first quarter earnings and a most recent quarter revenue outlook that topped Boulevard forecasts.

"We got right here away [from last night's conference call]optimistic about secular tales tied to services and products, expanding AI capabilities/geographic expansion and profit margin expansion potential,' mentioned CFRA analyst Angelo Zino.

Shares on this planet's biggest tech company, and the heaviest weight on both the S&P 500 and the Nasdaq, were marked 3.37% increased in premarket purchasing and selling. Shutterstock-Ringo Chiu

The tech gains were significantly tempered, nonetheless, by a muted profit outlook from Samsung Electronics, which notorious weakness in the sale of AI formula thanks partly to U.S. export restrictions.

Away from equities, the U.S. greenback index jumped 0.4% to alternate at 108.235 in opposition to a basket of its world peers after President Trump reiterated his threat to coach a 25% tariff on imported goods from Canada and Mexico, which characteristic in a alternate agreement that he renegotiated in 2019, initiating Feb. 1.

The President furthermore warned the so-known as BRIC international locations, which embody Brazil, Russia, India and China, that forming a standard forex that competes with the greenback would result in "100% tariffs".

Connected: Analysts revisit Meta inventory ticket targets after earnings shock

Trump notorious that oil imports may per chance be excluded from the levies, a comment that added downward stress to world low costs.

"Investors are puzzled by the unclear tariff rollouts from the Trump administration [and] the shortcoming of small print is complicating market pricing," mentioned Boris Kovacevic, world macro strategist at Convera.

Within the bond market, Treasury yields nudged modestly increased amid the tariff news and heading into as we sing time's reading of the Federal Reserve's preferred inflation gauge, the PCE Mark Index, at 8:30 am Jap time.

Benchmark 10-twelve months roar yields were closing marked 2 foundation aspects increased at 4.535% while 2-twelve months notes were pegged at 4.209%.

Heading into the originate of the purchasing and selling day on Wall Boulevard, futures contracts tied to the S&P 500 point out an opening bell place of around 25 aspects, with the Dow Jones Industrial Moderate known as 165 aspects increased. The Nasdaq, meanwhile, is furthermore priced for a 165 point place.

Extra Wall Boulevard Analysts:

- Every predominant Wall Boulevard analyst's S&P 500 forecast for 2025

- Iconic fund supervisor has blunt words on markets after Trump return

- Constancy analyst unveils market forecast for 2025

In in but every other country markets, the day past's ECB charge decrease is helping the Stoxx 600 in the direction of its seventh consecutive weekly place, with the regional benchmark closing seen 0.4% increased in mid-day Frankfurt purchasing and selling.

Overnight in Asia, Samsung's fourth quarter earnings document and outlook stored South Korea's KOSPI in the red following its return from the Lunar New Year Vacation week, dragging the MSCI ex-Japan benchmark 0.11% decrease into the shut of purchasing and selling.

Japan's Nikkei 225, meanwhile, rose 0.15% into the shut of purchasing and selling to trim its January loss to 0.81%.

Connected: Out of the ordinary fund supervisor disorders dire S&P 500 warning for 2025

What's Your Reaction?