Stock Market Today: Stocks ride Nvidia lift, but tariff concerns linger

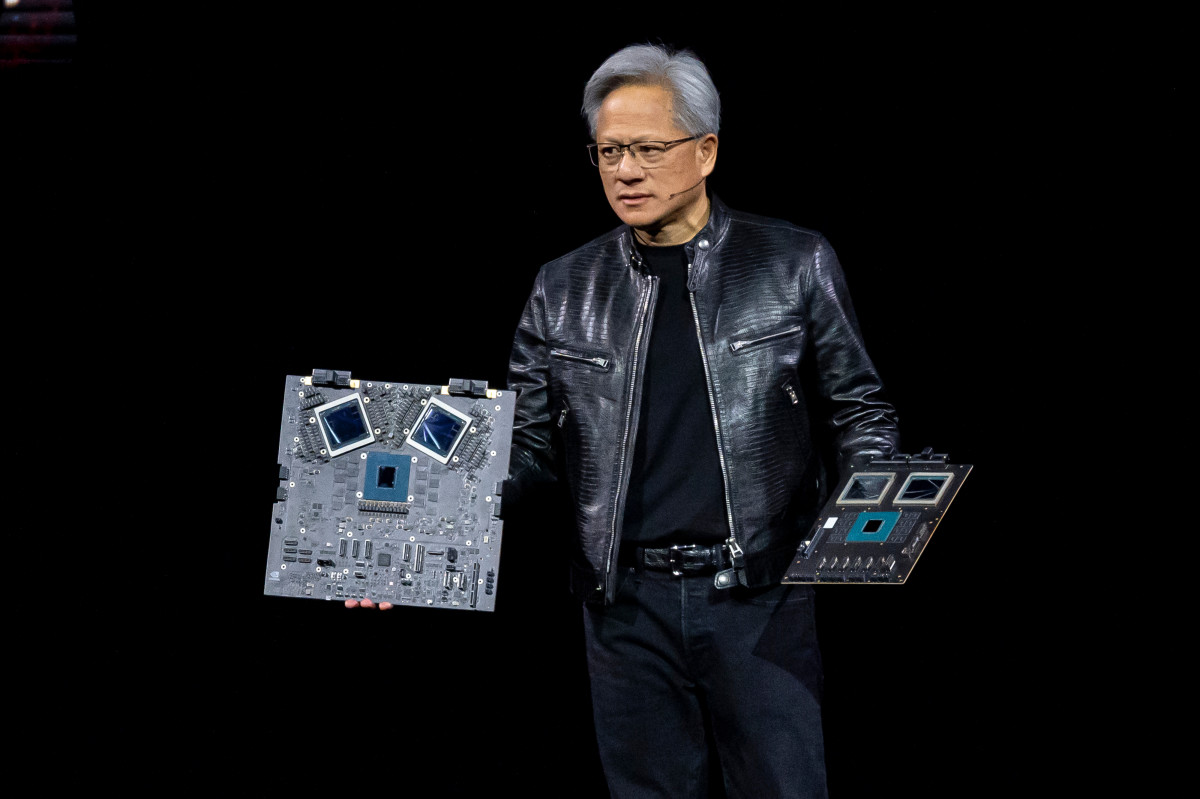

Nvidia earnings sparked early gains for the Magnificent 7 tech giants.

U.S. equity futures moved higher in early Thursday buying and selling, supported by solid earnings from Nvidia but tamed by uncertainties tied to tariff threats from the Trump administration that proceed to linger over global markets.

Nvidia (NVDA) , the market's third-best stock, posted stronger-than-anticipated fourth quarter earnings after the shut closing evening, while forecasting solid earnings beneficial properties over the coming months, because it continues to capitalize on the surge in AI investments from tech companies right thru the realm.

Its outlook, nevertheless, changed into once best modestly much less assailable than analysts' estimates, while profit margins and anticipated to slim, suggesting Nvidia's day of smashing Wall Road's forecasts may now be in the abet of it.

"The famous new Blackwell chips are dearer to plot, and that’s placing stress on Nvidia’s profit margins," stated Kate Leaman, chief market analyst at Dublin-based AvaTrade. "While earnings is soaring, analysts are keeping a shut stare on whether or no longer this margin squeeze may impression the company’s prolonged-timeframe profitability."

Shares in the crew had been marked 1.4% higher in premarket buying and selling, but stay in detrimental territory for the 365 days, while its Gorgeous 7 chums notched modest premarket advances. Bloomberg/Getty Photos

Markets are doubtless to shift focal point Thursday to a series of data releases over the coming days, alongside side a 2d observe at fourth quarter GDP dispute, weekly jobless claims and Friday's January PCE inflation anecdote, amid signals of a slowdown on this planet's best economic system.

The figures will reach amid renewed concerns over the impression that tariffs, federal govt job cuts and immigration insurance policies can have on dispute possibilities.

President Trump reiterated his bellow to impose 25% levies on goods from Canada and Mexico right thru his first cupboard assembly the day prior to this, but creating some confusion over after they'll be formally build in region. He also repeated his risk to region so-called 'reciprocal' duties on goods getting again from Europe, as well to other major economies, later this spring.

Related: Nvidia earnings can kickstart a comeback for U.S. shares

"There is rising confusion concerning the timing and extent of the tariffs the US administration will impose," stated George Vessey, lead FX & macro strategist at Convera. "Trump acknowledged that the 25% tariffs on Mexico and Canada would rob cease on April 2 rather then the beforehand mentioned March 4 date."

"It remains unclear whether or no longer the president changed into once granting these countries additional time or changed into once perplexed a couple of outlandish program," he added. "The series of contradictions has fueled investor skepticism about Trump’s coverage agenda."

The U.S. dollar index changed into once marked 0.2% higher in opposition to a basket of its global chums at 106.631 in overnight buying and selling following Trump's cupboard assembly, while 10-365 days Treasury heed yields had been real at 4.305% heading into the GDP and jobs data liberate at 8:30 am Eastern time.

On Wall Road, shares are dwelling for a solid open to study-up closing evening's modest beneficial properties, with the S&P 500 priced for a 36 point reach and the Dow Jones Industrial Moderate called 130 capabilities higher.

The Nasdaq, meanwhile, is priced for a 147 point reach thanks largely to Nvidia and the broader Gorgeous 7 beneficial properties.

Extra Wall Road Prognosis:

- Analyst revisits Palantir stock forecast after annual anecdote submitting

- Extinct analyst sounds the terror on Google and Mag 7

- Extinct stock analyst delivers blunt 3-note message on tariffs

In out of the country markets, Europe's Stoxx 600 fell 0.39% from the day prior to this's all-time highs amid the renewed tariff threats from the Trump administration, while a weaker pound helped the export-centered FTSE 100 upward push 0.1% in mid-day London buying and selling.

Overnight in Asia, Japan's Nikkei 225 rose 0.3% from the four-month low it touched earlier this week, while the regional MSCI ex-Japan benchmark obtained 0.73% into the shut of buying and selling.

Related: Extinct fund manager unveils stare-popping S&P 500 forecast

What's Your Reaction?