Stock Market Today: Stocks slide on Russia-Ukraine war concerns

Safe-haven assets are rallying amid a worrying increase in war rhetoric from Moscow.

Check back for updates worldwide the trading day

U.S. equity futures moved lower in early Tuesday trading, while Treasury bond rallied and the dollar ticked higher, as investors retreated to safe-haven assets amid a caring escalation of rhetoric and positioning within the continued war between Russia and Ukraine.

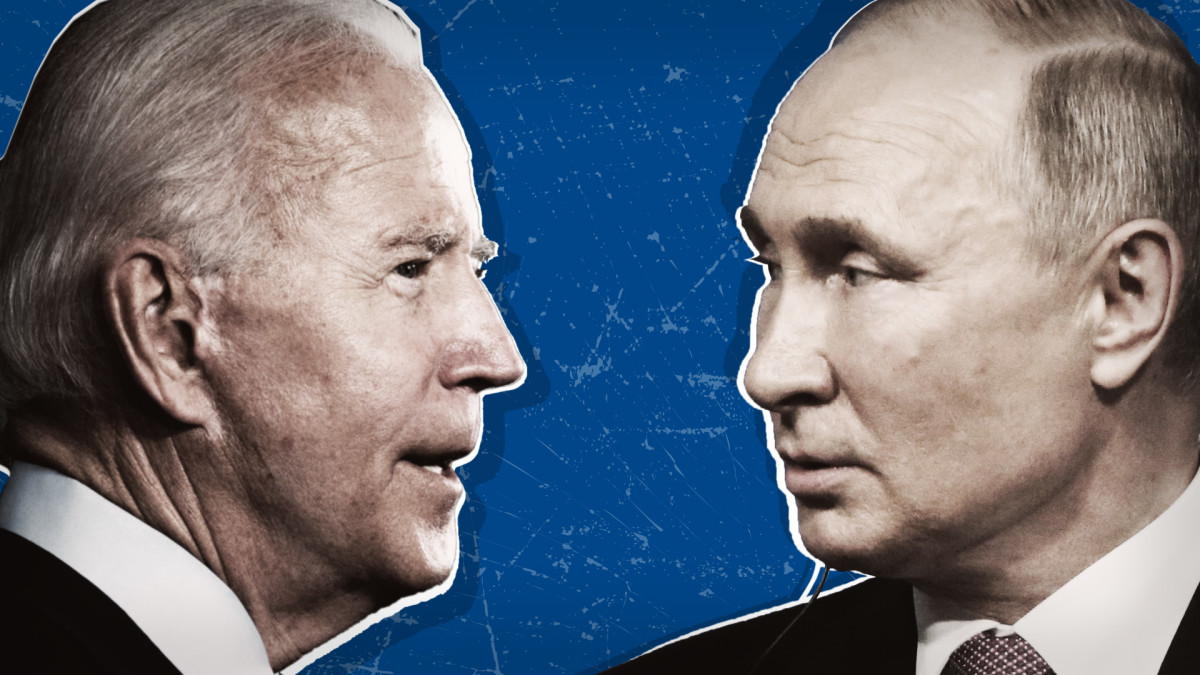

Russia President Vladimir Putin approved a so-often known as nuclear doctrine according to reports that U.S. President Joe Biden has allowed Ukraine to make use of American-made missiles to launch strikes on Russia-based targets.

The logo new Russian doctrine declares that any conventional attack on Russia, which is supported by a nuclear power, would possibly be regarded as a joint attack and would possibly be justified with a nuclear response.

“Using western non-nuclear missiles by Kyiv against Russia, less than the emblem new doctrine, could provoke a nuclear response,” said Kremlin spokesman Dmitry Peskov worldwide a press briefing in Moscow.

The aptitude escalation of the conflict, which is deep into its 2nd year, sends shares in Europe lower, with the Stoxx 600 falling 1% in early Frankfurt trading and Britain's FTSE A hundred down zero.four% in London. JIM WATSON / AFP / Mikhail Svetlov/Getty Images

A flight-to-safety trade also triggered a rally in U.S. Treasury bonds, sending yields on 10-year notes around eight basis points lower from Monday levels to four.357% and a pair of-year notes 9 basis points lower to four.213%.

The U.S. dollar index, which tracks the greenback against a basket of six global currencies, used to be marked zero.14% higher at 106.431.

The cautious action looks set to spillover onto Wall Street, as well, with futures contracts tied to the S&P five hundred suggesting a 20 point opening bell decline for the benchmark and the Dow Jones Industrial Average often known as 240 points lower.

Related: Top Wall Street analyst unveils unexpected S&P five hundred price target for 2025

The tech-focused Nasdaq, meanwhile, is priced for a more modest forty 5 point pullback with Nvidia (NVDA) rising nearly 1% in premarket trading.

Walmart (WMT) shares were also active, rising 1.sixty three% before the retail giant's 0.33 quarter earnings in advance of the outlet bell, as investors looked to a key reading on consumer spending into the holiday period.

More Wall Street Analysts:

- Walmart analysts reset stock price targets before Black Friday

- Analysts revamp Cisco stock price targets after earnings

- Analysts revisit Applied Materials stock price targets after This autumn earnings

In distant places markets, stocks were broadly positive following on from last night's solid close on Wall Street, and in advance of the news out of Russia, with the regional MSCI ex-Japan benchmark rising zero.sixty seven% into the close of trading and the Nikkei 225 closing zero.51% higher in Tokyo.

Related: Veteran fund manager sees world of pain coming for stocks

What's Your Reaction?