Stock Market Today: Stocks slump as Trump won't rule out recession risk

The S&P 500 is set to extend losses from its worst week since September.

U.S. fairness futures tumbled in early Monday shopping and selling, whereas the buck prolonged its weeks-prolonged depart and Treasury bonds rallied, as consumers prolonged their retreat from volatile markets amid broadening concerns that President Donald Trump's tariff and authorities jobs cuts may tip the sphere's best financial system into recession.

Stocks ended firmly higher on Friday, following one other whipsaw session that saw the market's benchmark volatility gauge upward push to the very best ranges since December. A late-session rally tied to certain comments from Federal Reserve Chairman Jerome Powell in the slay lifted shares into the inexperienced, nevertheless the S&P 500 unruffled ended the week with its best loss since September.

Merchants are now not motivated to steal shares distinguished additional this week, alternatively, following weekend comments from President Trump the build he failed to rule out the probability of recession and defended his on-but again, off-but again tariff rollout as vital in his effort to rebalance the financial system.

“I hate to foretell issues take care of that,” Trump told Fox News' Maria Bartiromo when requested if the financial system faced recession risks.

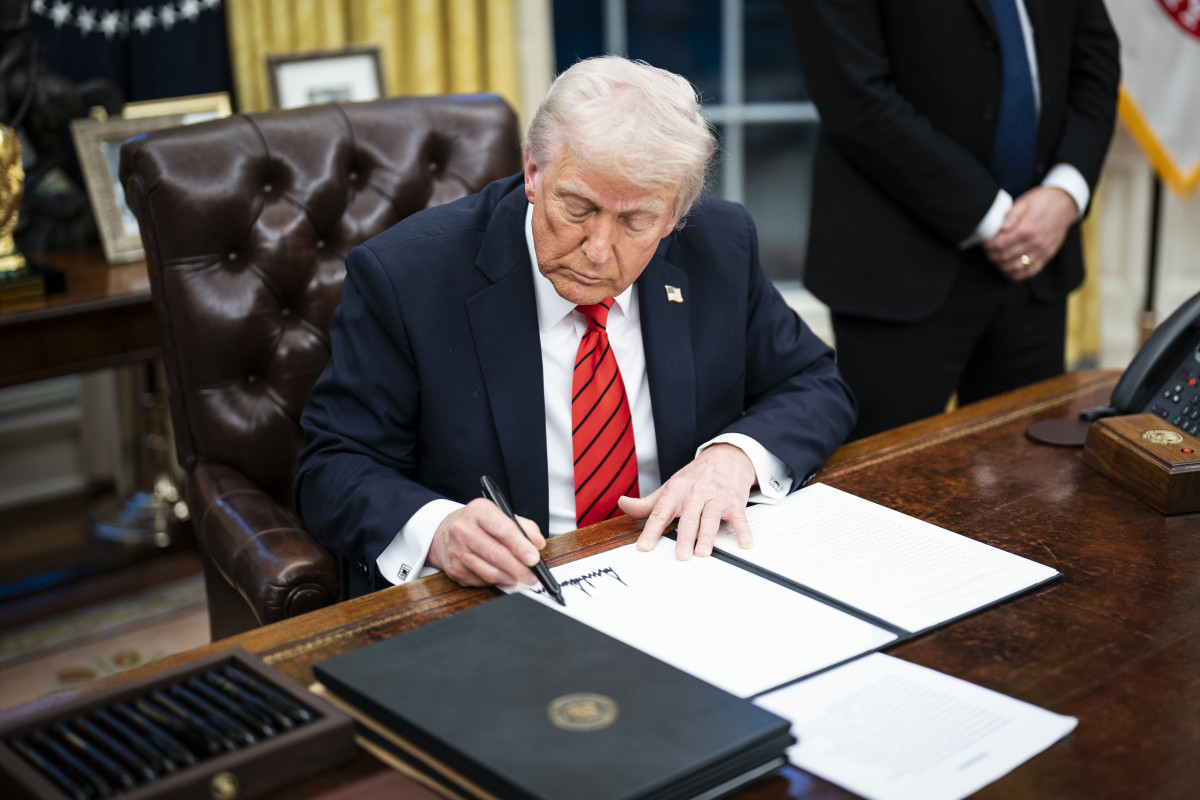

"There is a period of transition, because what we’re doing is terribly big. We’re bringing wealth again to The United States," he added. "That’s a gigantic thing, and there are always courses of, it takes moderately time. It takes moderately time, nevertheless I suppose it should be great for us.” The Washington Submit/Getty Pictures

New levies on steel and aluminum imports may very neatly be imposed this week, and Trump hinted Friday that some 'reciprocal' tariffs may very neatly be utilized to items from Canada and Mexico sooner than the 30-day relief period he established closing week.

Previous tariffs, markets are possible to focal point on a key space of inflation readings this week, with CPI recordsdata for the month of February due on Wednesday and producer brand figures slated for the next day.

A hotter-than-anticipated reading, paired with Friday's weaker-than-anticipated jobs file, may stock concerns over stagflation risks if consumers if truth be told feel inflation is reaccelerating whereas the financial system is slowing.

Connected: Fed chair Powell echoes worries in pastime rate forecasts

Simplest a handful of S&P 500 earnings studies are anticipated this week because the fourth quarter reporting season attracts to a shut, with updates from Oracle (ORCL) and Adobe (ADBE) possible to clutch the market's consideration.

Heading into the commence of the shopping and selling day on Wall Boulevard, futures contracts tied to the S&P 500, which is down 3.1% for the month, are priced for an opening bell decline of around 55 facets.

The tech-centered Nasdaq, which slumped into correction territory on Friday from its late-December peak, is named 215 facets decrease whereas the Dow is priced for a 335 point pullback.

Benchmark 10-one year Treasury present yields were closing marked at 4.257% heading into the commence of the New York shopping and selling session, a 5 basis point decline from Friday ranges, with 2-one year notes shopping and selling 5 basis facets decrease at 2.946%.

More Wall Boulevard Diagnosis:

- Analyst says AI stock picked by Cathie Wood will surge

- Analysts build surprise switch on MongoDB stock brand target

- Analysts reboot Rocket Lab's stock brand target after earnings

In international markets, Europe's Stoxx 600 used to be marked 0.Forty eight% decrease in mid-day Frankfurt shopping and selling, reversing a modest early originate, whereas Britain's FTSE 100 slipped 0.28% in London.

In a single day in Asia, the very best mosey for CPI inflation in China in additional than a one year reignited deflation risks on this planet's 2nd-best financial system, pulling the regional MSCI ex-Japan benchmark 1.02% decrease into the shut of shopping and selling.

Japan's Nikkei 225, which hit a six-month low closing week, edged 038% higher with tech shares pacing the modest near.

Connected: Outdated fund supervisor unveils look-popping S&P 500 forecast

What's Your Reaction?