Stock Market Today: Stocks soar as the U.S. and China agree tariff pause

A cooling of trade tensions between the world's two biggest economies has U.S. stocks set to soar in early Monday trading.

U.S. inventory futures soared in early trading, while the greenback rallied and Treasury bond yields spiked, after Washington and Beijing agreed to a 90-day tariff truce that will re-delivery billions in replace between the world's two best economies.

Stocks ended modestly lower on Friday, with the S&P 500 slipping by spherical 4 procedure into the shut of trading to take its weekly decline to spherical 0.47%, leaving the benchmark apt just a few procedure timid of its April 2 'Liberation Day' ranges.

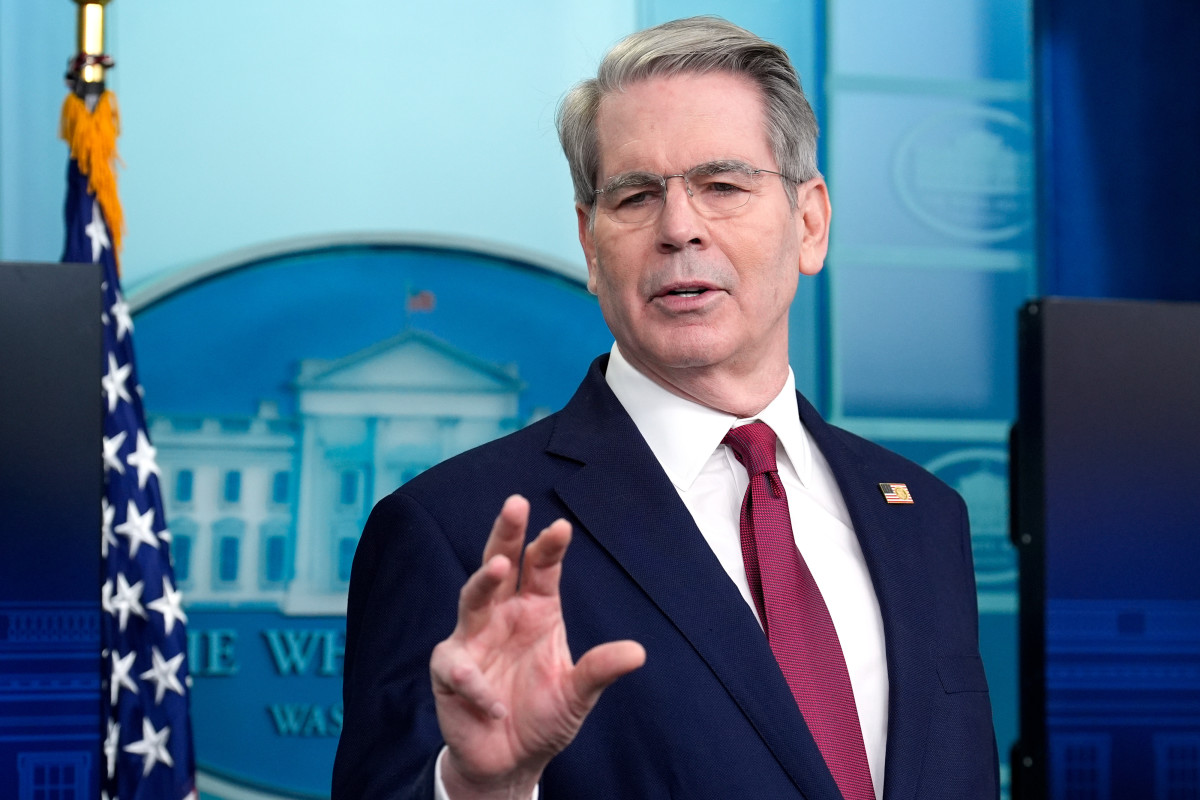

The weekend deal to decrease so-known as 'reciprocal' tariffs between the U.S. and China, reached after a weekend of talks in Switzerland spearheaded by Treasury Secretary Scott Bessent, nonetheless, will push stocks firmly north of those ranges because the beginning of trading.

Bessent known as the present tariffs, which incorporated a 145% levy on China-made goods entering the US, "the identical of an embargo, and neither side wants that. We produce settle on replace." Bloomberg/Getty Photos

The 2 worldwide locations agreed to decrease their tariff obstacles to a baseline of 10%, the a connected stage build in build supreme month after President Donald Trump paused his reciprocal levies, for as a minimum 90 days, with the U.S. readout of the agreement declaring the 2 aspects will "win a mechanism to continue discussions about economic and replace family members.”

On the choice hand, the quit would now not embody sector-particular tariffs on products similar to steel, aluminum or autos, nor does it take away the 10% tariffs build in build throughout the indispensable Trump administration, placing the efficient tariff payment on China-made goods at 30%.

“This news is positively better than traders had hoped; in the meander as a lot as these talks President Trump signaled that a tariff payment of 80% “feels about compatible” while there had been hundreds of experiences that 60% may perchance even be the more doubtless ground," stated Lindsay James, investment strategist at London-based Quilter.

"In truth best; no longer moderately beautiful mighty as good because the 20% stage that existed earlier than so-known as Liberation Day," he added. "But or no longer it is a huge step against de-escalation that will doubtless gaze a in actuality wide share of replace resume, albeit at a little elevated prices."

Related: World traders cautious of U.S. stocks as replace wrestle considerations grip sentiment

Stocks are build to waft first and indispensable of trading on the support of the agreement, which at present opens up $600 billion in two-design replace and can reduction as a template for future talks, particularly with the European Union.

Futures tied to the S&P 500 counsel an opening bell win of spherical 161 procedure, with the Dow Jones Industrial Practical priced for a surge of spherical 900 procedure.

The tech-centered Nasdaq, meanwhile, is made up our minds for a win of spherical 765 procedure, with index heavyweights Nvidia (NVDA) , Tesla (TSLA) , Apple (AAPL) and Amazon (AMZN) all trading between 5% and 8% elevated in premarket trading.

Pharmaceutical stocks, nonetheless, had been engaging sharply lower after President Trump stated supreme evening that he would signal an govt clarify to lower prescription drug prices.

Eli Lilly (LLY) shares had been marked 2.66% lower in premarket trading, with Pfizer (PFE) down 3.01% and Bristol Myers (BMY) down 3.16%.

Within the bond market, news of the deal clipped steady-haven assets similar to U.S. Treasuries, sending yields sharply elevated, with benchmark 10-year notes rising 7 foundation procedure to 4.431% and 2-year notes leaping 10 foundation procedure to three.983%.

The U.S. greenback index, which tracks the greenback against a basket of six world currencies, changed into once marked 1.14% elevated at 101.491.

More Financial Prognosis:

- Fed inflation gauge models up stagflation dangers as tariff insurance policies bite

- U.S. recession risk leaps as GDP shrinks

- Like it or no longer, the bond market guidelines all

World stocks had been additionally on the meander following news of the tariff truce, with Europe's Stoxx 600 rising 1.16% in Frankfurt and Britain's FTSE 100 up 1.16% in London.

In in one other nation markets, Japan's Nikkei 225 ended 0.38% elevated in Tokyo sooner than the U.S.-China tariff quit, while stocks in China rose by spherical 1.7%. The dwelling-wide MSCI ex-Japan index, meanwhile, surged 1.86%.

What's Your Reaction?