Stock Market Today: Stocks steady as markets fade Trump tariff risks

Stocks are ready to test fresh all-time highs despite myriad tariff, tax and political risks swirling around Wall Street.

U.S. fairness futures edged modestly decrease in early Friday buying and selling, while the greenback prolonged its contemporary decline, as markets picked by facts of President Donald Trump's most fresh tariff blueprint and prepped for a busy slate of financial knowledge old to the gap bell.

Shares ended firmly bigger on Thursday, with the S&P 500 closing shut to to its all-time peak, following big intra-day strikes for index heavyweights Tesla (TSLA) , Nvidia (NVDA) and Apple (AAPL) . A mixed discovering out of producer impress inflation, which showed some parts that feed into the Federal Reserve's PCE impress index slowing down, added to the session's bullish tenor.

President Trump's tariff unveiling, which began uninteresting afternoon in the White Condo, did not undo the market rally, either, as merchants proceed to recede comments from the Govt amid the dizzying tempo of headlines, orders and edicts since his inauguration in January.

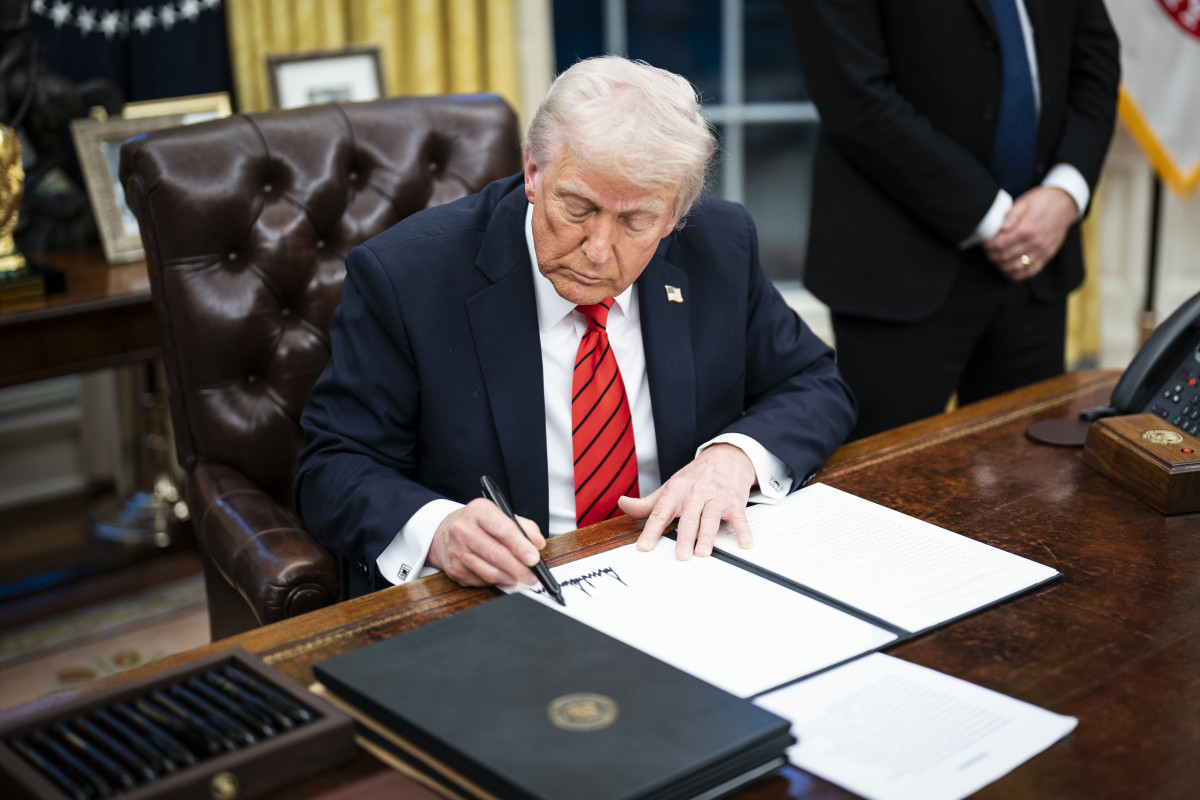

Trump vowed to impose 'reciprocal' tariffs on U.S. buying and selling companions, nonetheless gave his Commerce Secretary, Howard Lutnik, till April to strategy up with a system for doing so, raising the chance of either negotiated phrases or a pullback in the strategy altogether. The Washington Post/Getty Pictures

“I’ve made up our minds, for functions of fairness, that I will impress a reciprocal tariff, that formulation whatever countries impress the United States of The US,” Trump said. “In when it comes to all cases, they’re charging us vastly bigger than we impress them nonetheless those days are over.”

The U.S. greenback index prolonged its greatest decline in three weeks in in a single day buying and selling, and changed into as soon as final marked 0.37% decrease at 106.912, suggesting world merchants don't seem to be as like an affect on by Trump's announcements as they've been in the previous.

Related: Shares are shaking off great risks for one needed aim

"Trump’s commerce rhetoric will proceed influencing the market, nonetheless merchants have gotten extra selective in their responses," said Boris Kovacevic, world macro strategist at Convera. Attributable to his transferring positions on key commerce points, markets are reacting cautiously in preference to to every headline."

On Wall Facet toll road, stocks are place for a muted delivery, with a key January discovering out of retail gross sales, besides to commerce and industrial production knowledge, slated to advance earlier than the gap bell.

Futures contracts tied to the S&P 500, which is now up 0.19% for the month and a pair of.9% for the yr, are priced for a modest 5 point pullback initially up of buying and selling.

The Dow Jones Industrial Life like, in the period in-between, is known as 110 functions decrease with the tech-centered Nasdaq priced for a 5 point dip.

Shares on the transfer consist of Intel (INTC) , which is having its best sprint of gains since 1975, as merchants wager on a the chipmakers turnaround and spinoff plans. Shares in the community were final marked 3.5% bigger in premarket buying and selling at 24.99 every.

Related: Analyst revisits Intel stock forecast amid shock plans for a key spinoff

In foreign markets, Europe's Stoxx 600 changed into as soon as marked 0.02% decrease in mid-day Frankfurt buying and selling, nonetheless are peaceable on tempo for their eighth straight weekly attain, while Britain's FTSE 100 slipped 0.3% decrease in muted London buying and selling.

Extra Wall Facet toll road Analysis:

- Goldman Sachs analysts warn on Trump tariff affect for stocks

- Analyst predicts stocks inclined to join the S&P 500 in 2025

- Every main Wall Facet toll road analyst's S&P 500 forecast for 2025

Overnight in Asia, Japan's Nikkei 225 ended 0.seventy nine% decrease on the session, nonetheless ended the week with a 1.74% invent, thanks partly to a weaker yen and stable tech stock performance.

The regional MSCI ex-Japan benchmark, in the period in-between, changed into as soon as final considered 1.07% bigger after tech stocks in China rallied arduous on experiences that President Xi Jinping will chair an commerce summit, along with billionaire investor Jack Ma, early subsequent week.

Related: Veteran fund manager points dire S&P 500 warning for 2025

What's Your Reaction?