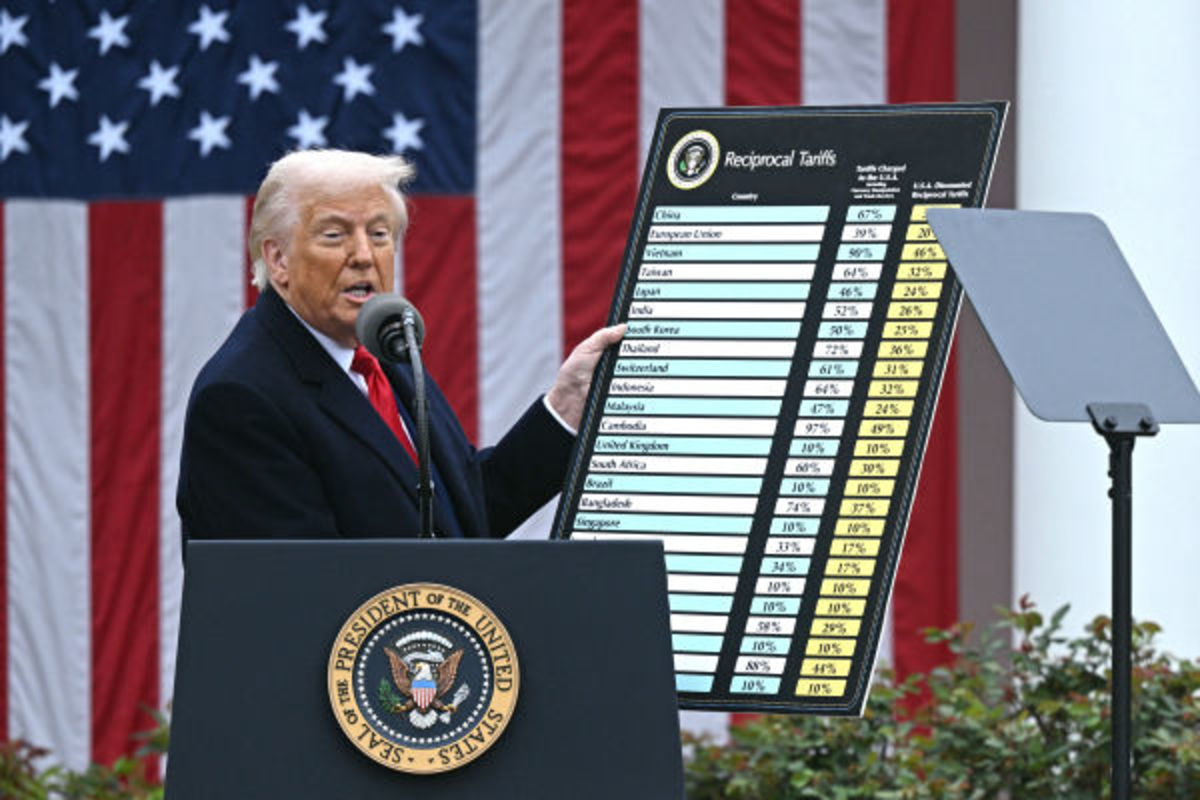

Stock Market Today: Stocks tumble as China hits back in escalating trade war

The S&P 500 has fallen more than 12.1% since President Trump's tariff announcement last week.

U.S. equity futures transfer firmly lower in early Wednesday trading, paired with a spike in Treasury bond yields, as customers braced for the realm market influence of President Donald Trump's sweeping tariffs and the rising odds of a domestic recession.

As much as this level at 7:05 AM EDT

China counter-punch

Shares turned sharply lower in premarket trading after China's Finance Ministry acknowledged it would impose an additional 84% tariff on U.S.-made goods in accordance with the 104% levy build in area by President Donald Trump earlier this week.

Futures tied to the S&P 500 now counsel an 85 level opening bell decline, with the Dow known as 630 aspects lower and the Nasdaq priced for a 172 level stride

BREAKING: CHINA ANNOUNCES ADDITIONAL TARIFFS OF 84% ON US GOODS BEGINNING APRIL 10TH.

WOW.— The Kobeissi Letter (@KobeissiLetter) April 9, 2025

Stock Market At the present time

Shares ended sharply lower on Tuesday following a dangerous session that incorporated a 360 level peak-to-trough swing for the S&P 500, one in every of basically the most tasty on document, as the benchmark closed below the 5,000 level sign for the principle time in better than a year.

The Nasdaq, which is now 25% south of its mid-December peak, fell 2.15% the day previous to this as China-gentle stocks comparable to Apple (AAPL) and Tesla (TSLA) tumbled earlier than President Trump's resolution to impose a crippling 104% levy on goods from the enviornment's 2nd-most tasty economy.

The mid-cap Russell 2000 index, meanwhile, entered undergo market territory at the cease, outlined as a 20% retreat from its new peak, suggesting elevated odds of a U.S. recession over the next twelve months. BRENDAN SMIALOWSKI/Getty Images

Markets are braced for a equally wild session this day, with the CBOE Neighborhood's VIX volatility index pegged at $Forty eight.63, cease to the best in five years and a stage that implies day after day swings of around 3.05%, or 150 aspects, for the S&P 500.

Bond market volatility gauges are also on the upward push, with Merrill Lynch's Suggestions Volatility Estimate, identified as the MOVE index, trading at the best ranges in a year amid a violent bond market selloff that has added around 40 foundation aspects to benchmark 10-year new yields correct thru the last week.

The paper became as soon as best marked at 4.376% heading into the birth of the New York trading session and a key $39 billion auction of re-opened notes later within the session.

Associated: 10-year bond auction will present key take a look at to Trump's tariff scheme

Heading into the birth of the trading day on Wall Avenue, futures contracts tied to the S&P 500, which has suffered basically the most tasty five-day loss for the rationale that index became as soon as established within the Fifties, counsel a gap bell decline of around 22 aspects.

Futures linked to the Dow Jones Industrial Moderate, meanwhile, are priced for a 255 level stride whereas the Nasdaq is is known as for a 10 level bump.

Shares foreign places are also in retreat, with Europe's Stoxx 600 falling 14 aspects, or 2.82%, to pull the regional benchmark to inner touching distance of undergo market territory. Britain's FTSE 100, meanwhile, fell 2.4% in London.

Overnight in Asia, the Nikkei 225 slumped 3.93% on the principle day of President Trump's so-known as 'reciprocal' tariffs on Eastern goods kicked-in, pinning the index at its lowest ranges since August.

The negate-broad MSCI ex-Japan benchmark, meanwhile, fell 1.21% into the cease of trading.

More Financial Prognosis:

- Wall Avenue overhauls S&P 500 mark targets as tariff selloff speeds up

- Inflation would love a note, please

- Shares may soar, however big monetary institution earnings preserve the playing cards

What's Your Reaction?