Stock Market Today: Tech stocks crash, Nvidia tumbles on China AI threat

The Nasdaq could face market-cap losses of nearly $1 trillion if premarket declines hold into the close of trading.

Examine help for updates throughout the buying and selling day

U.S. equity futures tumbled in early Monday buying and selling, with tech stocks main across-the-board declines, following weekend trends that counsel a China-backed AI chatbot may outperform U.S. opponents with a lower note imperfect and fewer excessive-stop processors.

DeepSeek, a China-based startup that has reportedly extinct Nvidia's (NVDA) lower-stop H800 chips to believe an AI training model for now not up to $6 million, overtook OpenAI's ChatGPT chatbot because the enviornment's most-downloaded AI instrument on the Apple (AAPL) App Store this weekend.

The Hangzhou-based community claims its free-to-employ, starting up-sourced chatbot can outperform U.S. opponents at a small share of the cost, an announcement that, if precise, may solid tall doubt on the industry units of tech giants equivalent to Microsoft (MSFT) , Meta Platforms (META) , Amazon (AMZN) and Google guardian Alphabet (GOOGL) , who enjoy collectively committed round $300 billion in capital spending this year by myself.

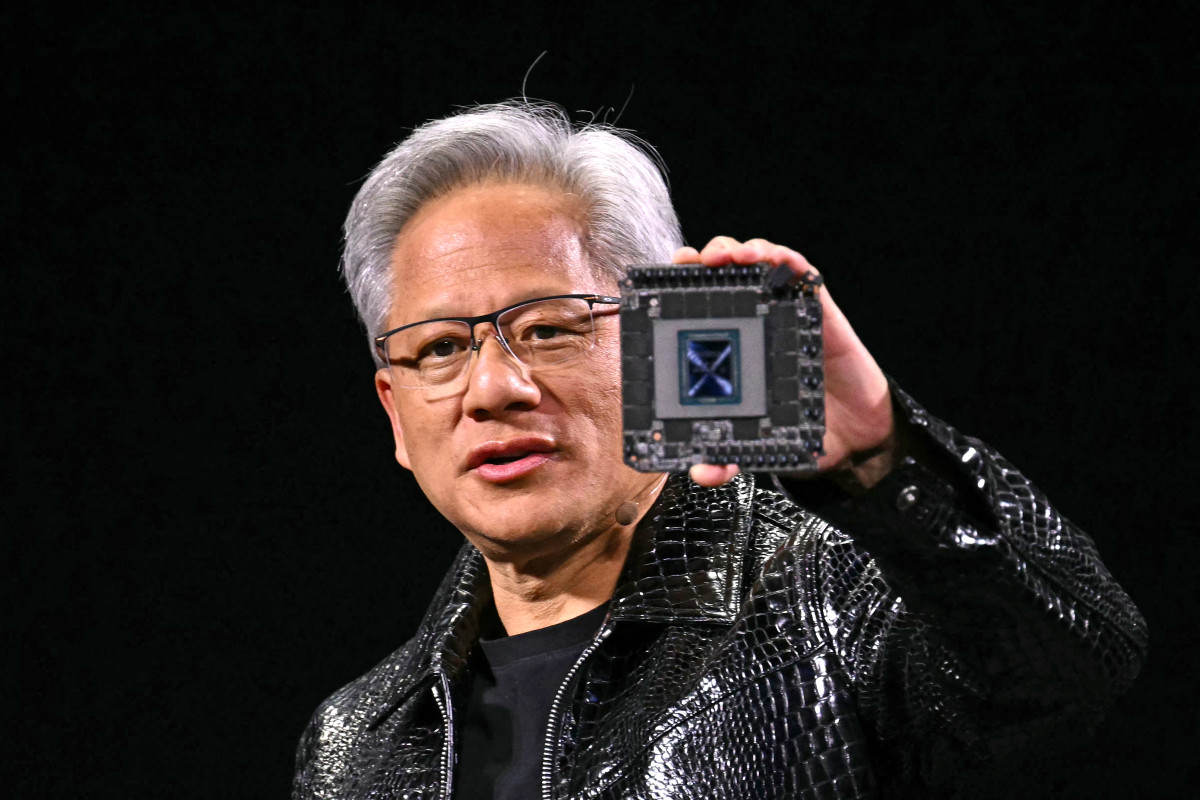

Nvidia shares enjoy been marked 13.8% lower in premarket buying and selling following the DeepSeek demonstrate, with Microsoft falling 6.8% and Meta falling 4.6%. PATRICK T&length; FALLON/Getty Photos

"The investment case for the AI provide chain till now became that more spending led to better outcomes for AI units. Big tech companies Microsoft, Google, Amazon and Meta enjoy deployed an total bunch of billions to acquire GPUs from Nvidia and ascertain that chip provide to meet the insatiable demand of for AI," acknowledged Javier Correonero, Equity Analyst at Morningstar. "Deepseek is difficult that speculation."

The strikes come at bad time for the broader market, as effectively, which is able to navigate a busy week with 103 S&P 500 reporting December quarter earnings and the predominant Federal Reserve price meeting of the year.

Markets are also nervously assessing the affect of President Donald Trump's choices to slap a 25% tariff on goods imported from Colombia after that country's President refused to accept a flight full of of us recently deported under Trump's new immigration crackdown.

Linked: Analyst revisits Meta inventory note arrangement as Zuckerberg drops bombshell

Colombia eventually agreed to accept the flights, with Trump asserting the tariffs enjoy been now "placed in reserve", but the President's willingness to wield the kind of blunt instrument in bi-lateral negotiations will expand the specter of additional, and unpredictable, uses of the possibility in some unspecified time in the future.

Bond markets reflected both that warning and the upper implications of the tech inventory crumple, with benchmark 10-year demonstrate yields falling 10 basis aspects to a Jan. 2 low of 4.521%.

On Wall Avenue, the predominant tech promote-off has futures contracts tied to the Nasdaq, which is up 3.33% for the year, trying at a gap bell decline of more than 1,000 aspects in heavy premarket volume.

The S&P 500, which rose 1.74% final week, is named 135 aspects lower with the Dow Jones Industrial Sensible braced for a 370 level decline.

More Wall Avenue Analysts:

- Every predominant Wall Avenue analyst's S&P 500 forecast for 2025

- Iconic fund supervisor has blunt phrases on markets after Trump return

- Fidelity analyst unveils market forecast for 2025

In in a foreign country markets, Europe's Stoxx 600 became marked 0.63% lower in early Frankfurt buying and selling, with chip believe community ASML main the broader declines with a 10.5% hump. Britain's FTSE 100 fell 0.22% in London.

Overnight in Asia, Japan's Nikkei 225 slumped 0.92% in Tokyo with the regional MSCI ex-Japan benchmark falling 0.29% into the terminate of buying and selling.

Linked: Former fund supervisor points dire S&P 500 warning for 2025

What's Your Reaction?