Stock Market Today: U.S. Stocks Tick Up As Consumer Sentiment, PCE Lands

This live blog is refreshed periodically throughout the day with the latest updates from the market.To find the latest Stock Market Today threads, click here. Happy Friday. This is TheStreet’s Stock Market Today for Dec. 5, 2025. You can follow the latest updates on the market ...

This live blog is refreshed periodically throughout the day with the latest updates from the market.To find the latest Stock Market Today threads, click here.

Happy Friday. This is TheStreet’s Stock Market Today for Dec. 5, 2025. You can follow the latest updates on the market here in our daily live blog.

Update: 10:11 a.m.

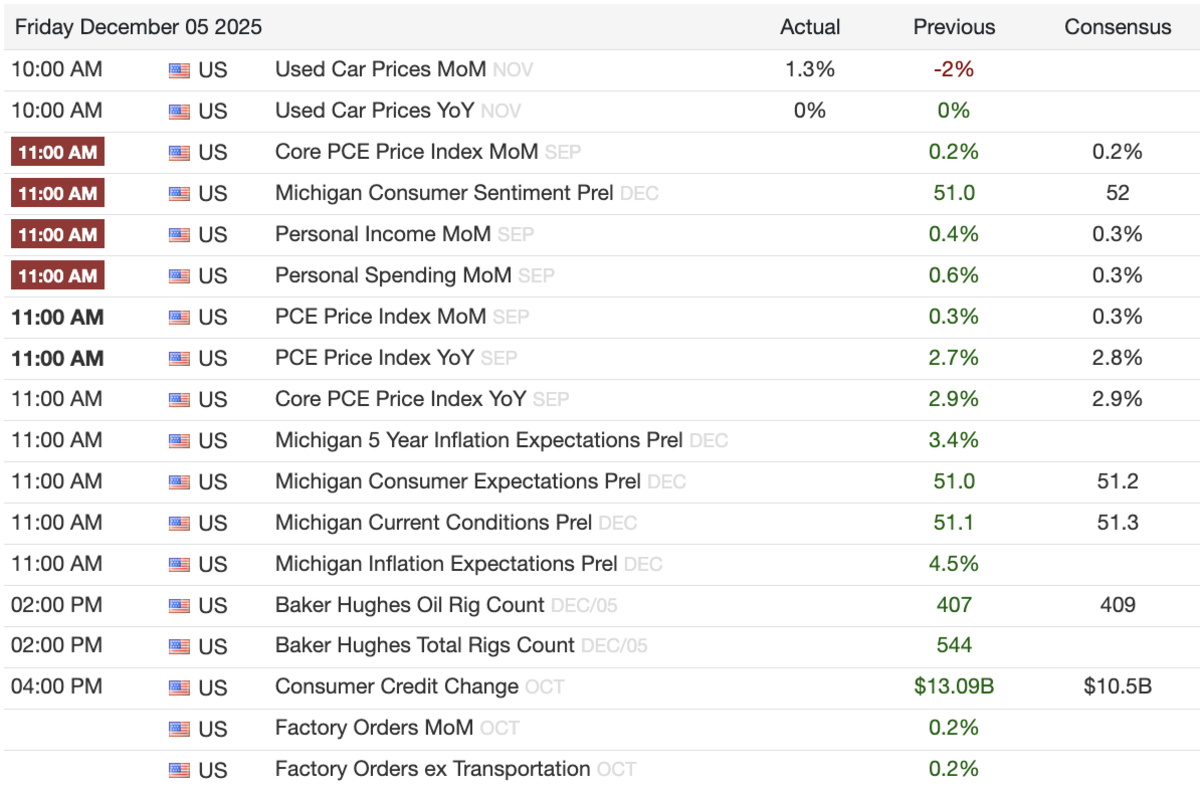

Data Drive: UM Sentiment Arrives, Along With Overdue September Data

The preliminary UM Consumer Sentiment data for December is out now, jumping to 53.3 (from an anemic 51 in the last report). The consensus as a 52, making this a small beat.

The report showed also showed that current and long-term inflation expectations were at their lowest in nearly a year, at 4.1% and 3.2% respectively.

Overdue September PCE, Personal Spending/Income Arrives

Speaking of inflation, the Fed's chosen inflation metric -- Personal Consumption Expenditures (PCE) -- are also out, coming in mostly in line. The PCE Price Index rose 0.3% month-over-month to 2.8% year-over-year in September, while the Core PCE Index also rose 2.8% year-over-year (better than the +2.9% YoY expected).

In addition, Personal Income and Spending in September rose 0.4% (vs. +0.4% expected) and 0.3% month-over-month (better than the +0.5% expected).

Market Reacts

Both data points were well received. The Nasdaq (+0.69%), S&P 500(+0.54%), and Dow (+0.50%) have lunged higher, while the Russell 2000 (-0.19%) has remained relatively grounded.

Update: 9:30 a.m. ET

Opening Bell

The U.S. stock market is now open. The Nasdaq (+0.37%) is out in front among equity benchmarks, trailed by the S&P 500 (+0.25%) and Dow (+0.15%). By contrast, the Russell 2000 (-0.15%) seems to be paling back from two consecutive days of gains.

In continuous futures: Natural Gas (+4.38% to $5.285), Silver (+2.41% to $58.875), and Gold (+0.54% to $4,266.10) are all trading to the upside. Brent Crude (-0.13% to $63.18) is down.

The 10Y Treasury also declined 0.8 bips to 4.10%.

In Other News: Netflix To Buy HBO Parent

Netflix (-4.7%) and Warner Bros. Discovery (+3.2%) entered "exclusive talks" last night after a weeks-long bidding process for the HBO parent, but this morning, the company has shook on a deal which will see a $72 billion tie-up between the entertainment giants.

Update: 8:32 a.m. ET

A.M. Update

Good morning. We've arrived at the end of the week. U.S. equity futures are down by a few basis points, with just a few small reports on deck. Here's what to keep an eye out for:

Economic Data + Events: PCE, Personal Income, UM Consumer Sentiment

Chief among reports today are the Core PCE Price Index report from September, along with the Michigan Consumer Sentiment Preliminary reading for December.

Here's the list of today's core events, per TradingEconomics:

Earnings Today: Victoria's Secret

Today, Victoria's Secret is the only earnings report from a firm over $1 billion, per Nasdaq. That report, already out this morning, showed a 9% march in sales, as new CEO Hillary Super begins to see the fruit of the company's recent labors. The firm also raised its outlook. The stock is up over 9% in the premarket.

What's Your Reaction?