Struggling semiconductor company gets second chance to avoid bankruptcy

Amid booming demand for next-gen technology, one US chipmaker is struggling to stay afloat under the weight of mounting debt and missed expectations.

Which cliché rings more good: working a a success business has never been straightforward, or having an very good business has never been more difficult? Either manner, the message is decided — presently time's companies face relentless challenges.

Totally different times endure completely different boundaries. There may be no longer one key to success, and there’s no guarantee how long the neatest thing will closing. As the realm develops, contributors trade. Our tradition, habits, and monetary abilities dictate the trends.

That’s why timing is every thing.

Connected: Apple iPhone choice will upset customers, appease White Condo

Trends can shift; on the opposite hand, one industry that looks relatively proof in opposition to economic turbulence and uncertainties is know-how.

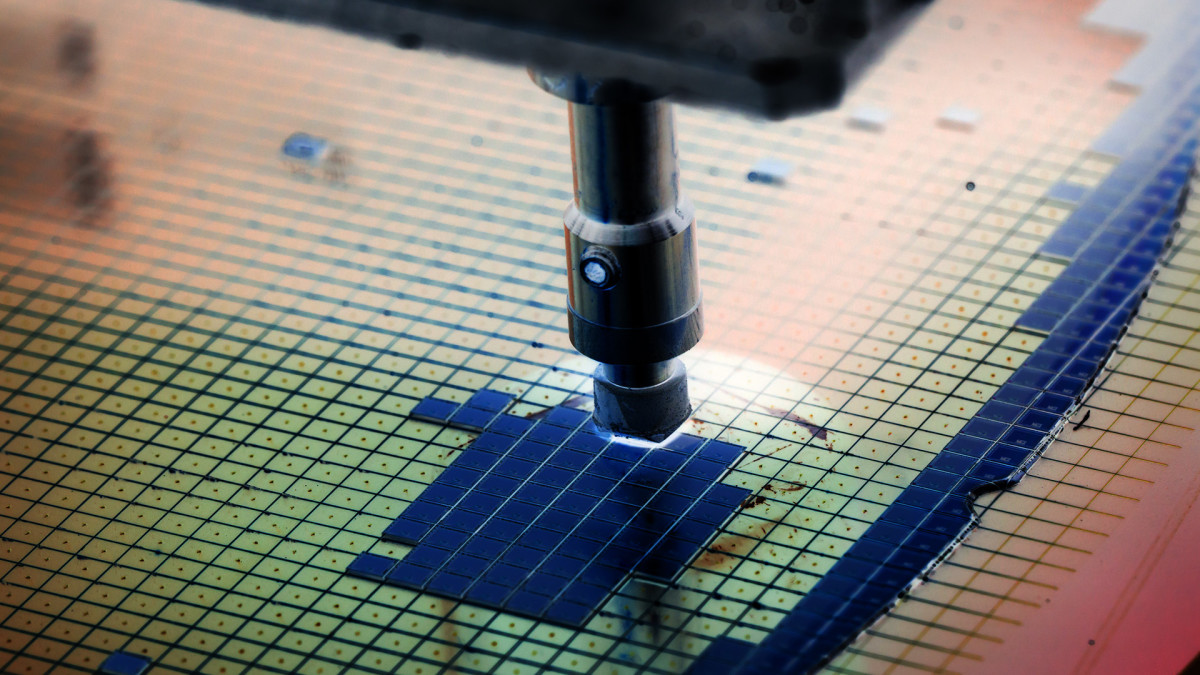

Expertise is deeply connected to virtually every thing we live and desire. It powers every thing from agricultural machines that bring food to our tables, to clinical gadgets that variety varied diagnoses or surgical procedures potential, to chill gadgets we don’t actually favor, but worship. Image source: Shutterstock

Semiconductors as a neat industry

Within the tech sector, indubitably one of many fastest-rising sub-industries is semiconductors. In step with the Deloitte Heart for Expertise, Media & Telecommunications, the semiconductor industry had sturdy growth in 2024, with sales reaching $627 billion.

Experts predict sales of $697 billion for 2025, signaling the industry is on direction to reach $1 trillion in chip sales by 2030. The industry must grow at a compound annual growth rate of 7.5% between 2025 and 2030 to hit that purpose.

More know-how:

- Microsoft cutting again workers in largest layoff since 2023

- AI attain prompts Google parent stock-rating tweak

- Legendary tech professional has surprising stumble on of AI affect on jobs

The stock market also displays industry performance. As of mid-December, the blended market capitalization of the high 10 world chip companies turned into $6.4 trillion, up 93% three hundred and sixty five days over three hundred and sixty five days and 235% over two years.

Alternatively, it's miles needed to display hide that the companies within the generative AI chip market safe led the performance. In disagreement, companies with out that exposure (car, smartphone, pc, and semiconductor) safe underperformed the frequent, explains Deloitte.

Subsequent-period semiconductor maker faces challenges

One semiconductor maker that has been facing challenges is publicly traded Wolfspeed WOLF. The Durham, North Carolina-headquartered firm prides itself on being the creator of the following-period semiconductor know-how, making big enhancements in efficient and sustainable energy.

Wolfspeed makes a speciality of silicon carbide (SiC) semiconductors constituted of silicon and carbon. Its advantages over silicon semiconductors consist of a breakdown electrical field energy 10 times increased than silicon, enabling the configuration of increased voltage (600V to thousands of V) energy gadgets.

This selection makes them real for applications requiring excessive patience, equivalent to electrical autos, telecommunication infrastructure, and renewable vitality systems. SiCs are also standard for their excessive mechanical, chemical, and thermal stability.

Wolfspeed shared on May 8 that it turned into concerned with a economic waste filing after failing to reach an settlement concerning a bond restructuring, reports The Financial Times.

The firm as we recount has $6.5 billion in entire debt, in conjunction with a $1.5 billion senior secured mortgage held by asset management firm Apollo World Management.

On May 11, Wolfspeed turned into thrown a likely lifeline as its junior creditors equipped $600 million in rescue financing to refinance a astronomical convertible bond coming due in 2026 and present contemporary capital.

Connected: Express-all says Facebook inclined injurious ways on inclined neighborhood

Wolfspeed’s senior lender controls its skill to difficulty more secured debt, while convertible bondholders admire Balyasny and Shaolin Capital dread a premature economic waste. If that happens, Apollo and companions may dominate restructuring, leaving junior creditors at a loss.

Meanwhile, Renesas Electronics gave Wolfspeed a $2 billion near for future products. In 2024, Wolfspeed secured a $750 million Chips Act variety out the Biden administration — even though the funds are serene pending.

Assured in its U.S. manufacturing edge over Chinese language competitors, Wolfspeed has heavily invested in manufacturing, staring at for EV-driven income to exceed $800 million every three hundred and sixty five days.

Alternatively, EV sales had been no longer hitting the anticipated numbers.

For the third quarter of fiscal 2025, the firm disclosed income of $185 million, as in comparison with $201 million in 2024, and a get loss of $1.86 million, in comparison with a get loss of $1.18 million within the equivalent length a three hundred and sixty five days ago.

All around the earnings name on May 8, Wolfspeed reminded traders about its mark-cutting again programs equivalent to mass layoffs, sharing plans to lower 30% of its senior management team and shut its 150-millimeter gadget facility in Durham.

Over the previous three hundred and sixty five days, Wolfspeed’s part mark dropped 84.35% to $3.71 per part, and its market capitalization has dropped from $4 billion closing three hundred and sixty five days to some $574 million as we recount.

Connected: Bankrupt retail chain gets potential billion-dollar rescue lifeline

What's Your Reaction?