Surprising Microsoft earnings sends stock surging

Microsoft shares are up 7% after quarterly earnings.

Fear that a slowing economic system will derail synthetic intelligence-fueled increase this 365 days may elevate a assist seat after Microsoft over-delivered in its most up-to-date quarterly earnings legend.

Connected: Surprising GDP legend sends shares on curler coaster fade

Microsoft outpaced Wall Street earnings estimates on revenue and revenue, largely due to this of rising AI adoption. The company saw outsized increase in key fashions, including its cloud industry, Azure, and stable Copilot AI adoption.

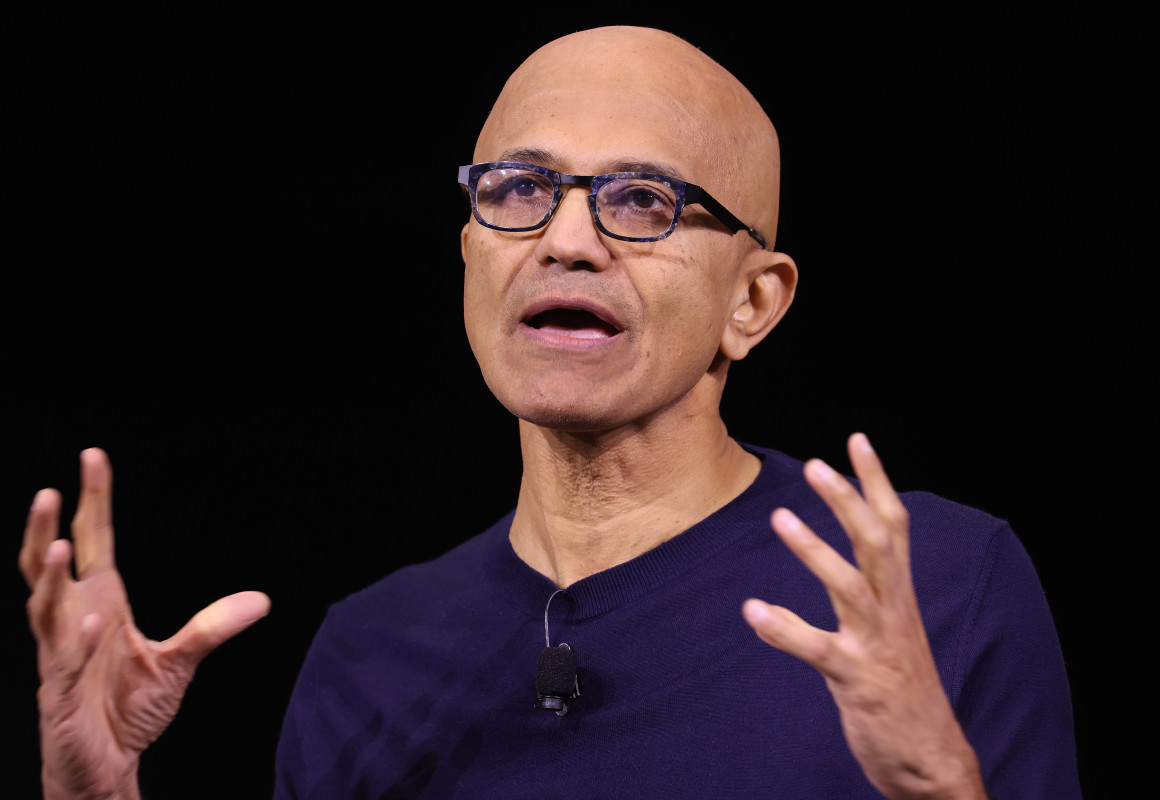

The upper-than-anticipated outcomes despatched Microsoft's stock label surging 7% in after-hours procuring and selling. Stephen Brashear/Getty Photos

Microsoft continues to maneuver stable AI tailwinds

Microsoft is one in all essentially the most infamous gamers in synthetic intelligence. It has a sweetheart handle OpenAI's ChatGPT that accelerated its have AI ambitions, and its AI offering Copilot continues to build up instant seat increase at enterprises.

In the corporate's fiscal third quarter, which ended March 31, it generated revenue of $70.06 billion, up 13% 365 days over 365 days, which was once $1.62 billion better than Wall Street analysts were modeling.

Connected: Microsoft shares monstrous new use for AI

Its final analysis increase was once noteworthy extra spectacular, with earnings per fragment clocking in at $3.46, 24 cents better than estimates and up 18% from one 365 days ago.

The company's success was once largely due to this of cloud and AI increase. Microsoft Cloud revenue rose 20% 365 days-over-365 days to $42.4 billion, while intellectual cloud revenue grew 21% to $26.8 billion, supported by 33% Azure increase. Azure's increase outpaced the analysts' 31% increase forecast.

It additionally posted increase in its other most foremost segments. Private computing gross sales rose 6% to $13.4 billion as search and info advert revenue grew 21%. Productivity and Substitute Route of revenue rose 10% to $29.9 billion.

Traders key in on AI increase and revenue growth

Azure's efficiency is helping ease some ache that AI effect an issue to may soften amid rising macro risk. In the meantime, running efficiency gains are translating into revenue margin increase.

Connected: Iconic fund supervisor sends elegant 3-notice message on shares

Up to now, the one-two punch is sufficient to lend a hand traders to bid elevated shares, reversing about a of Microsoft's 2025 losses. Heading into the legend, Microsoft's stock label was once down 6% 365 days-to-date and 10% over the previous three months.

The early response to Microsoft's quarterly earnings shows shares up 7.3% in put up-market procuring and selling. Of course, noteworthy depends on how traders react to the corporate's earnings convention name and forward steering.

There may be been discussion over whether or not Microsoft may mood its capex budget after two years of big knowledge heart buildout.

CEO Satya Nadella said on the choice that Microsoft opened 10 new knowledge centers final quarter. Administration expects capex to develop in fiscal 2026, albeit slower than in 2025.

Microsoft's CFO Amy Hood additionally said Azure should bring stable fiscal fourth-quarter increase of 34% to 35%.

Earnings in its Vivid Cloud segment is forecast to be between $28.75 billion to $29.05 billion, representing 21% to 22% 365 days-over-365 days increase.

Overall, Microsoft is guiding for total revenue of $73.15 billion to $74.25 billion for the quarter.

Connected: Frail fund supervisor unveils interrogate-popping S&P 500 forecast

What's Your Reaction?