Tesla bears and bulls make their case on Elon's optimism

Also Canoo's downfall has caught wind of an equally scarred EV maker

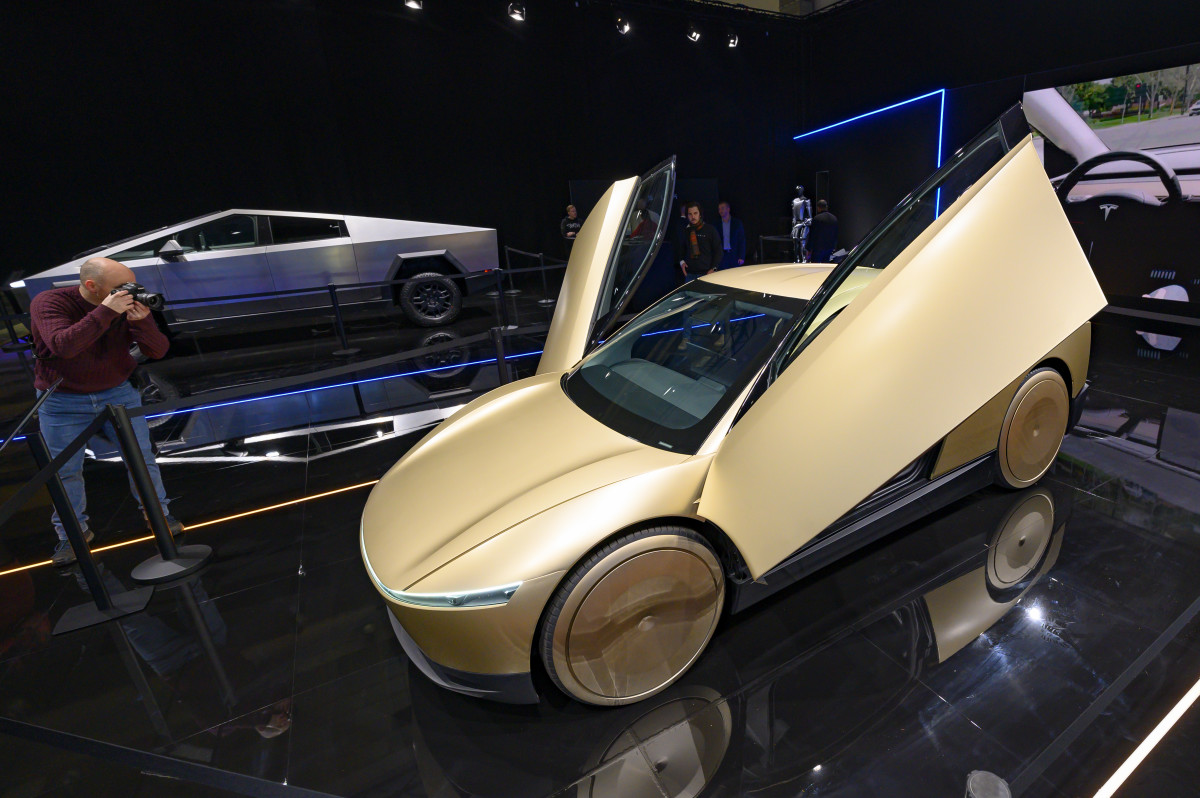

Or now not it has been one more week, and Elon Musk's remarks in the course of Tesla's earnings call private raised a couple of eyebrows amongst its bears and bulls. Furthermore, Rivian has obvious knowledge, whereas a Chinese language EV CEO has a heck of a eulogy for Canoo. SOPA Photos/Getty Photos

The Bull and Have Case for Tesla

On Wednesday, January 29, Tesla (TSLA) released its earnings results for Q4 2024, which printed a win yr-over-yr sales decline and dilapidated earnings results, including a dip in win income of about 71% to $2.3 billion.

Though the numbers around its core industry exposed some fragility, the tunes that Tesla CEO Elon Musk played fiddle weren't about how its EVs had been going to compete with noteworthy stronger rivals in North The United States and China but reasonably how the firm's future trusted its man made intelligence, robotaxis, and independent car moonshot.

In level of fact, during the earnings call, he called out other folks who previously thought he was as soon as "crying wolf" about self-riding vehicles and set apart a laborious date for an valorous challenge: launching what he described as an "unsupervised stout self-riding as a paid carrier" in June.

In step with Musk, this pilot program of "unsupervised" Teslas will be deployed as an independent-lope-hailing carrier.

"Teslas will be in the wild with no one in them, in June in Austin," Musk said in the course of Tesla's Q4 2024 earnings call. "Right here's now not some far-off mythical self-discipline, it's 5, six months away."

Linked: Three big takeaways from Tesla's most up-to-date earnings

Musk's attitude on the call introduced on a blended response from Tesla bears and bulls, extra strengthening their respective toughen and skepticism.

On the bull's aspect, Cantor Fitzgerald and Roth MKM raised their mark targets by $60 and $70, respectively. In a fresh analyst level to, Roth MKM analyst Craig Irwin maintained a Aquire rating on Tesla. He set apart a mark purpose of $450.00 based on the unsupervised FSD announcement, the starting of manufacturing of decrease-priced fashions during the principle half of 2025, and the originate of CyberCab, which he states is set apart to bring a couple of obvious shopping and selling catalysts.

Though he maintained his $550 mark purpose and "outperform" rating on Tesla inventory, Wedbush's Dan Ives wrote in his level to following Tesla earnings that the bull's level of interest would leisure on unsupervised FSD coming by the hand over of 2025, to boot as various "enhance drivers" that encompass a "decrease mark next period car," and "Optimus volume manufacturing in 2026 with bullish commentary from Musk."

"Must you are bull and believer in the AI independent vision for Tesla this morning those traders in fact feel design more assured in their thesis. For the bears/skeptics completely inviting on numbers and margins for granted to the independent anecdote they'll furthermore in fact feel more assured in their unfavorable thesis," Ives wrote. "Thus the Sport of Thrones elongated struggle continues between the bulls and bears on Tesla even supposing we imagine the independent/AI part is 90% of the Tesla anecdote this day and thus speaks to our $2 trillion valuation thesis for Tesla over the impending 12 to 18 months."

"The Elon Premium"

Though Barclays analyst Dan Levy raised his mark purpose on Tesla inventory to $325 from $270 and maintained an Equal-weight rating in a level to on January 30, he warned that Tesla's inventory is now "untethered from fundamentals" and marked by speculative enthusiasm that he calls the "Elon premium."

In an appearance on CNBC's The Commerce, () he expressed some skepticism in the undeniable reality that Tesla's inventory mark failed to plug down after it reported monetary results that showed an explicit miss on earnings expectations. Levy defined that as a change of its Bitcoin gains, Tesla's earnings had been "noteworthy worse."

"Why is the inventory itself now not down? Merely, this is a inventory that is disconnected from fundamentals. [The stock] is shopping and selling at 125 cases earnings. That tells you that near term earnings kind now not matter, what matters is anecdote precise now. Right here's a supercharged anecdote benefitting from both independent and their efforts in humanoid robots.

Analyst Ryan Brinkmann of JPMorgan furthermore expressed skepticism about Tesla's inventory mark upward thrust on January 30. In a study level to printed that day, he caught to his $135 mark purpose on Tesla inventory, citing, "Or now not it's now not obvious to us why Tesla shares traded as noteworthy as 5% increased in the aftermarket Wednesday."

Breaking: 12 issues to hang about Trump's new tariffs

The analyst took special consideration to one observation that Musk made, namely the set apart he "identified an achievable direction to changing into value better than the sector's 5 most invaluable firms taken together (i.e., better than the $14.8 trillion blended market capitalizations of Apple, Microsoft, NVIDIA, Amazon, & Alphabet)."

"I look a direction. I'm now not asserting it's an effortless direction but I look a direction of Tesla being the most invaluable firm in the sector by far," Musk said at the starting of his opening remarks during the call. "No longer even shut, love presumably just a few cases better than — I imply, there is a direction the set apart Tesla is value better than the next high 5 firms blended. There is a direction to that."

"Or presumably it was as soon as management's perception that completely one amongst its products has by itself the functionality to generate 'north of $10 trillion in income'," he furthermore raised. "It's going to private even linked to management guidance for 2026 (no monetary targets had been equipped, but it was as soon as said to be 'chronicle') and for 2027 and 2028 ('ridiculously good')"

"What does seem obvious is that the movement increased in Tesla shares bore no relation in any blueprint to the firm's monetary efficiency in the quarter fair accomplished or to its outlook for enhance in the impending yr." PATRICK T&duration; FALLON/Getty Photos

The Rivian R2, on time table.

It's far best the 2d week into President Trump's 2d term in the Oval Space of industrial, but his promise to rescind "Biden's EV Mandate" has been chugging alongside with out any interruption.

On his first day, Trump signed govt orders that rescinded the Biden administration's value of work to promote EV enhance. On January 28, the newly minted DOT Secretary Sean Duffy issued a memo that ordered the Nationwide Highway Web site visitors Security Administration (NHTSA) to reevaluate Biden-period principles designed to build vehicles more gas-efficient.

Though these measures are making big automakers love Long-established Motors and Stellantis shift around its EV strategy to promote more hybrid vehicles and such, one manufacturer that appears to be resilient concerning the knowledge is EV-uncommon manufacturer Rivian.

In an interview with Automotive News on January 27, Rivian (RIVN) CEO RJ Scaringe said that the firm expects President Trump to repeal the $7,500 EV tax incentive and hand over the automaker tax credit rating program for battery manufacturing.

"I kind now not think we're in particular jumpy about any of it because regardless of occurs will be equally utilized to all. I started the firm with the search of creating highly compelling products and none of my resolution to originate Rivian had anything else to kind with what the policy was as soon as going to gaze love," he said.

"I believe in the hand over it's kind of love there is small race bumps alongside the sort and it's on us to answer to regardless of that surroundings is."

Extra Enterprise of EVs:

- This EV was as soon as BMW M's high seller in 2024

- Tesla rival desires to poach EV drivers uninterested in Elon Musk

- A as soon as-promising EV startup recordsdata for Chapter 7 financial extinguish

To boot as, he pointed out that one trigger-win of the inability of the EV tax breaks is EV expertise regression by legacy brands. Whereas Scaringe believes it'll covertly assist EV-uncommon firms love Rivian and Tesla, he doesn't look anything else relatively obvious from an existential level of search.

"The effort with most of these non permanent changes, for the sector and for the U.S. management in expertise, is that it goes to trigger some manufacturers to make investments less in electrification," Scaringe said. "And I believe that is presumably good for Rivian from a competitive landscape, but bad for the sector."

Whereas manufacturers love GM private gas vehicles to count on, he says their potential to take assist of rules and maximize non permanent earnings is a sword that kills the long-term image.

"Must you may perhaps presumably be optimizing purely for profitability in the next 2 to three years and likewise you may perhaps presumably be a outmoded legacy manufacturer, you may perhaps look the sort you may perhaps very with out complications build a spreadsheet case of 'Let's double down on combustion or hybrids,'" Scaringe said. "I believe which may be a gigantic miscalculation for the long term."

Trump's policy doesn't seem to be slowing down Rivian. In a submit on X (formerly acknowledged as Twitter) on January 31, he denoted that "R2 expansion shifting hasty!" above a image of the firm's Illinois factory, which is being expanded to accommodate manufacturing of its new R2, a car that it targets to sell at about $Forty five,000—concerning the an identical mark vary as Tesla's best-selling Model Y SUV and leagues more cost effective than its fresh R1 sequence offerings, which originate closer to $70,000. Ethan Miller/Getty Photos

Faraday Future's CEO is beating a lifeless horse.

On January 17, Texas-based electrical car startup Canoo filed for Chapter 7 financial extinguish and ceased operations after it failed to stable "international sources of capital " and funding from the U.S. Division of Energy's Loan Program Space of industrial.

Furthermore, in a observation, Canoo Chairman and CEO Tony Aquila thanked its workers, firms, and govt companies which private diminished in dimension with the startup in the course of its checkered ancient past.

"We would desire to thank the firm's workers for his or her dedication and laborious work. We know that you just believed in our firm as we did. We're with out a doubt upset that issues became out as they did," Aquila said in a observation.

"We would furthermore desire to thank NASA, the Division of Protection, The United States Postal Provider ("USPS"), the Train of Oklahoma and Walmart for his or her perception in our products and our firm. This means a lot to all americans in the firm."

Linked: A as soon as-promising EV startup recordsdata for Chapter 7 financial extinguish

On the opposite hand, in a four-minute video posted on January 25 on X by YT Jia, the founder and CEO of Faraday Future (FFIE) , an EV agency with an equally shady ancient past, he commented on Canoo's financial extinguish, calling it "inevitable from the originate," as he accused its founding partners of starting Canoo off the support of 'stolen' FF knowledge.

In the video, Jia accused the Canoo's founding group of stealing ideas, suggestions, and various 'linked affords' when departing from Faraday Future, noting that its success in 2017 "drew ardour from the irascible other folks," including that Canoo's founding group "had been easy executives at FF" when they began Canoo.

This part is magnificent; the Canoo group, led by frail Deutsche Bank exec Stefan Krause and frail BMW exec Ulrich Kranz, had been both frail FF consultants. In 2017, Faraday Future issued a observation that claimed Krause and Kranz had been fired for "malfeasance and dereliction of responsibility." In old statements to the public and the media, they state that their anecdote was as soon as noteworthy various from what FF introduced up, but easy, this didn't hand over Jia from rehashing mature drama.

"Later that yr, whereas easy employed, they began secretly plotting their departure," Jia said. "As soon as they eventually left, they took with them an intensive amount of FF's product knowledge, technical recordsdata, suggestions, ideas, and even severe financing networks and linked affords."

For Canoo and loads identical rising car-making startups, why private they long gone bankrupt? And when dedicated other folks build profession decisions, how to settle the precise firm to be part of?

These days, Canoo declared financial extinguish in the US, an ending that seemed inevitable from the originate.… pic.twitter.com/ftlB7VRAW2— YT Jia (@YTJiaFF) January 25, 2025

Furthermore, Jia claimed that the Canoo founders "emptied out" Faraday, including that it pushed the firm "into its 2d vital crisis."

"Though we took correct motion later, the injure was as soon as done, and it left us struggling to movement forward for a whereas," Jia said. "As entrepreneurs, being betrayed and backstabbed by frail teammates undermined by a backdoor play in the U.S., the set apart intellectual property is on the total so well protected, was as soon as one amongst our toughest difficulty."

Furthermore, Jia said that Canoo's Chapter 7 ending "seemed inevitable from the originate," including that Canoo "was as soon as built on stealing intellectual property and technological achievements from others, which set apart the firm up with primarily 'mistaken DNA.'"

"The founders of Canoo came from backgrounds as real managers, now not entrepreneurs. As a consequence, their sense of mission was as soon as dilapidated. They had been inviting on shortcuts and hasty wins," he furthermore said.

Despite the social media spit roasting, Jia famed that Canoo had some "competitive edge in its products and expertise," namely what he sees as "futuristic symmetrical win, distinctive space-optimized interiors, next-period modern architecture, and a comparably evolved skateboard chassis."

Linked: Former fund supervisor factors dire S&P 500 warning for 2025

What's Your Reaction?