Top Stocks today: Nvidia, Robinhood and Pfizer lead the market

Here are the stocks that made the biggest moves today

Tuesday, Sept 30, 2025

Stocks fell at the market's opening today, reflecting the potential impact of a probable government shutdown on October 1, but gained significantly by the close.

- The S&P 500 gained 0.4%, led by rising stocks of pharmaceutical companies, such as Pfizer.

- The tech-heavy Nasdaq Composite rose 0.3%, driven by gains in Nvidia and Coreweave.

- Dow Jones Industrial Average closed 0.2% higher, with the Russell 2000 also slightly up by 0.05%.

CoreWeave, backed by Nvidia, gained 11.7% today after it secured a $14.2 billion long-term cloud deal with Meta platforms. This led to Nvidia stock rising 2.6%, a 52-week high for this tech stock.

Other major performers were Pfizer, up 6.8%, signaling a general gain in the healthcare sector today. A week after Robinhood’s entry into the S&P 500, it gained 4.7% today.

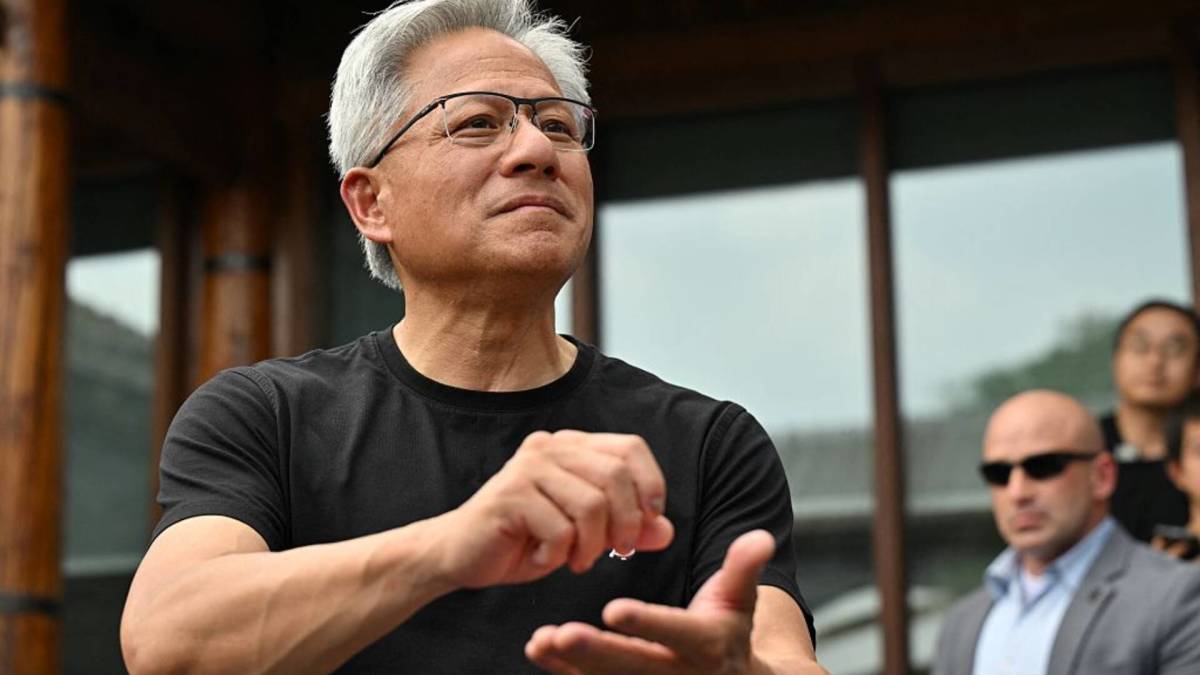

Investors appear bullish amid government uncertainties and the possibility of federal cuts; however, historically, a shutdown has harmed the stock market only if it continues for an extended period. Image source: Berry/AFP via Getty Images

Yet, concern over the nonfarm payroll report is clear. The Department of Labor will not release it in the event of a shutdown.

The report is expected later this Friday and will be crucial for the Fed's meeting in October.

Here are the Stocks that made the most market moves today

Five S&P 500 stocks making big moves today are:

- Pfizer Inc PFE: +6.8%

- Merck & Co MRK: +6.8%

- Danaher Corp DHR: +6.5%

- Bio-Techne: +6.5%

- Charles River Laboratories SCHW: +6.4%

The worst-performing five S&P 500 stocks today are:

- Albemarle Corp ALB: -6.7%

- MGM Resorts MGM: -5.1%

- Capital One Financial COF: -4.9%

- Paycom Software PAYC: -4.5%

- Block Inc XYZ: -4.1%

Stocks also worth noting include:

- Nvidia NVDA: +2.6%

- Warner Bros Discovery WBD : +3.5%

- Beyond Meat BYND: +3.8%

- CoreWeave CRWV: +11.7%

- Snap SNAP: -8.2%.

Nvidia rides the AI wave

Nvidia’s (NVDA) stock reached a 52-week high at $187.35 today, up 2.6%. Another milestone for the tech stock is that it has also joined the $4.5 trillion club.

More Nvidia:

- Analysts revamp Nvidia stock outlook on its investment in Intel

- Nvidia suffers a major blow from China

- Nvidia spending billions to spread its AI dominance

After Coreweave (CRWV) , backed by Nvidia, announced a $14.2 billion deal with Meta today, giving it access to Nvidia’s latest GB300 systems, both companies' stock soared.

Increasing analyst confidence, KeyBanc raised the firm’s price target on Nvidia to $250 from $230, keeping an overweight rating.

While Nvidia’s GPU Technology Conference (GTC) in Washington, to be held in October this year, has reaffirmed Citi's confidence in the company, believing it will prove a positive catalyst for the stock, as noted at TheFly.

It raised the price target to $210 from $200, keeping a Buy rating on the shares.

Related: Nvidia makes surprising move into British AI company

This has been a beneficial year for investors who have shown confidence in Nvidia’s stock, even when it traded at a 52-week low of $86.6 in April of this year. However, it has shown a 38.94% increase year-to-date, signaling a tremendous scope for overall AI growth.

Pfizer's promise of lower drug prices has its stock soaring

Pfizer (PFE) stock started trending today, up 6.8% after President Doland Trump’s historic move to lower drug prices for Americans.

Albert Bourla, Chairman and Chief Executive Officer of Pfizer, said in a statement,

By working closely with the Administration, we are lowering costs for patients and enabling greater investment in the U.S. biopharmaceutical ecosystem by ending the days when American families alone carried the global burden of paying for innovation. This is about putting all patients first and ensuring America remains world’s leading engine of medical breakthroughs.

Related: Pfizer just made a quiet move that could rewrite the obesity drug race

As Pfizer voluntarily agreed with the Trump administration to provide comparable prices to American consumers, it also sent the stocks of other pharmaceutical companies, such as Eli Lilly (LLY) , Johnson & Johnson (JNJ) , and Amgen (AMGN) , up.

Trump also announced the launch of the TrumpRX website, scheduled for 2026. The website will allow consumers to look up lower drug prices and be redirected to purchase them.

Soon after, CNBC reported that pharmaceutical company Eli Lilly is in talks with the White House to become the next company to lower American drug prices.

Robinhood soars with S&P 500 inclusion

A week after Robinhood (HOOD) was included in the S&P 500, it has gained momentum. On Tuesday, it rose 4.7%, reaching a 52-week high of 143.18.

The news came after it announced an expansion of its prediction markets products outside of the U.S., increasing its reach.

Robinhood stock has risen 284.27% year-to-date, a massive jump from its $22 stock price in September 2024.

Based on consistent growth across the platform, John Todaro, a Needham analyst, raised the firm’s target price to $145 from $120, keeping a Buy rating.

The investment firm also noted that it views Robinhood as the farthest along in becoming a “one-stop shop” for financial services, as reported by TheFly.

Related: Government shutdown poses threat to stock market rally

What's Your Reaction?