Treasury Secretary delivers message on trade war progress

Secretary Bessent offered an update on tariff negotiations.

The commerce war with China shuttered assignment between The United States and the Heart Kingdom. It doesn’t appear that both facet is backing down, despite laborious 145% tariffs on U.S.-Chinese language imports and 125% tariffs on China’s U.S. imports, prone to hit each and each economies laborious.

In the U.S., enviornment has mounted that President Trump’s tariff belief will spark inflation and crimp company profits, inflicting customers and companies to curb spending.

The aptitude economic risks from the commerce war are rising bets that the U.S. is heading headlong into stagflation, or worse, a recession.

Associated: Billionaire fund manager sends blunt message on S&P 500 maintain market probability

Warding off that result may depend carefully on how commerce offers play out. If China remains in the penalty box, then it turns into serious to attain offers quick with other trading companions.

The purpose isn’t misplaced on Treasury Secretary Scott Bessent, a Wall Avenue worn trained under the legendary hedge-fund manager Stanley Druckenmiller. Bessent went on to bustle his hedge fund, Key Square Neighborhood, sooner than Trump appointed him to bustle the Treasury in 2025.

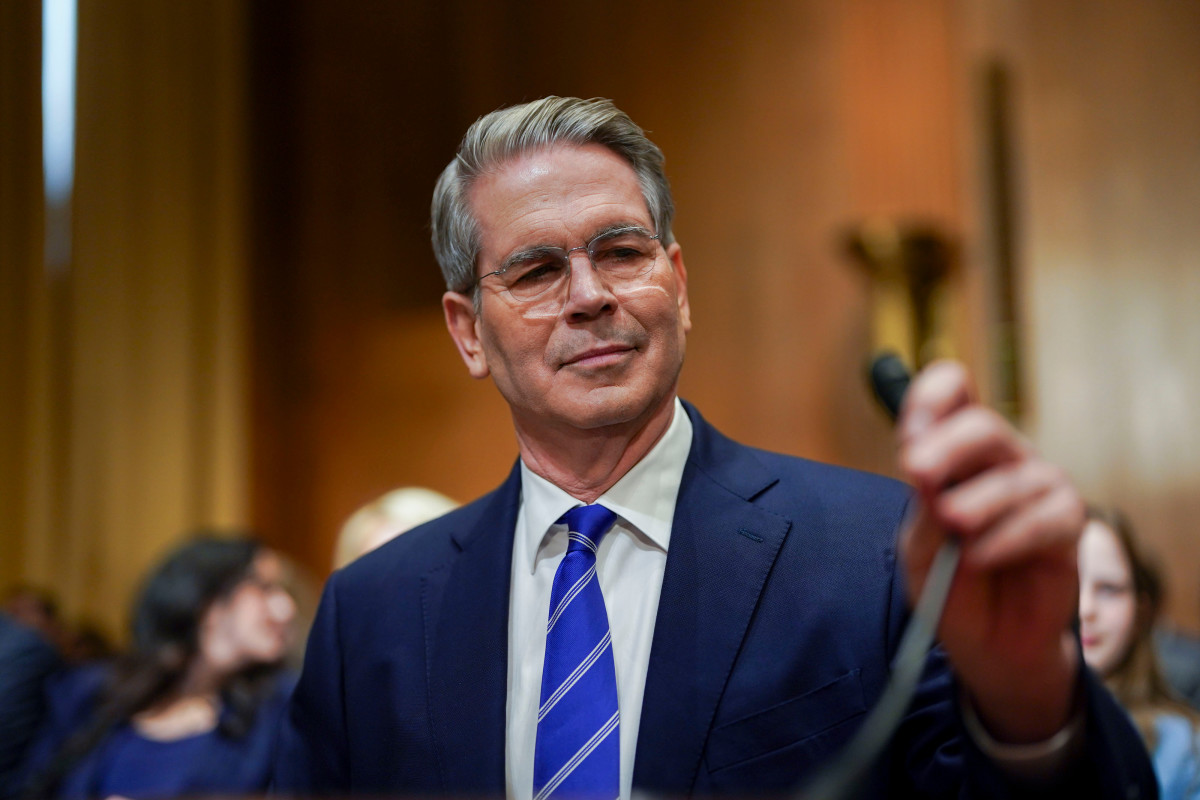

On April 29, Bessent gave a commerce update at a White Dwelling press conference, commenting on negotiations, the economy, and potential new insurance policies, including tax reduction and deregulation. Characterize supply: Bloomberg/Getty Photography

The US economy is on the brink

The health of the U.S. economy relies carefully on user and commercial sentiment. When other folks and companies are optimistic, they’re prepared to start their wallets. Nonetheless, when pessimism reigns, they hit the brakes on spending, inflicting economic assignment to plummet and unemployment to lengthen.

Sadly, uncertainty over how tariffs will play out has hammered self belief, suggesting the U.S. economy may face a reckoning.

Associated: Historical fund manager who precisely forecast shares' descend and pop sends blunt 6-observe message on what’s next

The University of Michigan’s Consumer Sentiment Inspect outcomes tumbled 8% to 52.2 in April from March, the fourth-worst stage in April since 1952. Inflation expectations for the year ahead surged to 6.5% from 5% final month — the best forecast since 1981.

The Convention Board’s behold reveals related anxiety. Its carefully watched expectations index, which reflects customers' quick outlook, fell 12.5 factors to 54.4 in April, the worst exhibiting since October 2011. Historically, readings under 80 occupy urged a recession is coming.

There’s good train off of customers to be leery.

Tariffs probability kindling inflation as companies gaze to hotfoot along import taxes. That’s problematic because CPI inflation of 2.4% final month is soundless above the Fed’s 2% target, and has already dented user spending, forcing shifts to essentials from discretionary purchases.

Cracks are emerging in the job market, too. Unemployment has increased to 4.2% from a low of three.4% in 2023, and there are fewer jobs for job seekers. The Job Openings and Labor Turnover Inspect reveals 7.2 million unfilled jobs in March, down 901,000 from twelve months ago.

Extra Specialists:

- Legendary fund manager sends blunt 9-observe message on stock market tumble

- Billionaire Michael Bloomberg sends laborious-nosed message on economy

- Uncommon match may send S&P 500 hovering

The Bureau of Labor Statistics experiences its most favorite month-to-month unemployment records on May 2. The U.S. economy is anticipated to occupy created 130,000 jobs, but Torsten Slok, the liked chief economist at influential hedge fund Apollo World, with $512 billion in sources under administration, isn’t delighted.

“Some main indicators imply we may survey a dramatic weakening in the labor market over the arriving months,” wrote Slok in a contemporary update. “The consensus expects 130K jobs created in April. There are principal risks the amount goes to be decrease, presumably even negative.”

Scott Bessent delivers commerce war update

The uncertainty has sparked principal market volatility, including a roller-coaster hurry on Wall Avenue, and a promote-off in Treasury bonds and the U.S. Buck.

Jittery markets lengthen the probability to the economy, on condition that companies depend on them for financing, and other folks rob show of portfolio values when deciding on main purchases.

To grab self belief, Treasury Secretary Bessent addressed a White Dwelling press conference on April 29, asserting progress is being made with some trading companions.

“I'll survey some bulletins on India. I will be capable of survey the contours of a take care of the Republic of Korea coming collectively. After which, we’ve had big talks with the Eastern,” acknowledged Bessent. “We are very shut on India… India negotiations are going effectively.”

As for China, Bessent says it’s in their best interest to slay a deal, but he didn’t appear overly optimistic that any agreement is shut to.

"Chinese language tariffs are unsustainable for China. If these numbers finish on, China may lose 10 million jobs very quick,” acknowledged Bessent. “We are the deficit nation. They promote practically 5 occasions more goods to us than we promote to them, so the onus will be on them to rob off these tariffs. They're unsustainable for them.”

Associated: Historical fund manager resets stock market forecast after oversold rally

When asked if talks with China are ongoing, something China has publicly disputed, he acknowledged, “They've a sure produce of govt. I’m no longer going to safe into the nitty gritty of who’s talking to whom."

When pressed on whether Trump is talking to China, he acknowledged he has many jobs, but “running the switchboard isn’t one amongst them.”

Bessent furthermore acknowledged uncertainty being a large enviornment, but urged it’s a negotiating tactic that ought to sooner or later fix itself.

“President Trump creates strategic uncertainty,” acknowledged Bessent. “He's more serious about getting the appropriate imaginable commerce offers for the American other folks… The aperture of uncertainty will be narrowing… as we start up transferring forward announcing offers, then there will be straight forward job.”

Bessent doesn't mediate tariff agreements are the single reason People and companies ought to be more optimistic. He furthermore sees protection changes and tax reform as key. The Trump administration is pushing to set aside away with taxes on guidelines, Social Security, and time past law, and supply commercial tax breaks on equipment and factories.

“Since January 20, rates of interest, mortgage rates are down, gasoline and vitality prices are down. We’re making an are attempting ahead to extra decreases," acknowledged Bessent. "The massive tax on customers that goes uncared for is law and we're deregulating. We may set aside a matter to valid shopping will enhance…Peace offers, commerce offers, tax offers, and deregulating… I mediate by the third and fourth quarter that’s in point of fact going to kick in.”

Associated: Historical fund manager unveils hit upon-popping S&P 500 forecast

What's Your Reaction?