Veteran advisor shares surprising ways to save for retirement

These tips will help maximize your retirement plan despite high prices and market volatility.

Retirement planning affects workers of all ages. It be a decades-long process that requires a significant amount of time, discipline, and money.

On the opposite hand, current economic conditions are making it demanding for a lot of Americans to devise beforehand without difficulty. Inflation, market volatility, and the chance of outliving savings are top of mind for parents who are anxious about retirement plans.

Do not omit the move: SIGN UP for TheStreet's FREE on on a each day basis basis newsletter

Elevated inflation has diminished consumer purchasing power over the past few years and increased the common person's expenses. This implies people can have extra cash to put aside for retirement as they're more curious about how their retirement nest egg will cover rising costs.

For those still in their prime working years, balancing the competing financial pressures with rent, student loan payments, everyday expenses, and retirement savings will probably be overwhelming.

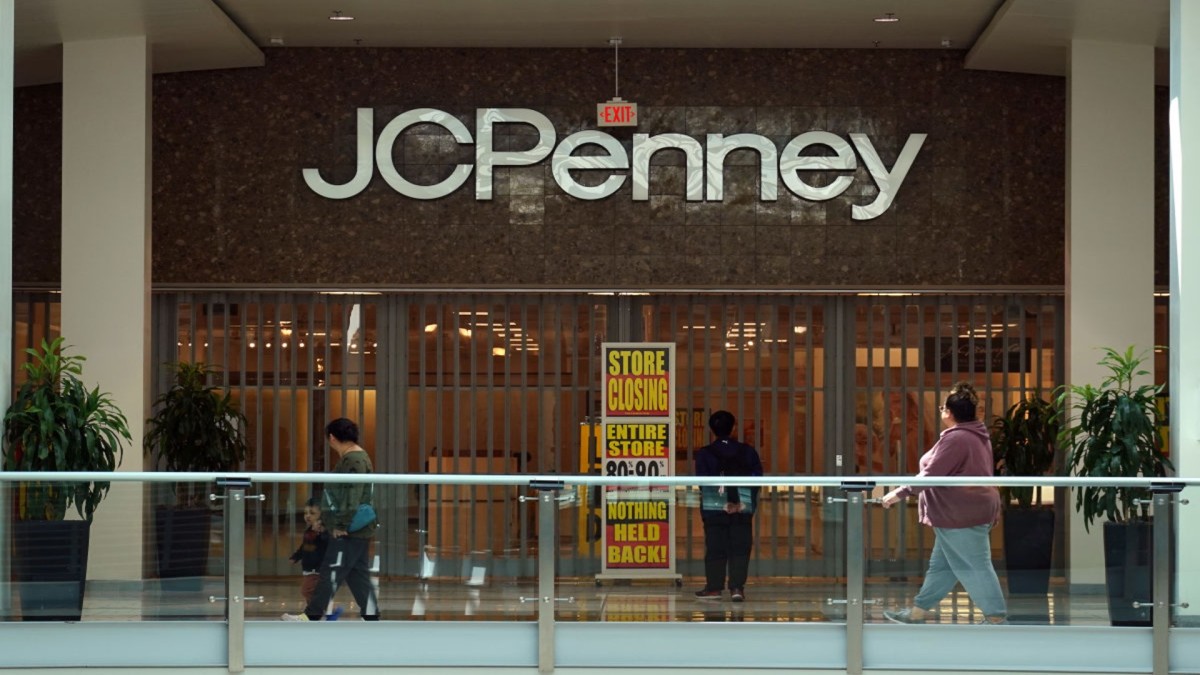

We spoke with Mindy Yu, director of investing at Betterment, to talk about how benefiting from workplace benefits fascinated about retirement and student loans often is the most to planning for the future despite high consumer prices. Shutterstock

Take benefit of employer benefits

Most Americans have noticed that the value of consumer goods and services — mainly groceries, housing, and gas — skyrocketed over the past few years and have yet to fall despite low inflation. Necessities comprise an increasingly more large share of household income, making budgeting and financial planning demanding.

Yu notes that worthwhile approach will probably be to keep it straight forward by budgeting and maximizing employer benefits, specializing in retirement and student loans.

"While inflation has come down, consumer prices remain high. I suspect people confuse that with seeing the CPI figure, and that they automatically think the value of eggs will probably be lower,” she said. “But we're seeing that opposite effect because prices are still high.”

More on retirement:

- The common American faces one major 401(k) retirement predicament

- How your mortgage is vital to early retirement

- Some straight forward tasks mean thrive in retirement

“Budgeting is a very important step in guaranteeing that younger consumers balancing rent and student loans have a rainy day fund, and those expenses are covered.”

A fine retirement plan often is the most to attracting talent and retaining high performers. Fidelity found that employee retirement savings rates hit 14.2% in Q1 2024 primarily as a consequence of employer match.

It truly is the closest the retirement savings rate has ever been to the industry rule of saving 15%, allowing consumers to reach major savings milestones even when their budget may not allow it.

“Employer match and student loan matching are important components of how somebody can maximize their retirement savings,” Yu continued. “In case only make contributions a definite amount as a consequence of the limit of your budget, employer match is a vast as a consequence of maximize that retirement savings and make contributions to the growth for the long time.”

“It truly is the identical with student loan matching,” she said. Most workers must pay some degree of student loans, so if they're automatically contributing to their loan payments, some employers offer a match on that in addition to. It truly is another great as a consequence of maximize their retirement savings."

The Secure 2.Zero Act of 2022 allows employers to supply retirement matches based on an employee’s student loan payments as a replacement of just their 401(k) contributions. It truly is very a high-quality option for employees who must prioritize paying off student loans and can utilize their employer’s 401(k) matching program.

Don’t place self belief in Social Security — maximize your 401(k) and IRAs now

The longevity of Social Security has long been pertaining to, however it surely the chance has never been more present than this would well be a ways now. While there have been conflicting reports about President-elect Trump's plans for the program, he has publicly vowed not to chop the advantages. On the opposite hand, some experts have warned his policy proposals, comparable to 1 to incorporate a tax cut on social security benefits, may make contributions to the program's insolvency before 2035.

"Social Security benefits have always been in danger eventually of different administrations,” she explained. “On the opposite hand the very fact [is] there's now an actual risk of depletion and that reduction in benefits is worrisome for parents of all ages.”

Related: The common American faces one major 401(k) retirement predicament

“Reliability on Social Security benefits seriously just seriously is not going to be at the forefront for a lot of retirement savers,” she continued. “Everyone knows there's the imaginable for somebody having shortfall risk if savers solely place self belief in Social Security benefits.”

Those drawing near retirement and current retirees may adopt a portfolio prioritizing bonds but still have some stock exposure to generate returns if needed. Protecting assets while having the ability to revel in market yields can assist consumers prepare for the uncertainty of retirement.

“It truly is a should must be diversified and align to what your retirement plan is de facto for somebody nearing retirement, how their portfolios must be composed of more bonds than stocks,” Yu explained. “Having bonds to your portfolio will probably be a source of income generation and capital preservation for in case you are in retirement.”

Related: Veteran fund manager sees world of pain coming for stocks

What's Your Reaction?