Veteran analyst early to quantum computing stocks revamps outlook after stocks get clobbered

The Wall Street veteran gives his take on the quantum computing stock debacle.

Used to be it something I stated?

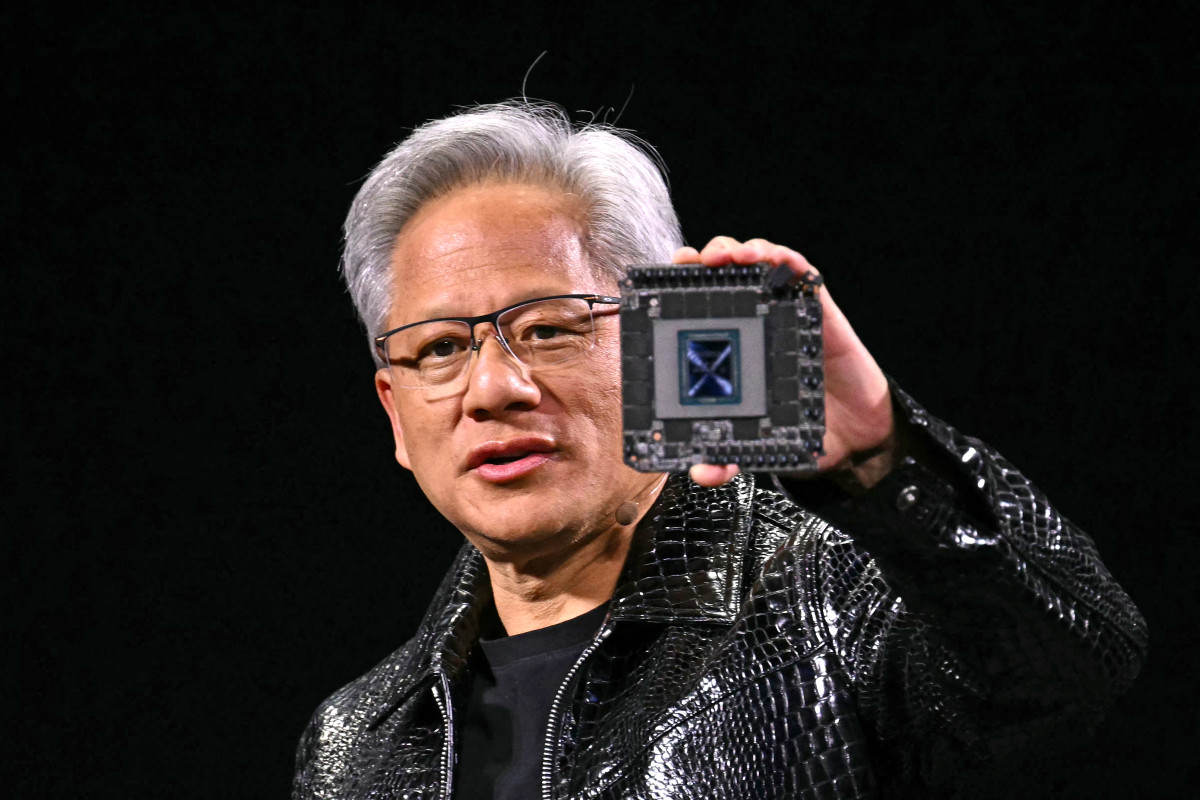

Properly, whenever you happen to will also be Jensen Huang, CEO of AI chipmaking empire Nvidia (NVDA) , yeah, undoubtedly, it used to be.

Connected: Fund manager who forecast Nvidia’s rally makes surprising transfer after CES keynote

Particularly, Huang's need of phrases in the midst of a chat with analysts nuked the shares of a neighborhood of quantum computing companies.

With factual a couple of sentences, the tip govt and co-founding father of the sector's second-most treasured company unhurried Apple (AAPL) deep-fried the Next Big Thing to cinders and despatched patrons screaming for the exits.

Some names on the deplorable aspect of the slaughter had been Rigetti Computing (RGTI) , down 40% at final test. IonQ (IONQ) , misplaced 38%, D-Wave Quantum (QBTS) tumbled 31%, and Defiance Quantum ETF (QTUM) , slipped 4.4%, a relative slap on the wrist in contrast with the diversified companies' double-digit drubbing.

Whenever you happen to didn't know, quantum computing is a discipline of computer science that makes utilize of quantum mechanics to solve complications which may be too no longer easy for classical computers.

Whereas at this time time’s computers utilize binary electrical indicators to indicate ones or zeros, quantum computers instruct quantum bits or qubits, which are subatomic particles.

It's being touted in lots of circles as the way in which forward for tech with powers and abilities a long way past those of mortal machines.

So what precisely did Huang jabber to do the quantum crowd melt luxuriate in a snowman in Singapore?

“In the event you stated 15 years for terribly priceless quantum computers, that may seemingly be on the early aspect,” Huang declared. “In the event you stated 30, it’s seemingly on the slack aspect. But whenever you happen to picked 20, I have faith a full bunch of us would fetch it.”

And that used to be ample to coloration the metropolis 50 very grotesque shades of crimson. PATRICK T&interval; FALLON/Getty Photographs

Nvidia CEO's feedback spark selling in quantum computing shares

Huang, who gave a keynote contend with at the CES 2025 replace point to in Las Vegas, added that he believes Nvidia will play a “very essential part” in constructing the computers and helping the industry “fetch there as fast as imaginable.”

Connected: 5 quantum computing shares patrons are concentrated on in 2025

D-Wave Quantum CEO Alan Baratz replied by announcing that Huang is “ineffective deplorable” and renowned that his company is “industrial at this time time” and its products and services are being used by companies luxuriate in Mastercard (MA) at this time time, “no longer 30 years from now, at this time time.”

In all fairness, Huang is no longer the staunch one to counsel that quantum computing's day in the solar may no longer be any day rapidly.

The Boston Consulting Crew stated in a July look for that "quantum computing at this time time affords no tangible advantage over classical computing in either industrial or scientific applications."

"Though consultants agree that there are sure scientific and industrial complications for which quantum solutions will sooner or later a long way surpass the classical alternative, the more fresh expertise has but to uncover this advantage at scale," the document stated.

BSG stated classical computing continues to seize the bar attributable to the broad strides it has taken in hardware, algorithms, and AI libraries and frameworks.

"At the an identical time, we're seeing straightforward growth and momentum in qubit counts, funding, and authorities increase," the document stated.

BSG stated it silent had self belief in its projection that quantum computing will make $450 billion to $850 billion of business charge—sustaining a $90 billion to $170 billion market for hardware and blueprint suppliers—by 2040, which matches Huang's early aspect projection.

An earlier McKinsey see of tech executives, patrons, and lecturers in quantum computing stumbled on that they fetch that by 2035, there'll seemingly be a in point of fact fault-tolerant quantum computer, which is a tool that will silent characteristic precisely even in the presence of errors or faults.

The last 28% of respondents fetch this milestone received’t be reached unless 2040 or later.

TheStreet Pro's Stephen Guilfoyle surveyed the injury of Huang's feedback and noticed a possibility.

Connected: Analysts revamp IonQ, Rigetti, and D-Wave Quantum inventory tag targets on quantum computing outlook

Guilfoyle, on the complete identified as Sarge, told readers that the quantum computing neighborhood had scored astronomical beneficial properties in mid-December and “then did a wild Celtic-vogue dance by means of a semi-volatile couple of weeks where the total direction used to be sideways.”

The feeble trader, whose profession goes support to the New York Stock Commerce ground in the Eighties, had precisely gone lengthy moderately tons of these shares earlier than their December surge.

Wall Side street feeble goes gash value wanting trades

He stated he used to be silent lengthy three-digit beneficial properties, "even after this morning as the complete neighborhood...is catching a excessive yard beating."

"One should search files from oneself. ... Self, does Nvidia stand to create if the quantum computing craze is pushed out a minute bit?" he requested. "I undoubtedly am no longer trim ample nor trained ample on the subject to answer to that ask with any kind of authority."

Connected: Analysts zero in on Nvidia after Client Electronics Point out surprises

"I attain know that technological style best appears to tempo up," he added, "and I truly have surmised that a legacy tech company that has no longer been a prime in the final two crazes, the cloud/data heart and generative AI runs, may do an aggressive transfer and rob a stumble on at to create enhance by means of a merge into this space in space of are trying and fetch there organically."

The Sarge acknowledged that "Jensen Huang clearly is more a knowledgeable than I on the subject."

"But we already knew that the industry that will seemingly be quantum computing is highly speculative and that valuations are more an expression of potential in space of of cash flows and profitability," he persevered.

"We already 'fetch' that quantum computing, which makes utilize of quantum mechanical system to fast solve highly advanced questions or complications, is no longer factual in its early innings, it is silent in the batting cage and the game may no longer delivery for a couple of hours," Guilfoyle stated.

The Wall Side street feeble noticed that nearly the total media appears to have skipped over one other of Huang's feedback in the midst of the an identical appearance.

He also stated, "factual about every quantum computing company on the planet is working with us now."

More Tech Stocks:

- 5 quantum computing shares patrons are concentrated on in 2025

- Fierce expertise fight erupts within Donald Trump's fanbase

- 5 potential tech IPOs that will supercharge markets in 2025

"Presumably the iron is sizzling, nonetheless Huang, who can barely preserve with AI-targeted search files from, factual doesn't need the following big thing to explode factual but ... and doesn't need these gamers to store in diversified locations," Guilfoyle stated.

"These are no longer conclusions," he added. "They are merely the thoughts which may be rattling around my cranium as I are trying to excel in a changing ambiance."

He explained that he's limiting his complete publicity to quantum computing as an industry to a cap of 1.5% of his most on the complete traded portfolio.

"I may be adding to QUBT because it trades under $12.25 this morning. I will seemingly rebuild my lengthy voice in QBTS as neatly and I will also bag an irregular lot's charge of RGTI factual to expand my publicity to the industry," stated Guilfoyle.

"This is speculative and we do now not know who the gamers will seemingly be in Huang's two decades (or much less, perhaps a lot much less), nor will we know if surely one of many more tired legacy tech companies does something aggressive in the distance," he stated.

And whenever you happen to suspect there is any danger occurring here, you don’t know the Sarge.

"We had been by means of too basic," Guilfoyle stated. "We do trained choices in accordance with what we know and what we see in an ever-changing ambiance. No, that you just may't frighten me by taking me down a notch. That best makes the fireplace burn brighter. Rock on, my chums. Rock on."

Connected: Broken-down fund manager delivers alarming S&P 500 forecast

What's Your Reaction?