Veteran analyst makes staggering AI spending prediction

The long-time Wall Street analyst updates the amount data centers will spend on AI.

It's a gold rush like nothing seen since the dawn of the Internet. Virtually every business is rushing to capitalize on artificial intelligence, which caught fire after OpenAI's ChatGPT became the fastest app ever to reach one million users when it was launched in 2022.

It doesn't matter if it's retail or banking; every industry is knee-deep in figuring out how AI may reshape businesses and boost profitability.

In short, AI has moved from science fiction to everyday use, not just for students looking to hack their homework.

Manufacturers are using it to improve supply chains and quality, retailers are using it to boost sales and prevent theft, healthcare companies are using it to design better medicines, and finance is using it to hedge risks. Even the military is in on the action, exploring its use on the battlefield.

The flurry of activity has meant a tidal wave of demand for the computers necessary to crunch AI's heavy workloads, a task ill-suited to the legacy central processors found in most data centers.

As a result, companies are spending big money on infrastructure, padding profits for AI darlings like Nvidia and Palantir, and sending their stocks soaring.

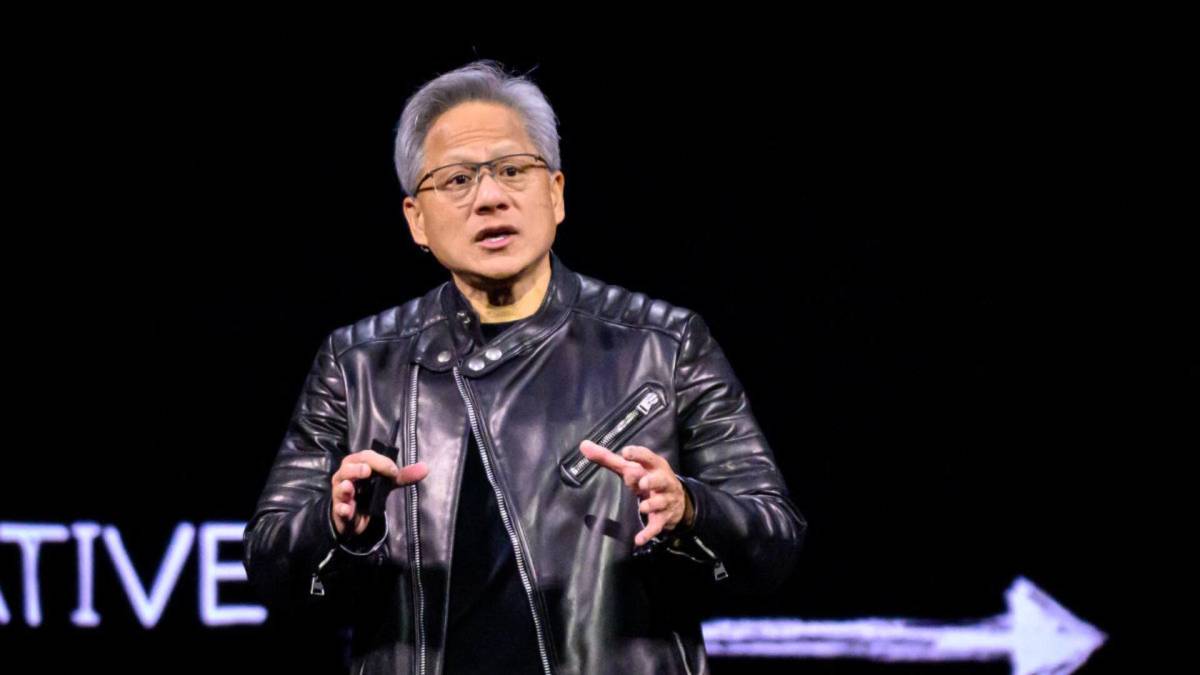

The situation isn't lost on long-time veteran analyst Sam Stovall. Stovall, CFRA's Chief Investment Strategist, has been tracking stocks for over 30 years, and his team thinks there's still a lot of runway left regarding the data center buildout.

Servers and chips are modern-day picks and shovels

In the gold rush, it was said that most of the money was made by those selling the picks and shovels to those traveling west in search of riches.

The modern-day equivalent could be players like Nvidia (NVDA) , Broadcom (AVGO) , AMD (AMD) , and Super Micro Computer (SMCI) , companies at the heart of supplying the demand for faster, more efficient data center infrastructure.

Related: Nvidia AI outlook resets after Meta Platforms, Microsoft update plans

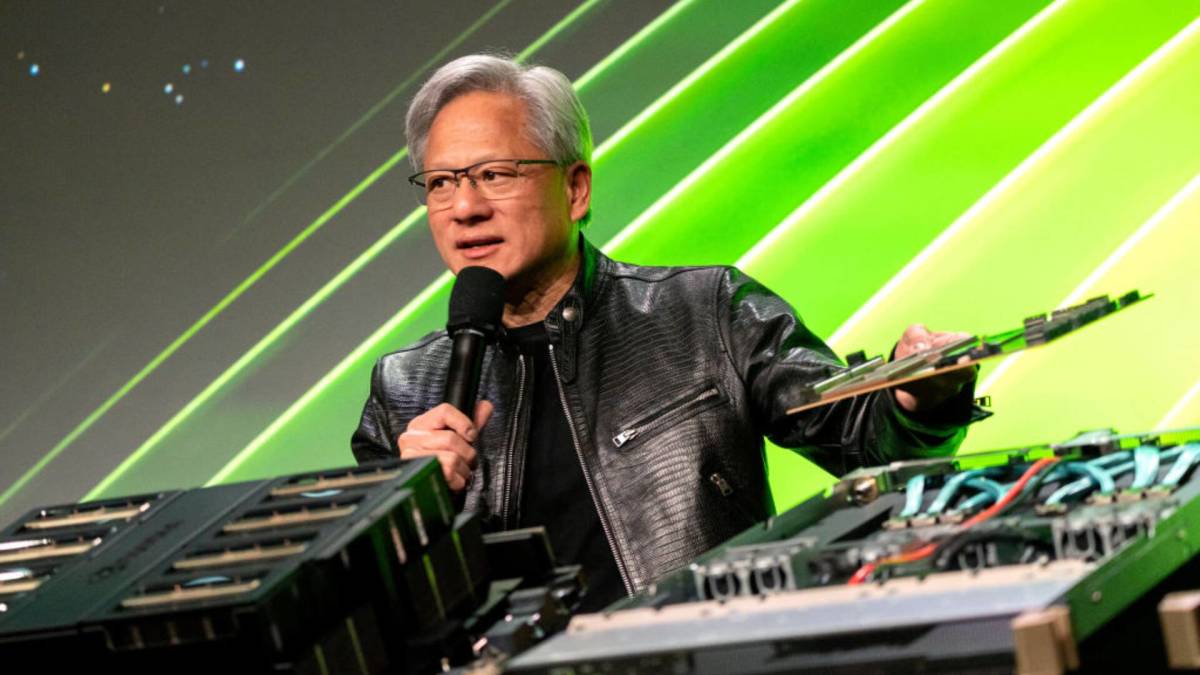

The darling, of course, is Nvidia.

Nvidia's highly optimized graphics processors for gaming and crypto mining proved the perfect tool for data hogging AI apps, causing sales to surge after ChatGPT's launch shocked the planet and caused a major re-shift in IT budget priorities.

Sales of Nvidia's GPUs -- first the H100, then the H200, and now its Blackwell lineup -- have grown from below $27 billion in 2022 to a stunning $130 billion last year. The reason? Its GPUs are paired with next-gen CUDA software optimized to keep workflows humming along more efficiently than any other chip option on the planet.

Availability, however, has been troublesome. Nvidia's demand has been higher than it can meet, and data centers have gotten creative, leveraging specialty chips, such as ASICs made by Broadcom and others, to fill in the gaps. AMD also recently joined the party, launching its own GPU line-up in a bid to carve away some of Nvidia's whopping 90% share of the AI chip market.

It's not just chips, though. It's the entire stack. And servers that can handle all the activity are also being bought by the pallet. Super Micro, a specialty server player with a liquid-cooled lineup, has seen its revenue surge to nearly $22 billion from just a shade over $5 billion in 2022. Image source: Edelson/Getty Images

The data center spending party isn't over yet, says Stovall

Investors have been handsomely rewarded for owning the likes of Nvidia, Super Micro, and Palantir, which provides the platform many companies use to build their AI apps.

Since 2022, those three companies have generated returns of 1,100%, 2,330%, and 421%, respectively, for investors.

More AI Stocks:

- Nvidia quietly buys more stock in AI infrastructure favorite

- Veteran analyst names 30 AI stocks shaping future of technology

- Cathie Wood buys $12 million of tumbling AI stock

It hasn't been a straight line higher, given some nerve-racking pauses and dips along the way. Based on Stovall's analysis, it's certainly possible we're about to experience another pullback in IT stocks soon.

Still, the longer-term outlook is pretty compelling.

"We continue to see upside to consensus estimates over the next 2-3 years, with annualized earnings growth of at least 15%-20% validating the sector multiple with higher AI infrastructure spend to remain the core driver to growth," wrote Stovall in a note to clients. "We think data center spending is poised to more than double to over $1 trillion by 2028, with the Big Four stocks representing about half of the total as the customer base broadens."

A doubling in spending by 2028 is pretty eye-popping, given what we've already witnessed.

If Stovall is correct, many people may be surprised, given arguments that IT stocks, including Nvidia, Palantir, and rivals, are overpriced.

What's next for AI stocks?

During the Internet boom, stocks surged too far too fast, pricing in tremendous growth and setting the bar incredibly high.

As a result, I saw many of the high-flyers cut in half or worse, go out of business, despite the fact that spending to build out the Internet was continuing to climb.

What's Your Reaction?