Veteran fund manager unveils bold Nvidia stock price target after rally

Could Nvidia stock surge to a new high heading into earnings? Here's what's next.

Nvidia (NVDA) shares dangle jumped practically 15% within the course of the final five days following a wave of definite files.

The chipmaker has announced a predominant handle Saudi firm Humain, owned by Saudi Arabia’s Public Funding Fund, to work on rising AI devices and building files center infrastructure the utilization of Blackwell GPUs.

The multi-300 and sixty five days initiative, estimated to be worth between $15 billion and $20 billion, speaks to the vision of “Sovereign AI” — countries rising their dangle AI the utilization of their files, resources, and team.

“Nationwide investment in compute capacity is a new financial imperative,” Nvidia CEO Jensen Huang acknowledged in 2023. “Of us keep in mind that they can’t afford to export their nation’s files, their nation’s culture, for any individual else to then resell AI help to them.”

One other steal for Nvidia inventory this week got here from reviews that the U.S. and China agreed to temporarily lower tariffs, boosting the tech inventory market.

In April, Nvidia became below stress because it disclosed that it would take a $5.5 billion charge to export its H20 GPUs to China and varied countries. The firm moreover acknowledged that transport those chips will require a authorities license.

Linked: Nvidia CEO sounds the horror on China

The H20 chip became developed to examine U.S. export controls below President Joe Biden’s administration, which banned the sale of evolved AI processors to China in 2022 and tightened restrictions in 2023.

Closing 300 and sixty five days, Nvidia became one of the most tip Nasdaq winners, up 171%. Nonetheless the inventory has lacked the identical impart momentum this 300 and sixty five days, up gorgeous 0.4%, weighed by the rollout of China’s cheaper AI mannequin DeepSeek, disappointing February earnings, and a market pullback amid tariffs and rising financial uncertainties.

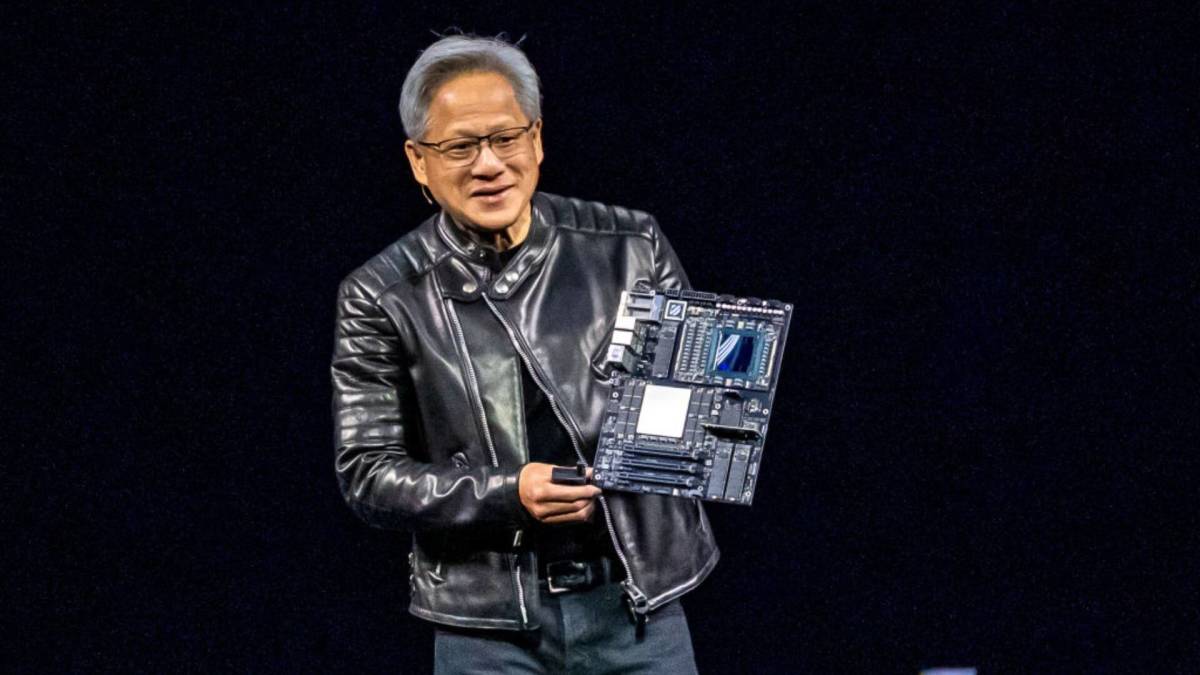

Chris Versace, Wall Avenue veteran fund supervisor who manages TheStreet Real's portfolio, shared his views on Nvidia inventory this week after its fresh rally. Image supply: Morris/Bloomberg by strategy of Getty Photography

Ragged fund supervisor bullish on Nvidia inventory

Versace, a 30-300 and sixty five days alternate veteran, acknowledged that Nvidia's handle Saudi Arabia is "blunting U.S restrictions on AI chips to China."

He moreover pointed to Foxconn Expertise (FXCOF) , which reported epic April revenue and bigger than 50% 300 and sixty five days-over-300 and sixty five days impart in AI server sales for the length of the principle quarter. Foxconn expects its revenue to practically double sequentially and 300 and sixty five days over 300 and sixty five days within the most up-to-date quarter.

Foxconn is a key manufacturer of Nvidia, serving to form its AI servers. Soundless, the firm trimmed its 2025 outlook from “solid impart” to “predominant impart.” Versace sees this shift as "reflecting keen U.S. tariffs and pending alternate deals between the U.S. and Taiwan."

In early April, the U.S. imposed a 32% tariff on imports from Taiwan, nevertheless paused enforcement for 90 days to enable negotiations. Except a deal is finalized, Taiwan faces a 10% tariff when exporting to the U.S. If talks fail by early July, the 32% charge may be reinstated.

"Despite those tariffs, the message is that AI server seek files from of for Foxconn, Taiwan Semiconductor (TSM) , and attributable to this fact Nvidia, stays solid," Versace wrote.

He raised his designate target on Nvidia to $160 from $150 and maintained a "One" ranking, indicating that he believes the inventory is a compelling buy now.

Linked: Ragged analyst unveils glance-popping forecast on Supermicro inventory

Versace moreover pointed to upcoming catalysts, collectively with Huang’s keynote at an change occasion on May 18 and Nvidia’s earnings file on May 28.

Versace first added Nvidia to his portfolio in February 2024. The inventory now accounts for 4.13% of his holdings, with an average return of 53.71%.

He added that varied AI and files center-connected names, collectively with Marvell Expertise (MRVL) , are moreover making the most of rising infrastructure investment.

Bank of The US raises Nvidia inventory designate target

Bank of The US analysts led by Vivek Arya raised the firm's designate target to $160 from $150 and reiterated a buy ranking this week following the Saudi deal.

More Nvidia:

- Will Nvidia rep hit laborious by AI capex probability?

- Analysts revise Nvidia designate target on chip seek files from of

- Graceful China files sends Nvidia inventory tumbling

The firm expects Nvidia to generate $3 billion to $5 billion per 300 and sixty five days from the deal, totaling $15 billion to $20 billion over a multi-300 and sixty five days interval.

"Sovereign AI also can help handle miniature energy availability for files facilities in U.S., plus offset headwinds from restrictions on U.S. firms transport to China," the analyst wrote.

Nvidia closed at $134.83 on May 15.

Linked: Ragged fund supervisor unveils glance-popping S&P 500 forecast

What's Your Reaction?