Veteran trader focuses on Nvidia price target following Toyota, Uber deals

The Wall Street veteran reviews the AI chipmaking giant's latest announcements.

If Daniel Sickles were alive as of late, he'd potentially desire to abet away from Stephen Guilfoyle.

Sickles used to be an American flesh presser, diplomat, and Union primary who commanded the 3rd Corps of the Navy of the Potomac at the Fight of Gettysburg.

Connected: Analysts zero in on Nvidia after Client Electronics Show cloak surprises

In a publish on TheStreet Respectable, Wall Road prone trader Guilfoyle used Sickles' actions at the pivotal Civil War struggle to illustrate his funding strategy for AI-chip-making brontosaurus Nvidia (NVDA) .

Salvage no longer fail to bear in mind, Guilfoyle is the identical man who cited heavy metal icons AC/DC in a writeup about Palantir Applied sciences (PLTR) a pair of weeks help. So listen.

Nvidia CEO Jensen Huang used to be all the contrivance in which by contrivance of the news on Jan. 7 when he gave the opening keynote address at the CES 2025 change cloak in Las Vegas.

Guilfoyle acknowledged Huang unveiled "a series of contemporary products and thrilling high-cease applied sciences as effectively striking together some collaborative offers with both established companies admire Toyota Motor (TM) and Uber Applied sciences (UBER) to boot to upstarts just like Aurora Innovation (AUR) and Arbe Robotics (ARBE) ."

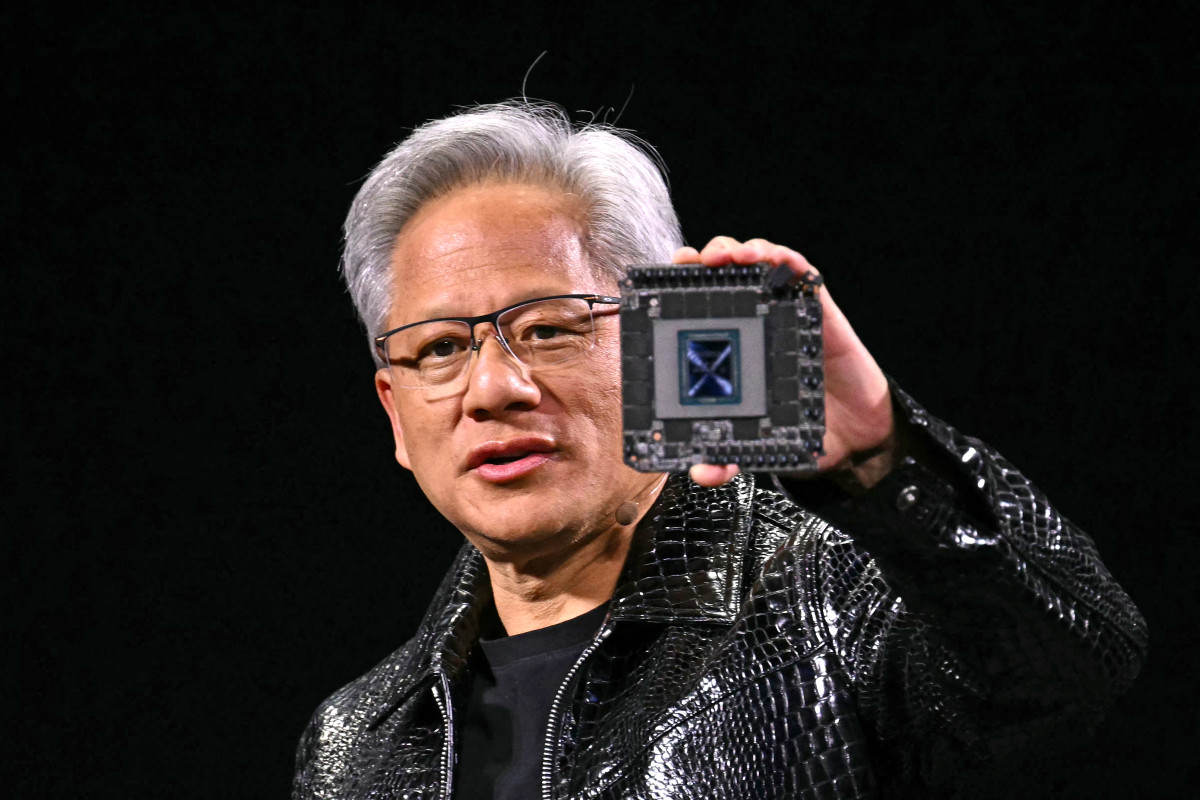

Nvidia, the second most treasured company on this planet after Apple (AAPL) , acknowledged Toyota would consume its Orin chips and car working system to energy evolved driver help in a couple of fashions. PATRICK T. FALLON/Getty Photography

Analyst cites Nvidia cope with Uber

"Of course, CEO Jensen Huang, who I settle on to refer to as ‘The Fonz’ on account of his completely prone leather-based jacket and his cool ability to upsell, led the type at the center of consideration," Guilfoyle acknowledged.

Now, sooner than we rep into the historical past lesson, let's behold what funding companies were announcing about Nvidia's contemporary announcements.

Extra 2025 stock market forecasts

- Stocks face correction threat as Santa Claus Rally fails to carry

- Outmoded trader who precisely picked Palantir as high stock in ‘24 exhibits best stock for ‘25

- 5 quantum computing stocks patrons are concentrated on in 2025

- Goldman Sachs picks high sectors to receive in 2025

Dawdle-sharing company Uber (UBER) will companion with Nvidia to droop the enchancment of AI-powered autos.

Analysts at Financial institution of The United States Securities acknowledged in a prove on Uber that the collaboration would pair Uber's dataset of millions of day-to-day trips with Nvidia's new Cosmos platform and Nvidia DGX Cloud.

Cosmos is Nvidia's new generative AI platform. It focuses on “bodily AI programs,” creating synthetic environments and weeding out payment boundaries to constructing evolved robotics.

“In our peek, Uber will likely commit essential resources given significance to the change,” acknowledged B of A, reiterating its buy ranking and $96 stamp aim on Uber.

DA Davidson affirmed a unbiased ranking and $135 stamp aim on Nvidia.

The firm acknowledged on Jan. 8 that a couple of of the tech large's announcements at CES bode effectively for its presence in loads of AI categories that creep past its contemporary success within the data center. On the other hand, DA Davidson additionally acknowledged 2025 would be a high year as its best possibilities sensible spending into 2026.

DA Davidson added that Nvidia shares reacted poorly to the company's CES presentation's lack of a topic cloth update on Blackwell shipments or the next generation of knowledge center products.

Shares of quantum computing companies just like Rigetti Computing (RGTI) , D-Wave Quantum (QBTS) and IonQ (IONQ) additionally tumbled after Huang's comments at CES, the funding firm smartly-known. Huang acknowledged in actuality priceless quantum computer programs may very effectively be two decades away.

Citi analysts acknowledged that for the length of its 2025 CES particular address, Nvidia additional laid out its hybrid AI platform, which is spirited to make consume of the company's graphics processing fashions within the cloud to droop the most effective language fashions.

After meeting with administration at the match, previously is named the Client Electronics Show cloak, the firm maintained a buy ranking on the shares with a $175 stamp aim.

The funding firm acknowledged administration expects Blackwell to outperform the prior guidance by a pair of billion dollars.

Citi acknowledged Nvidia additionally confirmed Hopper and Blackwell combined will grow within the January quarter and believes the disclose is sustainable.

Management mentioned four main traits, including the company making the most of what is probably going the tail cease of the $2 trillion passe computing market because it believes most workloads will in the end be accelerated, the funding firm acknowledged.

Outmoded trader lays naked Nvidia stock stamp aim

Citi pointed out that Nvidia believes quantum computing is candy at small knowledge concerns just like cryptography and no longer essentially the good knowledge concerns AI currently addresses.

This, in a (very) roundabout contrivance, brings us help to Dan Sickles, Stephen Guilfoyle, and the importance of sticking to 1's goals.

Connected: Analysts make Nvidia, AMD predictions sooner than Client Electronics Show cloak

Final week, Guilfoyle acknowledged that sooner than CES, he planned to positioned on a quick long-facet change in Nvidia that would be exterior of his longer-time period do. On the time, Nvidia used to be shopping and selling at $139.90.

His belief labored. On Tuesday morning, Nvidia traded as much as $153, offering a quick exit point and profit for people that adopted it. On the other hand, a reversal hasty adopted, and of us that did no longer stick to the belief may need left money on the desk.

Guilfoyle, whose occupation started on the New York Stock Change floor within the Eighties, believes sticking to a belief is essential.

He invoked Sickles's resolution to deviate from Union plans at Gettysburg to hammer the point dwelling.

"Sickles seen obvious floor sooner than his do and ordered his troops to movement out and rob that floor despite the truth that the 3rd Corps would turn into quiet from the rest of the navy on Cemetery Ridge to the north and Minute Round High to the south," wrote Guilfoyle.

"What Sickles had accomplished used to be provide an undersized Confederate Navy a risk, and in bid that they darned come rolled up the total of the Navy of the Potomac on that second day of that struggle."

If no longer for the spirited sacrifice of the first Minnesota Infantry and the stand made to the south by the Twentieth Maine Infantry, "Regular Robert E. Lee may never non-public made the blunder on day three at Gettysburg (Pickett's payment) that the Confederacy in point of fact never recovered from," the prone trader acknowledged.

"That's what no longer sticking to a belief does," Guilfoyle added. His point? Even because it's doubtless you'll presumably want a belief, stick to it.

What does Guilfoyle mediate may occur to Nvidia stock now? Previously, he'd written that Nvidia had to retake the 50-day easy transferring sensible [SMA] and build itself above $153 “to in point of fact feel good about a $161 aim.”

Now, the big query is whether or no longer or no longer Nvidia's stock stamp can dwell above the 50-day transferring sensible or no longer. If it doesn't, it may possibly possibly mean Nvidia shares tumble.

“The shares did prepare a quick kiss at $153 nonetheless surely did no longer build themselves,” he acknowledged. “Now, the dread is the shortcoming of the 50-day SMA, as that can power portfolio managers to cleave long-facet publicity.”

If the stock cedes the 50-day SMA — indicating a imaginable shift in market sentiment — "then a aim stamp below $110 would no longer be ridiculous," Guilfoyle acknowledged.

Connected: Outmoded fund manager disorders dire S&P 500 warning for 2025

What's Your Reaction?