Weekly Wrap: Market optimistic, Intel, Oklo and Paramount emerge triumphant

Here is how the market responded this week.

The market reacted positively to the Fed's announcement of a quarter-point rate cut. With a bullish run this week, the three major indices — the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average — closed this Friday at new 52-week highs.

The tech sector wavered slightly closer to the closing bell on Friday after President Doland Trump signed an executive order raising the H1-B visa fees to $100,000. But overall, the market rallied high this week, with several new deals pushing stocks to newer highs.

The S&P 500 was up 1.22%, the Nasdaq climbed 2.21%, and the DJIA was up 1.05% this week. It was a favorable week for the small-cap index Russell 2000, which was up 2.16% this week, even after it closed 0.77% lower on Friday. It also traded at a 52-week high on Friday's early trading hours. Image source: Sokolow/picture alliance via Getty Images

The Fed’s 25 basis-point rate cut and the prospect of two more cuts by the year’s end have provided significant optimism to the market.

Tony Pasquariello, global head of hedge fund coverage at Goldman Sachs Global Banking & Markets, weighed in on the Fed’s decision, noting a favorable investor dynamic.

In the latest episode of The Markets Podcast, he explained that “When the Fed is cutting into a cyclical upswing, typically the outcomes are favorable.”

He added, "In the absence of recession, markets tend to go up. When the Fed is adding stimulus on top of that, typically the wind is blowing in a favorable direction for the bulls.”

Friday's market confirmed this sentiment, as all major indices reached new all-time highs. Investors remain optimistic for the coming week ahead, particularly for the housing market.

Related: Analysts revamp Nvidia stock outlook on its investment in Intel

For years, owning a house has been unfavorable for buyers due to high borrowing costs, and the possibility of lower mortgage rates has captivated investor sentiment.

However, reduced mortgages are not directly dependent on the Fed’s benchmark rates. Instead, they are more significantly influenced by 10-year Treasury bonds.

While markets opened strong on Monday, with new highs for the Nasdaq and S&P 500, they turned bleak on Tuesday, the first day of the Federal Open Market Committee Meeting (FOMC).

The markets, which were primarily flat on Wednesday, quickly reacted to the Fed announcement, leading to a better day for the Russell 2000.

On Thursday and Friday, the market reacted optimistically to the rate cuts and stocks racked up fresh highs.

In addition to the first rate cut in nine months, the Nvidia-Intel deal was notable in the week, leading to Intel share value achieving a 52-week high on Thursday.

After uncertainty over the takeover bid, regained interest led Paramount Skydance to a 52-week high on Friday. Oklo, an advanced nuclear technology company, reaped the benefits of the U.S. and U.K. nuclear deal and was up 28.8% at closing on Friday.

Intel rides high on Nvidia deal

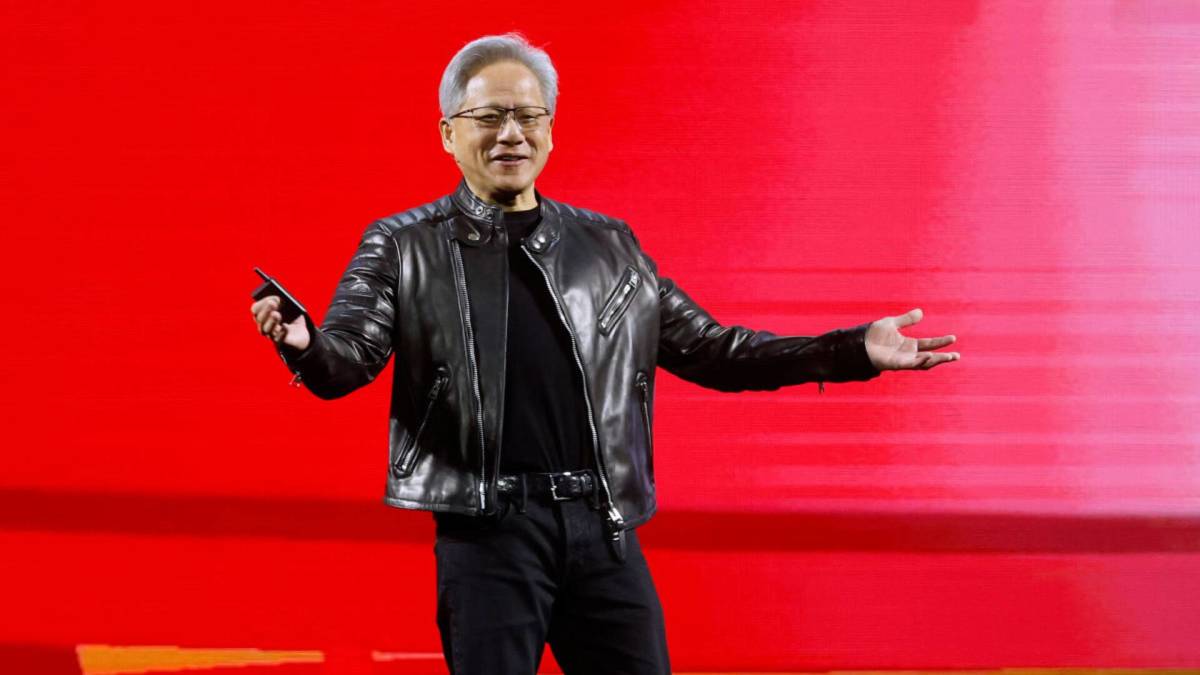

After Nvidia announced a $5 billion investment in Intel’s common stock, Intel stock surged to a 52-week high on Thursday at $32.38 and gained 22.8% this week.

It also gave Nvidia some respite after continuously trading low, and it was up 3% after the news was released.

The two tech giants will jointly develop multiple generations of custom data center and PC products to accelerate workloads and deliver cutting-edge solutions to customers.

Fund manager buys and sells

- Market rally still has room to run: Where to invest

- Major investment manager raises S&P 500 target twice in a month

- Cathie Wood sells $22 million of surging stocks

“This historic collaboration tightly couples NVIDIA’s AI and accelerated computing stack with Intel’s CPUs and the vast x86 ecosystem — a fusion of two world-class platforms. Together, we will expand our ecosystems and lay the foundation for the next era of computing,” says Jenseng Huang, Founder and CEO of NVIDIA.

After this, Nvidia became one of Intel's largest shareholders, with a 4% stake in the chip maker.

Benchmark raised Intel’s price target to $43 and upgraded it to Buy from Hold, as noted at The Fly. It believes this deal represents a “significant fundamental tipping point” in Intel’s competitive positioning.

Paramount Skydance is up again

After Paramount Skydance announced a takeover bid for Warner Bros. Discovery, both media conglomerates’ stocks soared, but instability soon led to a turnaround. However, Paramount became a top S&P performer on Friday, up 5.8% at closing after renewed interest.

CNBC’s David Faber reported that Paramount Skydance could offer Warner Bros. $22-$24 per share, with at least 70% in cash. The news of backing from Larry Ellison, co-founder of Oracle, also led to higher stocks for both companies at Friday's closing.

Related: Paramount gives hard-nosed message to employees

David Ellison, CEO of Paramount Skydance, has been eyeing to close the deal that would bring Warner Bros. Discovery out of its debt, which has troubled it since its merger in 2022.

Nuclear Technology company emerges as a top achiever

Oklo, based in California, soared 28.8% after it announced plans to build and operate a fuel recycling facility in Tennessee. It is the first step in Oklo’s larger plan to create an advanced fuel center.

This nuclear technology company's new 52-week high, Oklo, was $136.5, a far cry from its lowest of $6.4 in September 2024. Gaining 536.98% year-to-date, Oklo plans to invest $1.68 billion at the Tennessee center, which will be the first of its kind nuclear fuel recycling center and also aims to create more than 800 jobs.

It benefited greatly from the recent multibillion-pound nuclear deal between the U.S. and the U.K., which aims to expand nuclear power across the nations.

The Atlantic Partnership for Advanced Nuclear Energy will help next-generation nuclear companies like Oklo expand in the U.K. and strengthen Oklo’s position as a key player in the clean energy transition.

Related: McDonald's CEO shares dire warning about the US economy

What's Your Reaction?