What Nvidia didn’t show at CES, and whether AMD should care

Nvidia (NVDA) stock is trading about 3.39% lower near $180, at the time of writing, Tuesday afternoon, Jan. 20, according to Yahoo Finance. And as if the worries about the AI bubble weren’t enough, other big tech stocks, including Apple, Meta, Microsoft, Tesla, and Google, are also down, as ...

Nvidia (NVDA) stock is trading about 3.39% lower near $180, at the time of writing, Tuesday afternoon, Jan. 20, according to Yahoo Finance.

And as if the worries about the AI bubble weren’t enough, other big tech stocks, including Apple, Meta, Microsoft, Tesla, and Google, are also down, as President Doland Trump’s Greenland plans, and the associated trade war, have made the investors nervous.

However, there are exceptions, like Intel (INTC) and Advanced Micro Devices (AMD), which are up. Intel is riding on the wave of upgrades from several analysts, but the optimism might be premature. To learn more, read my article “Analysts reset Intel stock price target ahead of earnings.”

AMD has been boosted by KeyBanc, upgrading the stock on January 13, to an overweight (buy) rating from sector weight (hold) with a $270 price target. KeyBanc analysts believe MI355 demand and MI455 support AMD AI revenues of $14 billion to $15 billion in 2026, according to TheFly.

In my article “Bank of America resets Nvidia stock forecast after key event,” about what Nvidia presented at CES and how analysts reacted to it, I wrote: “Nvidia decided to go all in with its announcements during CES. It almost looks as if the company may have nothing left to reveal during its own [GPU Technology Conference (GTC)] in March.”

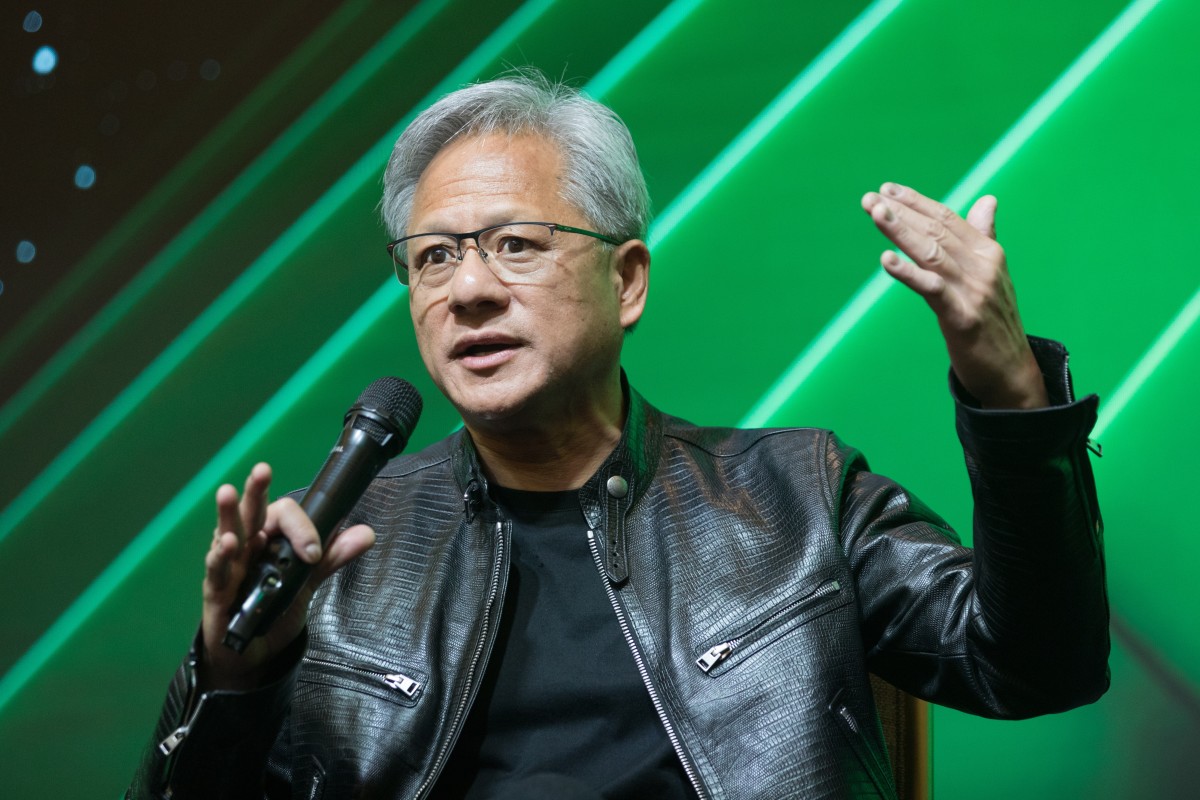

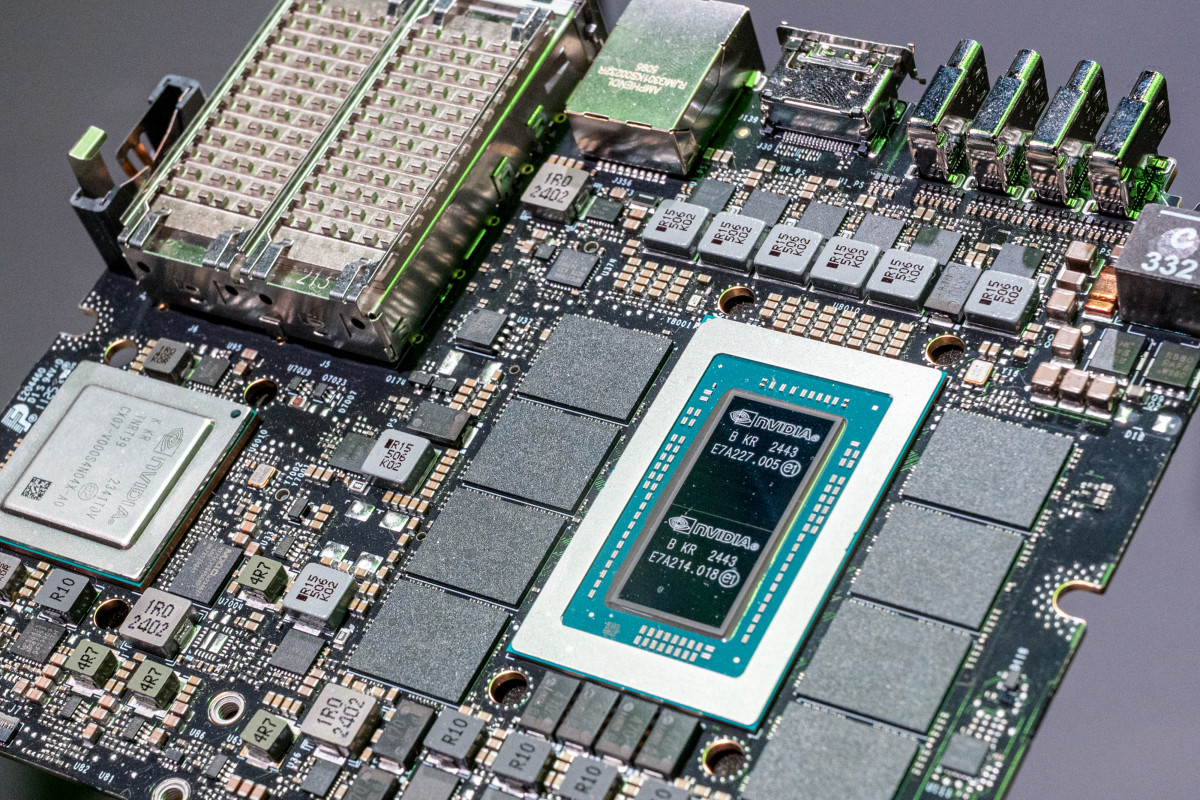

I now have a pretty good idea of what Nvidia left for GTC, and that is its N1X laptop chip. Photo by Bloomberg on Getty Images

Nvidia N1X laptop chip to launch in Q1

According to supply-chain operators, laptops with Nvidia N1X targeting the consumer market will debut in the first quarter of 2026, reported DigiTimes Taiwan and Tom’s Hardware.

The same sources stated that the other three versions of the chip will go on sale in the second quarter, and that the next-generation N2 series is expected to launch in Q3 of 2027.

N1X was only confirmed by Nvidia CEO Jensen Huang to be essentially the same chip as in DGX Spark, VideoCardz reported. Considering that N1X was never officially unveiled, I think officially announcing it at GTC in March makes the most sense.

The long-rumored chip, a variant of the GB10, is ARM-based and will compete with AMD’s Strix Halo chip.

The Register recently tested DGX spark vs HP Z2 Mini G1a Strix Halo based workstation, concluding that Spark is faster: “In our testing, the machine consistently delivered performance 2-3x that of the AMD-based HP system, while also benefiting from a significantly more mature and active software ecosystem.”

More Nvidia:

- Nvidia’s China chip problem isn’t what most investors think

- Jim Cramer issues blunt 5-word verdict on Nvidia stock

- This is how Nvidia keeps customers from switching

- Bank of America makes a surprise call on Nvidia-backed stock

However, the tests were, for the most part, about running LLMs. Strix Halo-based products have two big advantages over N1X/GB10-based ones: a lower price and the ability to run any software, including games.

Laptops with N1X will be shipping with Windows ARM, which might pose a significant hindrance to gaining market share. We’ve seen this already as Qualcomm struggles to gain market share with its Snapdragon X chips.

I believe Nvidia doesn’t have high expectations for N1X, and in my article “Nvidia makes good on a key 2025 promise," I’ve explained how this led the chipmaker to make the deal with Intel. Bottom line: I don't expect AMD to be worried about N1X.

What Bank of America thinks about Nvidia and AMD stocks

Bank of America analyst Vivek Arya and his team updated their opinions on Nvidia and AMD stocks in their latest research note from January 20, shared with me.

Arya reiterated a buy rating for Nvidia stock and a target price of $275, based on 28 multiple his estimate for price-to-earnings ratio, excluding cash, for calendar year 2027. This is within Nvidia’s historical forward year price-to-earnings range of 25 to 56.

Analysts noted downside risk factors for Nvidia:

- Weakness in the consumer-driven gaming market

- Competition with major public firms

- Larger-than-expected impact from restrictions on compute shipments to China

- Lumpy and unpredictable sales in new enterprise, data center, and autos markets

- Potential for decelerating capital returns

- Enhanced government scrutiny of Nvidia’s dominant market position in AI

chips

Arya reiterated a buy rating for AMD stock and the target price of $260, based on 27 multiple his estimate for non-GAAP EPS for 2027, which is toward the middle of AMD’s historical range of 13 to 58.

Analysts noted downside risks for AMD:

- Execution on the first rack-scale product (MI400 Series)

- Timing/magnitude of Middle East AI projects

- The lumpy nature of consumer and enterprise spending, which could create delays in the acceptance and success of new products

- High reliance on one outsourced manufacturing partner

- Maturity of the current game console cycle

Upside risk for AMD:

- Greater share gain potential in the PC and server processor market against

competitors.

Related: Bank of America resets IBM price target before earnings

What's Your Reaction?