What Nvidia just did could rewire the AI race

The AI chip leader just shifted expectations again.

Nvidia isn't going to wait until spring. The AI chipmaker just changed the rules for its competitors and maybe for the whole AI infrastructure timeline, as CES 2026 is still going strong.

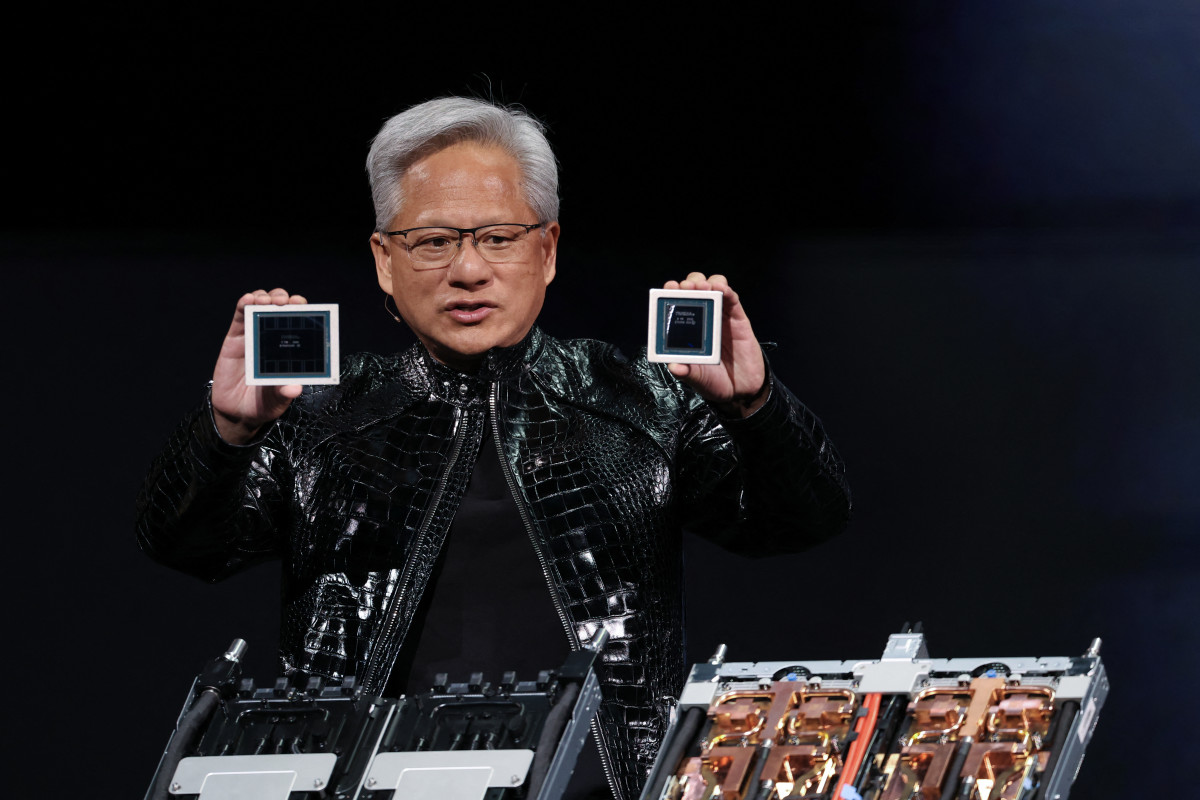

CEO Jensen Huang used the stage in Las Vegas to show off Nvidia's next-generation AI server platform, Vera Rubin, months before it was supposed to happen at GTC. And the move was planned.

Huang signaled urgency to the crowd, The Wall Street Journal reported.

And Nvidia isn't just running; it's sprinting.

Why Nvidia broke tradition with its Rubin reveal

Nvidia usually waits until GTC to share deep tech news. So why cut in line?

One reason is that AMD and Intel are putting pressure on it. Both competitors used CES 2026 to talk about their next-generation accelerators. AMD, in particular, presented its Helios rack-scale solution as a direct competitor to Rubin.

Related: Samsung's AI companion push could fuel a pricier upgrade cycle

Nvidia changed the story by showing off Rubin early. It reminded customers and hyperscalers that it's not only ahead, but also setting the pace for the race.

There is also an urgency on the demand side. Nvidia says Rubin was made in light of a world with 10 trillion parameters, The Wall Street Journal reported. Supporting that scale necessitates making big changes, not just small ones, to the architecture.

Rubin delivers more memory bandwidth, less latency between connections, and more power efficiency.

The early reveal also built the company's confidence. Rubin systems will be available in the second half of 2026, according to Tom's Hardware. The timing means the design and production are far enough along to make that promise public. Fallon/Getty Images

Rubin and the shift toward "physical AI"

Nvidia is counting on "physical AI," which are models that act like real-world settings, in addition to text and images. Think self-driving cars, smart factories, and digital twins.

This is Rubin's purpose. Its high compute density, memory throughput, and networking fabric enable physical AI to handle massive simulation demands.

Related: Novo and Lilly shift GLP-1 strategy abroad: US may be next

That bet could pay off. Physical AI lets Nvidia get into areas such as robots, defense, health care, and logistics, where it costs a lot to switch.

It tells Wall Street that Nvidia isn't just going after the next great thing. It's getting ready for the next wave of industry.

How big a leap is Rubin, really?

Nvidia says Rubin cuts the cost of inference by 10 times and the number of training GPUs by 75%.

Are you doubtful? So were analysts, but only when they saw the specs.

Rubin GPUs are up to 5 times faster at inference and 3.5 times faster at training than Blackwell. This is thanks to a redesigned Transformer Engine and adaptive compression. HBM4 memory offers more than 20 terabytes of bandwidth per second.

More Nvidia:

- Nvidia’s China chip problem isn’t what most investors think

- Jim Cramer issues blunt 5-word verdict on Nvidia stock

- This is how Nvidia keeps customers from switching

- Bank of America makes a surprise call on Nvidia-backed stock

Rubin's NVL72 design connects 72 GPUs and 36 CPUs at the system level using sixth-generation NVLink switches, enabling performance on a rack scale with very low latency.

This isn't a new chip, but a redesign of the whole stack.

Market reaction to Nvidia's Rubin is flat now, but watch 2026

The news about Rubin didn't have much of an effect on Nvidia's stock, but that has more to do with what people expect than with Rubin's effect.

UBS and Bank of America analysts reaffirmed their buy ratings, saying that Rubin will help Nvidia keep its AI lead.

BofA Securities kept its buy rating and $275 target, saying Rubin is proof that Nvidia will "continue its AI accelerator dominance."

UBS also kept its Buy/$235 target, saying that demand visibility for 2026 is at an all-time high. When hyperscaler orders materialize into shipments in late 2026, the real revenue effect will start to show.

Microsoft, Google Cloud, AWS, Oracle, and CoreWeave all announced they aim to offer Rubin systems. Nvidia's competitors can't yet match that vote of confidence.

Why AMD and Intel may struggle to keep pace with Nvidia

AMD showed off its Instinct MI455X CPUs and Helios architecture, but Rubin's early release sets a new standard.

Nvidia still has the edge when it comes to integration, which means GPUs, software, and networking all work well together.

Although Intel is still trying to sellGaudi 3 as a low-cost solution, there isn't much traction in hyperscale yet.

Policy clouds still hover over Rubin

One thing that could change is regulation.

President Doland Trump's administration just made it easier for Nvidia to export goods. But that window might close. Rubin's move to a new generation will bring back arguments about the U.S.'s chip dominance and market power.

The president even talked of breaking up Nvidia, but then changed his mind — for now.

Nvidia reset the race

Nvidia isn't only moving quickly with Rubin. It is affecting the speed for everyone else.

If Rubin comes through, Nvidia will have a bigger lead until 2027 and beyond. People who are betting on an AI slowdown might want to rethink their theory.

Nvidia didn't just jump the gun this time. It may have created a new starting line.

Related: Palantir tells teens to skip college. Here’s what it really means for the stock

What's Your Reaction?