Why small firms are glued to a Fed meeting missing a rate cut

Small- and medium-sized business owners are tuning into this week’s Federal Open Market Committee meeting despite expectations that policymakers will hold interest rates steady. There are still a great deal of economic tailwinds to distill into sound business decisions for the rest of the year. ...

Small- and medium-sized business owners are tuning into this week’s Federal Open Market Committee meeting despite expectations that policymakers will hold interest rates steady.

There are still a great deal of economic tailwinds to distill into sound business decisions for the rest of the year.

Andy Bregenzer, Head of U.S. Regional and Small Business Banking and Co-Head of Commercial Bank at TD, said inflation is still running above the Fed’s 2% target and volatility is lingering across markets.

“Growth remains solid today, but uncertainty heading into 2026 continues to keep financial conditions tight and risk appetite in check,’’ Bregenzer said. TheStreet/Federal Reserve Bank of New York

Powell’s comments on interest rates

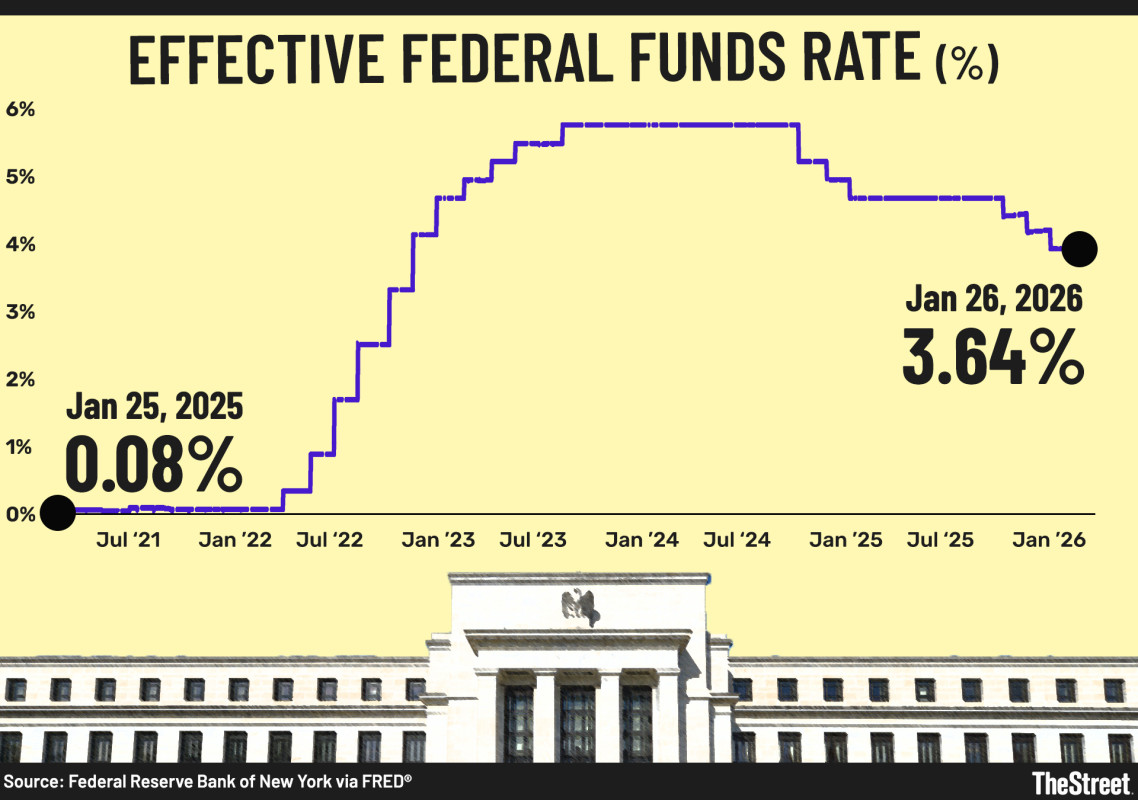

The FOMC cut the benchmark Federal Funds Rate three times for a total of 75 basis points in 2025.

More Federal Reserve:

- Fed faces 2026 upheaval as economy shifts, Powell exits

After the December rate cut, Federal Reserve Chair Jerome Powell said that the lowering of rates brought monetary policy “within a broad range of neutral.”

Looking ahead to 2026, the Fed’s own median projection or “dot plot” suggested there would be only one additional 25 basis points cut. This would move the rate to around 3.25% to 3.50% by year's end.

Fed’s dual mandate requires a delicate balance

In its Dec. 10 announcement, the FOMC signaled it may be pausing cuts in the short term:

“In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks.”

The Fed’s dual congressional mandate requires it to balance inflation and job growth via interest rates.

- Lower interest rates support hiring but can fuel inflation.

- Higher rates cool prices but can weaken the job market.

The two goals often conflict, operate on different timelines, and are influenced by unpredictable global events.

What traders expect for interest rates

The widely watched CME Group FedWatch Tool says there is 97.2% chance the FOMC holds rates steady Jan. 28.

Looking ahead to the rest of the year, the FedWatch Tool estimates a quarter-percentage point cut:

- March 18: 15.5%

- April 29: 25.5%

- June 17: 45.9%

The June date is worth noting in that FOMC meeting will come under the leadership of the new chair of the Federal Reserve.

Related: Fed rate cut chances shift ahead of FOMC this week

Kalshi gives Blackstone executive Rick Rieder, formerly a dark horse, a 47% chance of being President Doland Trump’s pick with former top runner Kevin Warsh coming in at 34%.

Trump has said he will name a nominee soon.

What the neutral interest rate means

The Federal Funds Rate approaching neutral means the Federal Reserve’s benchmark interest rate neither stimulates nor restrains economic growth.

Economists define the neutral rate, or r-star (r*), as the interest rate that keeps the economy at full employment while maintaining stable inflation around the Fed’s 2% target.

When rates hit this level, monetary policy is neither pressing the gas pedal nor pumping the brakes on economic activity,

It’s important to note that the neutral rate isn’t a fixed rate.

The neutral rate fluctuates according to productivity growth, demographic trends and global capital flows.

Most Fed officials currently estimate that the long-run neutral rate falls between 2.5% and 3% but roughly 4.5% to 5% when accounting for inflation.

Markets look for additional 2026 interest-rate cuts

The markets have a different idea regarding 2026 interest-rate cuts. Market expectations are slightly more dovish, calling for two rate cuts, which would push rates closer to 3%.

President Doland Trump has spent the past year blasting Powell and the FOMC for not lowering rates to around 1%.

The White House maintains this will stimulate the stagnant housing market and reduce the amount of interest on the nation’s debt, which currently hovers between approximately $38.4 trillion $38.5 trillion.

Impact on inflation, jobs and economic growth

Understanding neutral helps policymakers at the independent central bank determine whether current monetary policy is restrictive or accommodative.

If the Federal Funds Rate exceeds the neutral rate, then borrowing becomes more expensive. As inflation cools, it potentially slows economic growth.

Below neutral, cheaper credit encourages spending and investment but potentially slows growth.

“For small businesses, this environment underscores the need for disciplined cash‑flow management, thoughtful timing around investments, and strong strategic planning. A stable policy backdrop is encouraging, but resilience remains the name of the game until confidence firms," Bregenzer said.

Middle-market businesses monitoring inflation

Jill Gateman, Head of U.S. Middle Market and Specialized Finance and Co-Head of Commercial Bank at TD, said that while Inflation has come down from where it was, “it’s still not consistent across the economy, and that’s something middle market businesses feel every day.”

“Many companies are still managing higher labor and input costs while demand remains cautious, and planning feels harder than it should,’’ Gatemen said.

“A pause gives the Fed time to see how earlier rate moves are really working their way through the economy, and it gives businesses a bit more clarity as they make decisions about investing, hiring, and managing liquidity in a very uncertain environment,’’ Gateman added.

Related: Fed official signals openness to more interest-rate cuts this year

What's Your Reaction?