A simpler way to pass on your home without probate

Homeowners looking to pass property to heirs without probate are increasingly asking about transfer-on-death deeds, a tool that can simplify estate planning while allowing owners to keep full control of their homes during their lifetime. In a recent interview, Harry Margolis, author of "Get Your ...

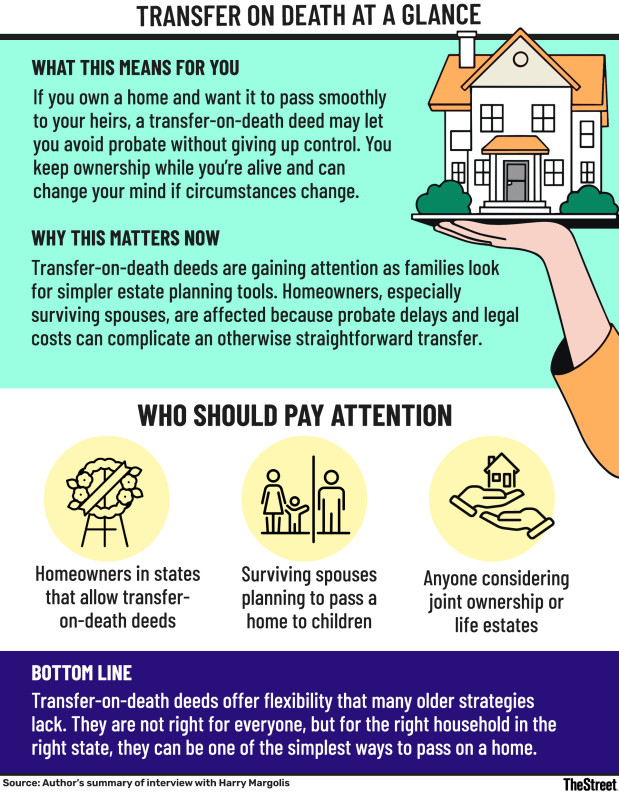

Homeowners looking to pass property to heirs without probate are increasingly asking about transfer-on-death deeds, a tool that can simplify estate planning while allowing owners to keep full control of their homes during their lifetime.

In a recent interview, Harry Margolis, author of "Get Your Ducks in a Row," said these deeds are available in about half the states and are gaining traction because they combine simplicity with flexibility, two qualities many traditional estate planning strategies lack.

Below is a transcript of that interview, edited for clarity and brevity. Author’s summary of interview with Harry Margolis

Using transfer-on-death deeds to pass on a home

Robert Powell: If you own a home and you’re doing your estate plan, you might be wondering whether you should use something called a transfer-on-death deed as a way to pass your house from one person — you, in this case — to another.

Here to talk with me about that is Harry Margolis, author of "Get Your Ducks in a Row." Harry, welcome.

Harry Margolis: Good to see you.

Robert Powell: Likewise. I think this is a topic that can be surprisingly complicated.

What a transfer-on-death deed does

Harry Margolis: Transfer-on-death deeds are available in about half the states. There’s a lot that’s appealing about them. They avoid probate without requiring a trust or joint ownership.

Compared with joint ownership, which also transfers property at death, a transfer-on-death deed has a major advantage. If you add someone as a joint owner, they become a co-owner right away. That means they have ownership rights during your lifetime, and you give up some control.

Related: Expert explains whether ChatGPT-written will is legal

With a transfer-on-death deed — much like a transfer-on-death designation on an investment or retirement account — you can always change it. If you’ve already named someone as a co-owner, you generally can’t undo that without their cooperation.

It’s flexible and relatively easy to use, but it’s not available everywhere.

Life estates and control issues

Harry Margolis: In states that don’t allow transfer-on-death deeds, people sometimes use life estates. That’s also a deed where you name who will receive the house when you die.

The difference is that the future owners actually have an ownership interest right away. That means you can’t change your mind, and you generally can’t sell the house without their cooperation. Even though you keep the right to live there for life, you’re still giving up control.

Some states allow enhanced life estate deeds, sometimes called Lady Bird deeds. These let you keep the right to change the arrangement, which gives you some of the benefits of both approaches. But overall, I like transfer-on-death deeds a lot.

They just aren’t available in my state of Massachusetts. Still, I think they’re spreading because they make a lot of sense.

How spousal ownership affects the options

Robert Powell: If my spouse and I buy a house together and own it jointly, do I need my spouse’s permission to create a transfer-on-death deed? Or would I need to own the house outright?

Harry Margolis: If you’re joint owners and want to create a transfer-on-death arrangement that applies after the second spouse dies, you would have to do that together because you’re both owners.

Typically, spouses own property as tenants by the entirety, which is a form of joint ownership. It transfers automatically to the surviving spouse at death. Neither spouse can encumber or mortgage the property without the other’s cooperation.

Using a transfer-on-death deed after the first spouse dies

Robert Powell: So the primary use would be after one spouse dies, allowing the surviving spouse to pass the house to children or other heirs using a transfer-on-death deed.

Harry Margolis: Exactly. That avoids probate, but the surviving spouse keeps full control.

Also worth reading

- Retirees may want to rebalance as markets broaden, volatility rises

- Why “breaking even” on Social Security is the wrong goal

- The $83,250 secret every solo entrepreneur needs to know for 2026

Robert Powell: And if there were four children, the deed could specify that the house transfers to all four, equally or however the owner wants.

Harry Margolis: Right. And unlike a life estate or joint ownership, the surviving spouse can always change that designation later if circumstances change.

Weighing the options with professional help

Robert Powell: It sounds like a useful tool for people who want to avoid probate without giving up control.

Harry Margolis: Yes. Life estates aren’t especially expensive, but transfer-on-death deeds are often simpler and retain more control, which is a big advantage.

Robert Powell: And for people weighing these choices, working with an estate planning attorney can help them sort through the pros and cons.

Harry Margolis: Absolutely. An attorney can tell you whether transfer-on-death deeds are allowed in your state and walk you through other options. A trust, for example, can offer more flexibility, potential Medicaid planning advantages, and protection for heirs after you pass away.

There are many possibilities, depending on your goals.

Robert Powell: In my experience, many people just don’t know what tools are available. That lack of knowledge can lead to decisions that aren’t in their best interest or their heirs’ best interest.

Harry Margolis: That’s true. Circumstances change. What made sense 10 years ago may not make sense today.

Related: Notarize a will online: Expert explains when you can and can't

What's Your Reaction?