AMD stock faces its next big test in 2026

For the better part of the last decade, Advanced Micro Devices (AMD) lived in Nvidia’s shadow. In 2025, that changed. AMD stock took off handsomely (up 78% year-to-date), as Mr. Market stopped calling it “the alternative.” The tech giant landed major AI deals in proving its mettle as more than just ...

For the better part of the last decade, Advanced Micro Devices (AMD) lived in Nvidia’s shadow. In 2025, that changed.

AMD stock took off handsomely (up 78% year-to-date), as Mr. Market stopped calling it “the alternative.”

The tech giant landed major AI deals in proving its mettle as more than just a CPU turnaround story.

Despite Nvidia’s dominance in the AI chip space, the narrative has shifted to how much market share AMD can realistically capture.

That matters a great deal because breakthrough years, such as 2025, raise expectations much more quickly than earnings can keep pace.

Nevertheless, AMD enters 2026 with solid momentum, real long-term customers, and a fast-growing AI revenue base, but also with a stock price that reflects plenty of that optimism.

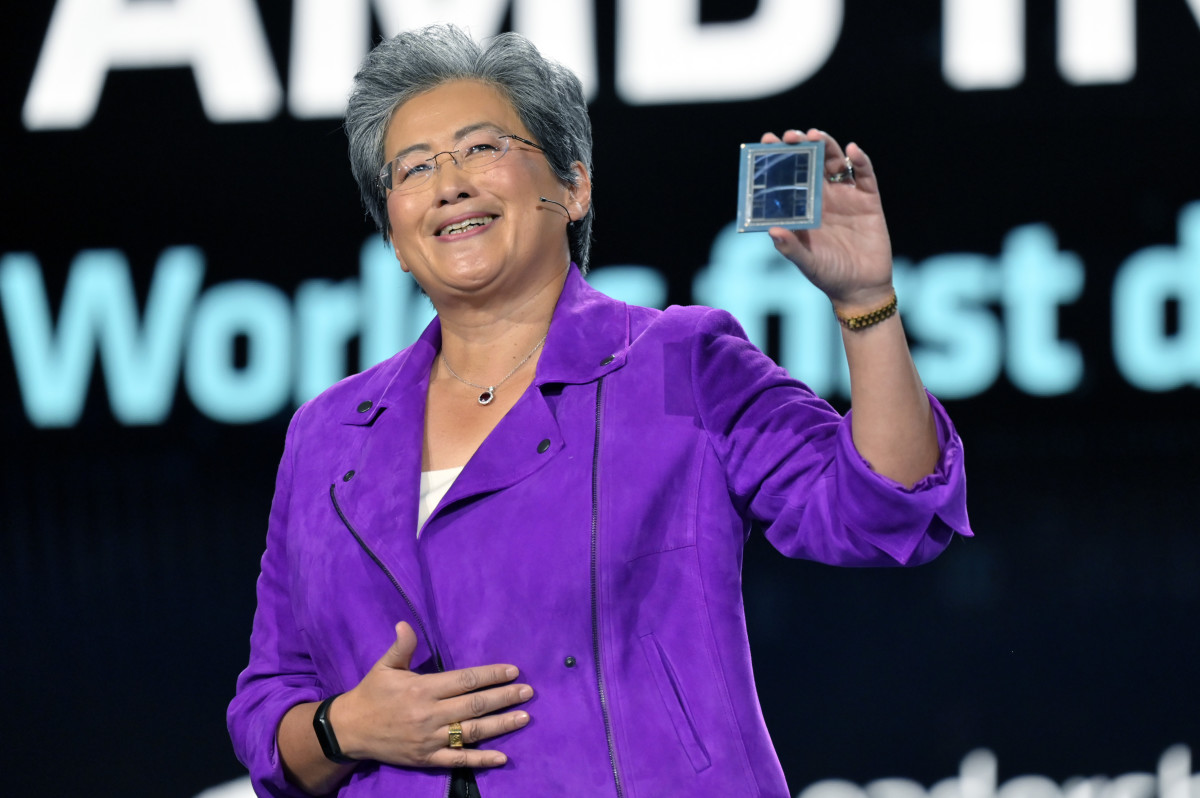

Hence, 2026 might not just be a victory lap but a proving ground. Photo by David Becker on Getty Images

AMD proved it can compete in AI

2025 was clearly the year when AMD began to land real wins in the AI space.

The turning point came in October, when AMD announced marquee AI partnerships with the likes of OpenAI and Oracle, sending its stock up 34% in a single day, according to Reuters.

Related: CoreWeave CEO delivers blunt 5-word take on AI debate

OpenAI selected AMD as its go-to GPU supplier, looking to deploy 6 gigawatts of AMD Instinct accelerators for its next-generation AI infrastructure plans.

Oracle followed suit by showing off its first public AI supercluster built around AMD’s new Helios rack design, covering 50,000 MI450 GPUs slated for release in Q3 2026.

Here are some of AMD's biggest deals in 2025:

- OpenAI: Multiyear deal to deploy 6 gigawatts of AMD Instinct GPUs; the first 1 gigawatt of MI450 is expected for deployment in the second half of 2026.

- Oracle: Expanded partnership; Oracle plans a publicly available AI supercluster with 50,000 MI450 GPUs starting Q3 2026.

- DOE/ORNL: $1 billion partnership with ORNL, HPE, and Oracle Cloud to build Lux and Discovery supercomputers.

- Sanmina: Agreement up to $3 billion to buy ZT Systems manufacturing.

- Cisco + G42: UAE secure AI cluster built and secured by Cisco for G42, featuring Instinct MI350X GPUs.

Moreover, CEO Lisa Su outlined a solid path to double-digit AI share, spearheaded by MI300 chips, which are forecasted to generate over $2 billion in sales and memory advantages favoring large AI models.

The financial proof behind AMD’s AI push

The bull case for AMD is now clearly showing up in the numbers.

Earnings snapshot over the past four quarters:

- FQ3 2025 (Sept. 2025): EPS 1.20, beat by 0.03; revenue 9.25 billion, up 35.59% year over year, beat by 487.48 million.

- FQ2 2025 (June 2025): EPS 0.48, in line; revenue 7.69 billion, up 31.71% year over year, beat by 255.65 million.

- FQ1 2025 (March 2025): EPS 0.96, beat by 0.03; revenue 7.44 billion, up 35.90% year over year, beat by 318.31 million.

- FQ4 2024 (Dec. 2024): EPS 1.09, in line; revenue 7.66 billion, up 24.16% year over year, beat by 132.12 million.

AMD’s stellar results were capped off by a standout Q3 2025.

Revenue hit a record $9.25 billion, up 36% year over year, Investing.com reported, as GAAP net income surged 61% to $1.24 billion.

At the same time, margins moved higher, as AMD’s gross margins skyrocketed 52%, up from 50% a year earlier, while its operating income climbed another 75% year over year.

On top of that, AMD generated record free cash flow, underscoring how growth is translating into cash.

Growth was broad-based:

- Data Center: Revenue reached $4.3 billion, up 22% year over year, led by stellar demand for EPYC server CPUs and Instinct MI250 and MI300 accelerators (despite the $1.5 billion revenue headwind linked to China).

- Client and Gaming: Combined sales skyrocketed to $4 billion, up 73% year over year. PC sales reached a record $2.8 billion (up 46%), while gaming revenue was up a whopping 181% to $1.3 billion.

- Embedded: Revenue dropped 8% year over year to $857 million, a modest drag linked to tougher comparisons following the Xilinx acquisition.

For perspective, AI-related products accounted for roughly 21% of AMD’s total sales, pushing expected full-year 2025 sales around $33 billion mark.

Guidance shows momentum isn’t slowing

In addition to that, AMD guidedQ4 2025 sales to be at $9.6 billion (±$300 million), with the midpoint implying a sizeable 25% increase year over year.

Additionally, AMD’s management guided for non-GAAP gross margin to be at around 54.5% and operational expenses near $2.8 billion.

On the call, CEO Lisa Su said demand looks remarkably durable heading into next year.

Where AMD stock could trade in 2026

Wall Street is optimistic about AMD heading into 2026.

The bulls see substantial upside if execution holds up. On the other hand, skeptics view a stock that’s already pricing in a lot of good news.

Here’s how the big firms are lining up:

- Goldman Sachs — $210 (Neutral): Goldman is still cautious, warning that AMD’s outlook is linked to flawless execution of its big AI deals and margin expansion, leaving virtually little room for error.

- Bank of America — $300 (Buy): BofA expects AMD to effectively capture a double-digit share of a trillion-dollar AI market by 2030.

- HSBC — $310 (Buy): HSBC points to AMD’s incredible OpenAI win and expects a significant ramp-up in earnings growth as those deals scale.

- Wells Fargo — $345 (Overweight): Perhaps the Street’s most bullish calls, spearheaded by healthy data-center momentum and AI product traction.

- Melius Research — $380 (Buy): The most aggressive target, which assumes AMD securing 10%+ AI chip share while sustaining its top- and bottom-line growth numbers.

- Across roughly 51 analysts in the past three months, AMD stock’s consensus 12-month target sits near $282.82 (32% upside from current levels), underscoring superb confidence.

AMD’s 2026 test: big AI upside, bigger expectations

Heading into 2026, AMD’s not exactly easing into the hotly competitive AI race.

At its late-2025 Analyst Day, the management laid out some remarkably aggressive goals:

- Revenue growth: Targets 35%+ compound annual revenue growth over the next several years.

- Data center engine: Expects 60%+ annual growth in data-center sales as the key driver.

- AI kicker: Projects 80%+ annual growth in AI revenue, implying a growing mix shift toward AI.

Moreover, AMD will be rolling out its MI450 AI accelerators and Helios rack-scale systems in the back half of 2026, with early deployments linked to OpenAI and Oracle.

Whether it can result in repeatable share gains remains a significant question mark.

That’s exactly why Bernstein’s Stacy Rasgon framed it as follows, according to Reuters.

The risks are real.

Nvidia still commands 80-90% of AI accelerators; this, along with a misstep in AMD’s ROCm ecosystem, may slow adoption.

Execution matters too, with delays in MI450 production, customer concentration around OpenAI, or tighter export controls impacting results. Throw in a rich valuation at over 54 times 2026 earnings, and the upcoming year becomes a not-so-simple test.

Related: Cathie Wood drops $1.3 million on healthcare stock

What's Your Reaction?