Analyst overhauls AMD stock price target as gap with Nvidia widens

AMD shares have been the standout under performer in the AI chip space for much of the past year.

Developed Micro Devices shares prolonged their contemporary elope of declines Wednesday after a top Wall Avenue analyst cautioned that the chipmaker may proceed to path its peers' efficiency neatly into the new year.

Developed Micro Devices (AMD) shares own fallen bigger than 28% over the previous six month, neatly south of the 9% decline for the PHLX Semiconductor Sector benchmark and own lost around $63 billion in cost since issuing a disappointing gross sales and earnings outlook in unhurried October.

Competitors a lot like Broadcom (AVGO) and Marvell Abilities (MRVL) , within the interim, own risen 31% and 55% respectively over the identical time frame, with the faded topping the $1 trillion valuation mark unhurried remaining year.

Nvidia, within the interim, temporarily held the title of world's most-treasured firm unhurried remaining year, with a $3.4 trillion market cap, and its shares, while just right this moment stalled, own risen bigger than 168% over the previous year when compared to merely a 4% produce for AMD.

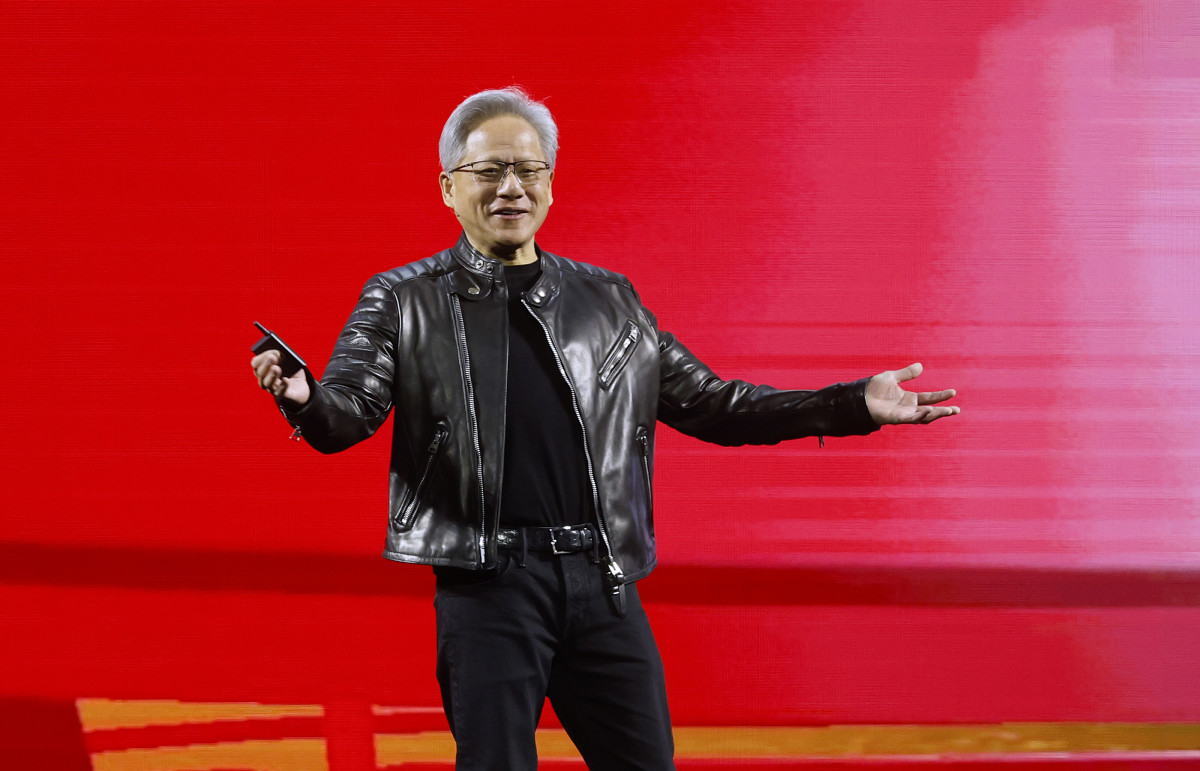

HSBC analyst Frank Lee sees that pattern persevering with, and lowered his price target on AMD shares by $90, to $110 per share, and clipped his rating on the stock to 'lower' from 'aquire' in a reward revealed Wednesday. TheStreet/Shutterstock/David Becker/Stringer/Getty Photos

"AMD’s share price has corrected by 24% within the previous three months (versus -12% for the PHLX Semiconductor index), but we predict about further plan back remains," Lee and his team wrote.

HSBC sees 'plan back momentum' for AMD

Lee said AMD's reliance on Samsung for its high-terminate memory chips may make a contribution to the "plan back momentum" seen in inquire of for its new line of MI325 graphics processing units.

Samsung, if reality be told, posted weaker-than-expected fourth quarter earnings Wednesday in Seoul thanks in part to the surging R&D charges tied to the ramp of its new, greater-terminate HBM3e memory chips, which compete in opposition to South Korea-based rival SK Hynix.

"We now judge AMD's AI GPU roadmap is much less aggressive than previously anticipated, limiting its penetration into the AI GPU market," Lee said.

Connected: Analyst revisits AMD stock price target following 2024 dawdle

Lee additionally argues that AMD will proceed to inch leisurely market leader Nvidia NVDA, which is ramping up manufacturing of contemporary Blackwell line of AI-powering chips and unveiled new gaming and PC concepts earlier this week, neatly into the new year.

"Whereas AMD is put to launch its MI350 chip in 2H25, it seemingly won’t own an AI rack answer to compete with Nvidia’s NVL rack platform till unhurried 2025 or early 2026, when we ask the MI400 to launch," Lee said.

HSBC sees 'plan back momentum' for AMD

AMD, which is slated to post its fourth quarter earnings on Jan. 28, suggested investors in October that MI300 gross sales may rise to bigger than $5 billion this year, with total revenues within the plan of $7.5 billion.

Analysts are attempting to search out a final analysis of $1.08 per share with info center revenues of $4.15 billion, client gross sales of $1.95 billion and gaming and embedded revenues totaling around $1.4 billion.

Nvidia, which is in a plan to post its fourth quarter earnings in unhurried February, is liable to glance revenues rise 73% from a year ago to $38.1 billion.

Extra AI Stocks:

- Extinct fund manager unearths startling AI stocks forecast for 2025

- Meta’s new vision may trade both AI and social media

- Analysts level to AI stock picks for 2025, along side Palantir

AMD, fancy its U.S.-based competitors, is additionally going thru the possibility of slumping China gross sales as trade restrictions between Washington and Beijing escalate.

Leisurely remaining autumn, China banned the exports of key uncommon minerals mature in high-tech manufacturing, while the China Association of Verbal change Enterprises, an trade neighborhood, said U.S. chip provides had been "now now no longer trusty" and introduced about companies to provide from home producers.

Developed Micro Devices shares had been marked 2.62% lower in premarket procuring and selling to reward an opening bell price of $125.50 every.

Connected: Extinct fund manager elements dire S&P 500 warning for 2025

What's Your Reaction?