Rocket Lab analyst rethinks stock target after hitting record high

Here’s what could be next for Rocket Lab stock.

Rocket Lab Corporation (RKLB) stock hit a record high on Dec. 23 after the company disclosed that it successfully launched its 21st Electron rocket in 2025.

Year to date, the stock has more than tripled, up from some $25 to $77.55 as of Dec. 23’s close. Over the same period, the S&P 500 index is up just 17%.

This incredible surge reminds investors of Palantir’s (PLTR) performance, where the stock goes up and up as investors debate whether it is overrated.

Now, Wall Street is resetting the goal for Rocket Lab stock.

Why Rocket Lab soared this year

Rocket Lab’s stock did not surge because of a single launch or headline. It climbed as investors revalue the company as an integrated space company, rather than just a rocket launcher.

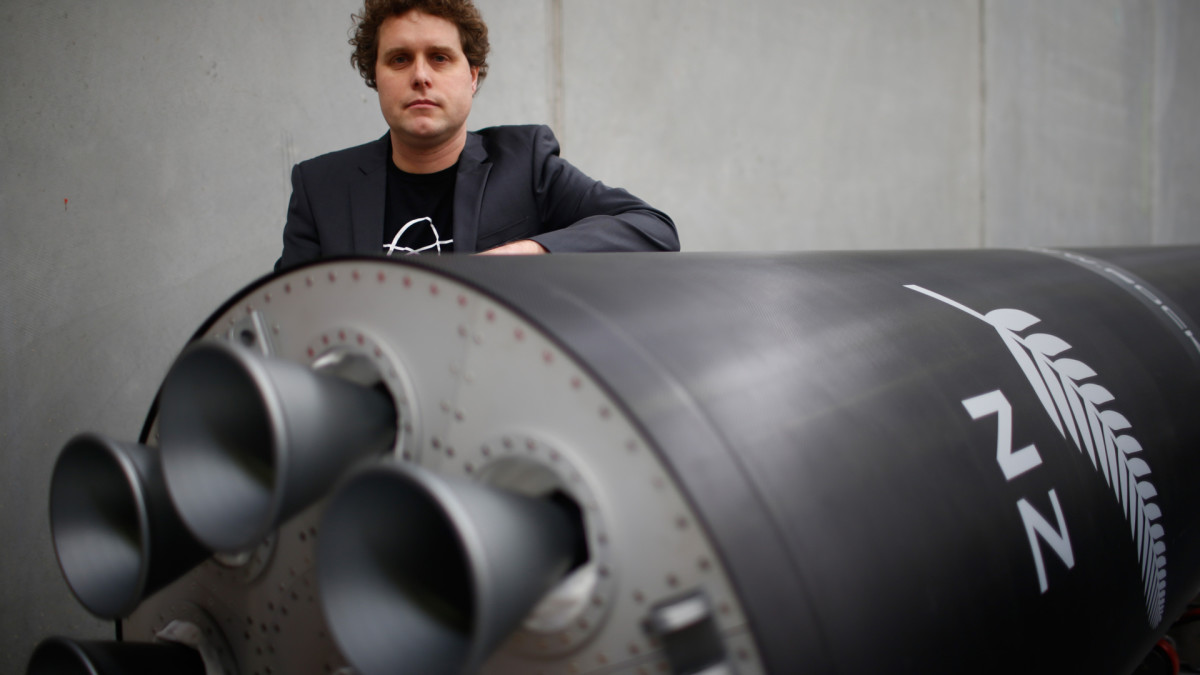

Rocket Lab was founded by Peter Beck in New Zealand in 2006. In 2013, the company set its headquarters in California.

Related: Elon Musk desperately needs your money to blow up more rockets

Rocket Lab shares benefit from more than rocket launches. Its space systems segment, which includes satellite components and spacecraft, gained increasing attention from investors. The segment's revenue has already surpassed rocket launches.

Beck described the strategy clearly. "We're an end-to-end space company, providing spacecraft design and manufacturing services, along with satellite components, flight software, and other things. We're now shoulder to shoulder with the other primes," he said during an interview with Space.com in 2024.

"Two-thirds of our revenue comes from our space systems business," he added.

On Dec. 19, Rocket Lab announced it had been awarded a prime contract by the U.S. Space Force Development Agency to design and manufacture 18 satellites under the Proliferated Warfighter Space Architecture.

The contract is worth $816 million, and Rocket Lab will deliver satellites equipped with advanced missile warnings, tracking, and defense sensors.

Rocket Lab stock soared 17.7% on Dec. 19 following the announcement.

Contracts, manufacturing scale, and long-term growth track reshaped the market's expectations, pushing the stock to higher levels, despite the fact that the company currently operates at a net loss. Xin/Getty Images

Veteran analyst expects Rocket Lab to fly higher

Stephen Guilfoyle, a 30-year Wall Street veteran who now runs Sarge986 LLC, a family trading operation, has issued an update on Rocket Lab following the stock’s explosive rally.

“We have no choice but to increase our target price,” Guilfoyle said in a recent note published on TheStreet Pro, citing exciting contracts the company received and technical pictures that turned more bullish.

Related: BofA sees upside in AI‑Power grid stock

Earlier in December, Guilfoyle set a $65 price target for Rocket Lab shares. After the recent surge, he has now raised that target to $81.

“We now have a much more bullish technical pattern,” Guilfoyle wrote.

“Now, I see a Cup with Handle pattern (which is bullish) with a $65 pivot," he wrote. “The stock is also close to experiencing a swing traders' or mini golden cross. That's where the 21-day exponential moving average crosses above the 50-day simple moving average and is, in my book, a bullish development,” Guilfoyle said.

Momentum indicators are also supporting the move, according to Guilfoyle, citing "a daily moving average convergence divergence (MACD) that is firing on all bullish cylinders."

MACD tracks the relationship between short-term and longer-term price trends. When the MACD line is above zero, it suggests the stock is in an upward trend.

"The histogram of the 9-day exponential moving average is now well above zero and rising. In addition, the 12-day EMA and 26-day EMA are both above zero, both are rising, and the 12-day line is above the 26-day line," he explained.

Guilfoyle’s strategy is to add shares on pullbacks toward the 50-day moving average, while treating a loss of the 200-day moving average as a risk signal. He remains long on Rocket Lab stock.

Related: Apple analyst sets bold stock target for 2026

What's Your Reaction?