Analyst unveils shocking Fed interest rate cut prediction

Here's when the Federal Reserve may cut interest rates.

The Federal Reserve is tasked with a tough job. It has to steadiness a twin mandate focusing on low inflation and unemployment, two continuously competing desires which are in particular at odds in 2025.

We possess seen increasing unemployment and layoffs, and inflation growth has stalled lately. The likelihood of tariffs fueling inflation later this year leaves the Federal Reserve in an inconceivable self-discipline: Slit rates and risk runaway inflation, or amplify rates and risk sending the economic system into recession.

Linked: Goldman Sachs unveils tariffs prediction, recession forecast

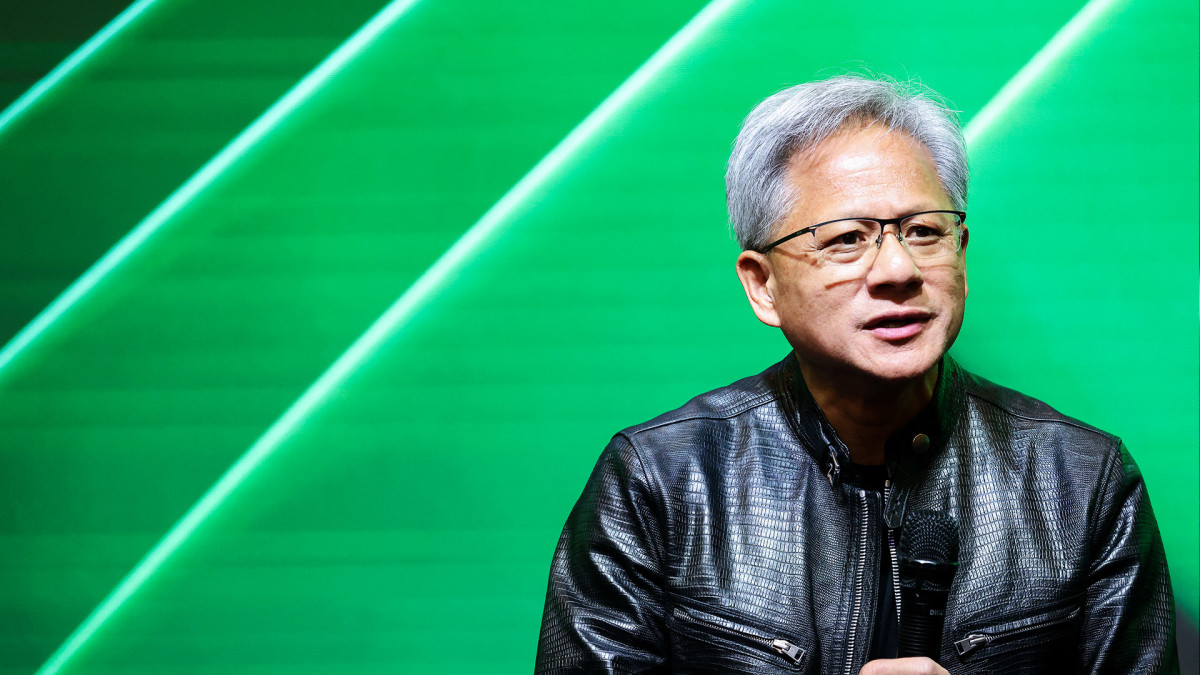

Given the dangers, the Federal Reserve is taking a wait-and-gaze means to setting ardour rates, forcing market watchers and economists to rethink their ardour rate cut forecasts. Image source: Chip Somodevilla/Getty Pictures

The Fed risks falling in the abet of the curve this year

The economic system is arguably at a crossroads. Even though economic train was once sturdy in 2024, cracks are rising, and newly instituted tariffs may send GDP reeling later this year.

The U.S. unemployment rate has ticked as a lot as 4.2% from 3.4% in 2023 and there is been a genuine drumbeat of layoffs lately. In line with Challenger, Gray, & Christmas, 497,000 Individuals got crimson slips in the main quarter, largely as a result of know-how sector layoffs and job losses linked to the Department of Government Efficiency, or DOGE, efforts. There were 105,441 cuts in April, up 63% from three hundred and sixty five days in the past.

Linked: Gross jobs file resets Fed ardour rate cut forecast

These losing their jobs possess fewer alternatives than they did three hundred and sixty five days in the past. The Job Openings and Labor Turnover Peer, JOLTS, reveals over 900,000 fewer unfilled jobs accessible in March than last year.

Job losses are rising, despite inflation being stubbornly above the Fed's 2% inflation purpose. In March, CPI inflation was once 2.4%, unchanged from last September.

The mix of job losses and sticky inflation has led many Individuals to rethink their spending, gripping bucks from discretionary purchases to essentials. Following newly instituted tariffs, that habits is more seemingly to continue this year.

Eager to revive U.S. manufacturing, President Donald Trump has embarked on an arguably bad tariff procedure. He instituted 25% tariffs on Canada, Mexico, and autos earlier this year and launched elevated-than-hoped reciprocal tariffs on April 2, so-called "Liberation Day."

The market response to those tariffs has been resoundingly detrimental. The S&P 500 peaked in mid-February, quickly after the Mexico and Canada tariffs were launched, and despite a fresh rally, it stays down 4% year-to-date.

President Trump paused most reciprocal tariffs on April 9 to permit for alternate negotiations. Quiet, he's left in location other tariffs, including a whopping 145% tariff on Chinese language items that has lifted tariffs on some Chinese language imports to about 160%.

These tariffs will seemingly amplify prices on many objects, sparking inflation. In the intervening time, tariff uncertainty is taking a toll on sentiment, leading households and businesses to stop or abolish spending plans.

If that habits continues, the Fed may discover its choice to retain ardour rates genuine on May 7 a mistake that puts it in the abet of the curve in avoiding a recession.

Analyst resets ardour rate cut outlook after FOMC fails to cut rates

The Federal Reserve meets eight times yearly to settle on appropriate ardour rate ranges to ensure low inflation and unemployment.

Linked: Customary fund supervisor who predicted the S&P 500 rally updates forecast after Fed, China records

It hiked rates substantially in 2022 and 2023 to crimp runaway inflation earlier than lowering rates three times slack in 2024 to shore up the jobs market.

The shift to dovish monetary coverage was once widely expected, a key reason stocks rallied sharply last year. Optimism was once that the Fed would continue easing ardour rates in 2025; on the different hand, stalled growth on inflation and tariff uncertainty has derailed these predictions.

Absent a serious downturn in economic train that causes the unemployment rate to surge meaningfully elevated, and elevated clarity into how tariffs affect inflation, the Fed has shifted to the sidelines.

As a result, the CME FedWatch instrument, which gauges market contributors' ardour rate outlook by monitoring the futures market, now predicts we won't gaze an ardour rate cut except not not as a lot as July.

The Fed Funds Price is for the time being location at 4.25% to 4.5%. The FedWatch instrument locations odds rates may be cut to 4% to 4.25% on the Fed's June assembly at prison 20%, down from 55% one week in the past. The percentages rates may be 4% to 4.25% in July possess elevated to 52% from 8% one month in the past.

Now not all individuals is convinced that we are going to gaze decrease rates that rapidly, despite the fact that.

Extra Economic Evaluation:

- Fed inflation gauge objects up stagflation risks as tariff policies chew

- U.S. recession risk leaps as GDP shrinks

- Esteem it or not, the bond market solutions all

After Chairman Powell outlined his reason for maintaining rates unchanged in May, Barclays analysts updated their ardour rate cut outlook. Their tackle what's subsequent for rates may disappoint many.

"Absent a decisive turn in U.S. economic records, the FOMC seems chuffed closing on retain indefinitely," wrote Barclays' analysts in a analysis present on May 8. "We continue to imagine, as we possess got since December, that rates will set unchanged via year-rupture."

A Fed on retain for the total lot of 2025 will not be what customers and businesses are attempting to hear, nonetheless it unquestionably's extra and extra seemingly.

"If it were evident that the following switch is a cut, Chair Powell would possess cut already. The direct of affairs is that this isn’t evident at all," the analysts wrote.

The reality is that there are such quite a lot of unknowns, and the stakes so excessive, that the Fed has tiny incentive to plug to cut rates.

"We mediate it's miles the risk of a loss of self belief in the FOMC’s 2% y/y inflation purpose, and the risk that policymakers want to hike rates (or not not as a lot as raise on retain), that holds the committee abet, and namely the risk that an ill-commended cut makes the direct of affairs worse and requires a moving, costly reversal," stated Barclays. "The resilient labor market, pushed by alternate self belief that tariffs may be moderated, has made it much less difficult for Powell to stick to his weapons on not delivering pre-emptive motion."

Linked: Customary fund supervisor unveils take into epic-popping S&P 500 forecast

What's Your Reaction?