Analyst who correctly said Nvidia's stock would fall has a new price target

Here's what could happen to Nvidia's shares next.

Nvidia has ridden a wave of rising demand for its high-end semiconductor chips this year. The company's revenue and earnings have soared, sending shares rocketing in 2023. However, it's recently been a rough ride for investors.

The company's shares have retreated from their summertime peak because of worry over stringent U.S. restrictions on the sale of chips to China for artificial intelligence.

The decline took many investors by surprise, but Real Money analyst Bruce Kamich wasn't among them. Kamich was one of the few who predicted Nvidia's sell-off, warning investors in September that shares could tumble to $400.

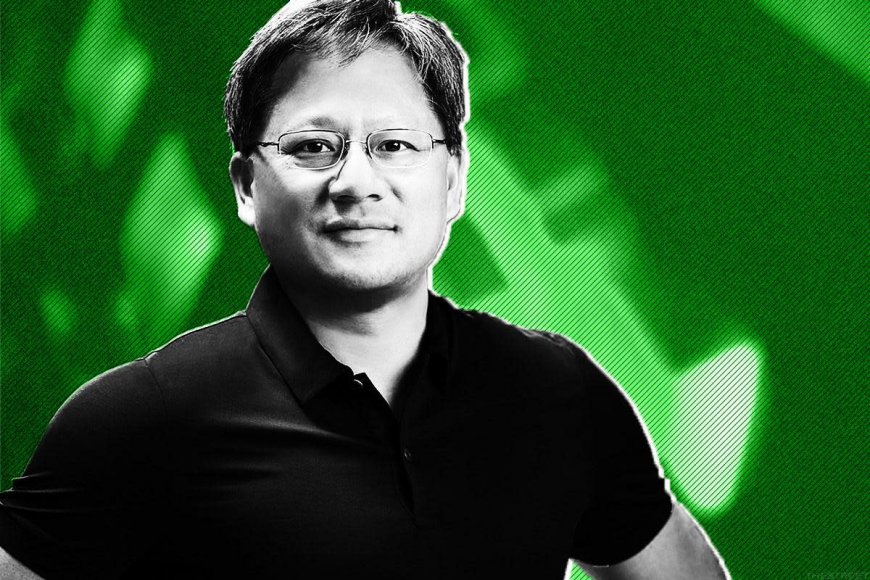

The prediction looks prescient, given Nvidia was trading almost precisely where Kamich said it would at the end of October. What could happen to Nvidia's stock next? Kamich just updated his analysis and set a new price target for Nvidia shares. SAM YEH/AFP via Getty Images

Nvidia's AI demand is surging

The successful launch of ChatGPT last December unleashed a torrent of interest from companies interested in training and launching artificial intelligence solutions.

Generative AI applications like ChatGPT mainly help users with searching, parsing, and creating content. However, AI’s benefits could be much broader, reshaping how many industries do business.

Related: Tesla chief Elon Musk targets Google, Microsoft and Sam Altman with latest move

Investment banks are using AI to develop models that more efficiently hedge their risk. Manufacturers are considering how AI may help them reduce waste, improve quality, and better anticipate demand. Drug manufacturers are evaluating its use in selecting drug targets and modeling clinical trial outcomes. Retailers are even researching to see if AI can reduce theft.

The applications are seemingly endless, so companies are plowing big money into AI initiatives. In turn, that's increasing demand for networking equipment that can train and operate AI apps faster and cheaper, driving sales of Nvidia's graphics processing chips that are better suited to AI than traditional CPUs.

Specifically, sales of Nvidia's H100 chipset, which can cost upwards of $30,000, have outstripped supply, causing revenue to skyrocket. Since these chips cost just $3,320 to manufacture, according to Raymond James, the sales growth has been a boon to the company's bottom line.

In the second quarter, Nvidia reported revenue of $13.5 billion, far higher than CEO Jensen Huang's prior guidance of $11 billion. Earnings jumped 429% year-over-year to $2.70 per share in Q2, handily outpacing Wall Street forecasts.

Nvidia's management exited the second quarter, expecting the trend to continue. Its third-quarter sales guidance exiting Q2 was $16 billion, trouncing analysts' $12.4 billion estimates.

Nvidia's AI opportunity hits a speed bump

Demand for Nvidia's high-end chips is global, and since a lot of technology stems from China, demand there has been robust, accounting for over 20% of Nvidia's data center sales.

The U.S. government, however, isn't too happy about that. Worries that Chinese buyers could deploy Nvidia's chips to outflank U.S. interests have prompted the Department of Commerce to restrict sales of high-end technology to them.

Initially, Huang's team thought they could get around those restrictions by selling watered-down versions of their most powerful chips. As a result, they developed the A800 and H800 specifically for use in China.

More From Wall Street Analysts

- Tesla analyst who told investors to ‘nail down profits’ in August has a new price target

- Hedge Fund Manager Doug Kass correctly said to sell stocks in July; here’s what he’s doing now

- Analyst who predicted the S&P 500's correction has a new price target (many will be unhappy)

Unfortunately for them, updated guidance from the U.S. government includes those chips on its restricted list, effectively ending sales of its AI chips there effective immediately. Nvidia wrote in an SEC filing on Oct. 18:

"The Interim Final Rule amends ECCN 3A090 and 4A090 and imposes additional licensing requirements for exports to China and Country Groups D1, D4, and D5 (including but not limited to Saudi Arabia, the United Arab Emirates, and Vietnam, but excluding Israel) of the Company’s integrated circuits exceeding certain performance thresholds (including but not limited to the A100, A800, H100, H800, L40, L40S, and RTX 4090) [emphasis mine]. Any system that incorporates one or more of the covered integrated circuits (including but not limited to NVIDIA DGX and HGX systems) is also covered by the new licensing requirement. The licensing requirement includes future NVIDIA integrated circuits, boards, or systems classified with ECCN 3A090 or 4A090, achieving certain total processing performance and/or performance density."

The broad-sweeping restriction on current and future chips suggests Nvidia may struggle to find a workaround.

Nvidia's price chart reveals a new target

The news unsurprisingly took a toll on Nvidia's share price. In August, its shares were trading above $500, but they had sunk to about $400 in the final week of October.

The sell-off in its shares once again caught the eyes of Kamich, who has analyzed price charts for professional investors for over 50 years. His bearish takeaway on Nvidia in September was driven by his analysis of Nvidia’s price, volume, and momentum.

Kamich, on Nov. 6, reviewed Nvidia’s daily and weekly price chart for updated insight. He also calculated a new price target using a weekly point-and-figure chart.

Unfortunately, Kamich is downbeat about what could be next for Nvidia's stock price.

"The daily chart is tracing out a downtrend with lower lows and lower highs while the trading volume is not expanding, which tells me that investor interest is on the wane," wrote Kamich. "In the weekly Japanese candlestick chart of NVDA, below, I can see a large top pattern. The shares are above the rising 40-week moving average line but the weekly OBV line has rolled over to the downside. The MACD oscillator remains in a corrective mode since early August."

On-balance-volume (OBV) is essentially up minus down day volume, while the moving average convergence divergence (MACD) oscillator is a momentum indicator.

Kamich would want to see more volume on up than down days and momentum follow through before advising Nvidia's shareholders that the coast is clear.

His weekly point-and-figure price target of $333 is particularly concerning, given his weekly P&F target in August was $397. Nvidia's shares are trading over $450 after rallying in the first week of November.

Point-and-figure charts don't predict when a stock will reach a specific price target, but the potential for further declines makes caution warranted.

That's especially true because Nvidia is scheduled to report third-quarter financial results on Nov. 21. What Huang says during the company's quarterly conference call about China restrictions could cause Nvidia stock to trade unpredictably.

"Nvidia has been a leadership stock but I think that is in the past tense. Markets are forward-looking," concluded Kamich.

What's Your Reaction?