Apple sees sharp narrative shift as tariffs dominate tech giant's outlook

Apple is moving quickly to address a growing investor concern.

Narratives can trade gorgeous quickly on Wall Freeway, dragging even the greatest companies into discussions that were largely left out best a pair of months ago.

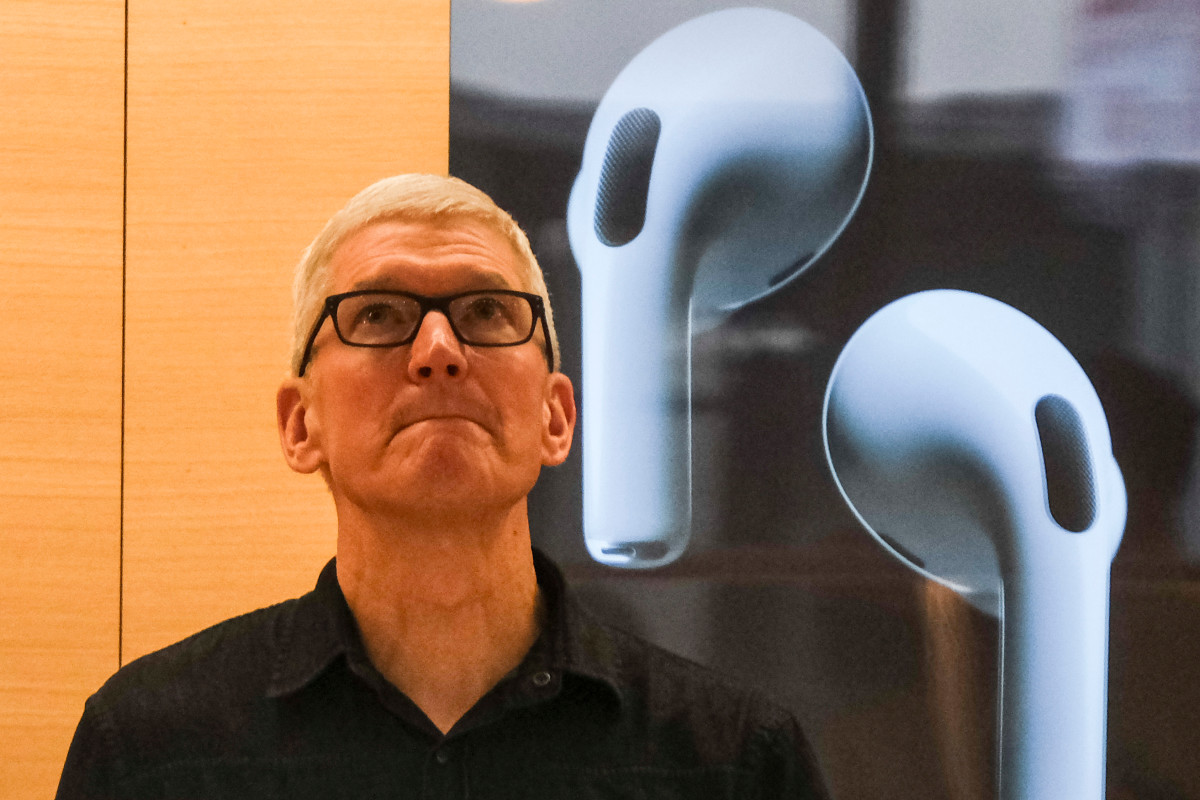

Apple (AAPL) , which earlier this year became once below fire for failing to devote the correct resources to its AI funding thesis, made no mention of tariffs on its first-quarter conference call in January. Actually, aesthetic 10 days after President Donald Trump became once inaugurated, Chief Executive Tim Cook would tell best that the realm's greatest tech firm became once "monitoring the space."

Closing evening, on the other hand, all the design by strategy of Apple's March-quarter earnings call, tariffs were talked about 27 numerous cases as Cook conceded that the administration's 145% levy on China-made items, as effectively as baseline tariffs of 10% on in terms of every numerous U.S. trading partner, would add a $900 million value headwind to the new quarter.

That's shifted investor disaster from Apple's AI investments to its provide chain, and the scurry with which it'll transition from overreliance on China-based manufacturing to lead plod of being caught within the crosshairs of the escalating trade war between Washington and Beijing.

Most U.S. iPhones this quarter will doubtless reach from India, in desire to China, Cook acknowledged, while numerous Apple hardware is anticipated to originate in Vietnam. Image source: Justin Sullivan/Getty Photography

"What we learned some time ago became once that having every part in one space had too significant threat with it," Cook instructed investors dreary Thursday. "And so we now bear got, over time, with sure facets of the provide chain, no longer all of the thing, but sure facets of it unfolded new sources of provide. And that you will to find that variety of thing persevering with within the long term."

Apple soundless managed a solid March quarter, the 2nd in its challenging fiscal calendar, with overall revenues rising 5% from closing year to $95.36 billion, topping Freeway forecasts, and iPhone gross sales rising 2% to $46.84 billion.

The neighborhood expects contemporary quarter revenues to rise within the "low single digits" this quarter, suggesting an overall tally of between $86.6 billion and $90.1 billion, with revenue margins narrowing to assume the $900 billion in tariff charges.

Connected: Analysts revisit Apple stock value targets as Cook courts Beijing

KeyBanc Capital Markets analyst Brandon Nispel, on the other hand, thinks the tariff overhang is more doubtless to closing week into the aid half of of the year and plod on Apple's fragment value efficiency on the same time.

"We deem Apple's tariff mitigation efforts are doubtless higher than most search recordsdata from, but on the end of the day, we expect it's doubtless a piece-to-no-increase commercial, where expectations proceed to demand an acceleration in increase into 2026," he acknowledged in a present published Friday.

Wedbush analyst Dan Ives, on the other hand, thinks Apple became once ready to search out some "breathing room" from the tariff uncertainty by strategy of its India provide chain shift, allowing it to introduce the new iPhone 17 later this autumn without a critical disruption in its key U.S. market.

"The ask atmosphere appears to be like stable for Apple and the guidance for June became once in total in-line with expectations and we were stunned the firm in reality gave an outlook the least bit given the tariff complexity," he acknowledged.

"It feels love Apple has a improbable grip around this very complex tariff challenge with Cook being 10% baby-kisser and 90% CEO," Ives added.

How that mix, which Ives suggests can even be as excessive as 20%/80% within the new tariff native weather, adjustments Apple's draw-length of time efficiency is anybody's wager.

Shares within the neighborhood bear fallen nearly 18% from their dreary-December prime, and were closing marked 3.1% lower in premarket trading at $206.63 every.

China has commended a potential thaw in U.S. trade kinfolk, by strategy of a commentary from its Finance Ministry that it's "evaluating" an overture from Washington, but as well warned that "making an attempt to utilize talks as a pretext to bear interaction in coercion and extortion wouldn't work."

Connected: Analysts revisit Apple stock value draw as Trump offers tariff aid

Apple is also best getting a minimal tailwind from the infusion of Apple Intelligence into its new suite of iPhones, and a pullback in person spending over the approaching months will cloud each its iPhone 17 open and gross sales of its hardware and companies.

That will be why Apple undershot expectations in its fragment buyback plans, which were pegged at $100 billion.

"We discovered this a piece of a head-scratcher, as Apple historically either holds its buyback or increases it authorization versus the prior year," acknowledged CFRA analyst Angelo Zino, who commended the neighborhood is keeping a pair of of its buyback powder dry amid tariff considerations.

Cook, on the other hand, struck and upbeat tone as he navigated investors into the murky uncertainty of a world trade war.

"For our part, we will doubtless be succesful to location up the firm the technique we always bear, with considerate and deliberate selections, with a specialize in investing for the long length of time, and with dedication to innovation and the potentialities it creates," he acknowledged.

"As we glimpse ahead, we stay assured, assured that we will doubtless be succesful to proceed to originate the realm’s best merchandise and companies and assured that we can proceed to mosey our commercial in a draw that has always location Apple apart."

Extra Tech Stocks:

- Amazon makes transfer that the White Home hates, then walks it aid

- Analyst reboots Apple stock value draw sooner than earnings

- Controversial EV tax credit will doubtless be bad news for Tesla

What's Your Reaction?