Bank of America delivers bold S&P 500 target

The major investment bank unveiled an updated S&P 500 forecast.

The S&P 500 is broadly thought in regards to the benchmark index most merchants exercise to measure efficiency for good reason. It involves 500 of the most effective companies in The USA, crisscrossing sectors and industries.

The index displays the strength or weak spot of the U.S. economy. Its pops and drops are a leading indicator market members exercise to manufacture buy-and-promote choices.

Earlier this 300 and sixty five days, the S&P 500's huge promote-off made merchants anxious. Cracks within the jobs market and ache over sticky inflation amid President Trump's greater-than-anticipated tariffs gain brought on many to ache about stagflation or an outright recession.

Linked: Goldman Sachs revamps Fed hobby rate reduce forecast for 2025

It has been a clear myth since April.

After tumbling 19% from its mid-February high, the S&P 500 has skyrocketed since April 9, when Trump paused most reciprocal tariffs announced on April 2, so-known as "Liberation Day."

The S&P 500 has now rallied over 25% from its early April low, a grand efficiency given the index's realistic annual return since 1957 is spherical 10%.

The strong beneficial properties gain merchants questioning whether shares gain lunge too a long way, too snappily. Here's terribly dazzling given the White Dwelling's hottest return to not easy focus on on tariffs and the looming discontinue to the tariff live imminent on August 1.

The dynamic has caught the distinction of Wall Road, and Monetary institution of The USA currently updated its S&P 500 target. Record supply: Michael M&duration; Santiago/Getty Photos

Fed sits, economy staggers as tariff tussle resumes

It is miles not easy being Jerome Powell at the 2nd. The Fed Chairman is tasked with upholding the Fed's dual mandate of low inflation and unemployment, two targets in total at odds with one one other.

Balancing unemployment, which rises when the Fed will enhance hobby charges, and inflation, which rises when the Fed cuts charges, just isn't easy in typical times. This 300 and sixty five days, or not it's particularly not easy thanks to the mounting uncertainty connected to President Trump's tariff policy.

Linked: Legendary fund manager has blunt message on 'Big Enticing Bill'

The White Dwelling maintains tariffs are the accurate technique to arm-wrestle manufacturing attend to the US. Nonetheless, most economists behold tariffs as a consumer tax possible to delay inflation.

President Trump has enacted 25% tariffs on Canada, Mexico, and autos, 30% tariffs on China and a 10% baseline tariff on all imports. This week, he announced increased tariffs on key trading companions South Korea and Japan and, after extending the tariff live reduce-off date from July 9 to August 1, acknowledged no extra extensions would possibly be granted.

Sadly, that does runt to relief give the Fed the clarity it wishes to embrace dovish rate cuts, luxuriate in it did late in 2024. Unless there is fade bet on tariff ranges from alternate deals, the Fed is left to shock if extra rate cuts may fan inflationary fires even as the affect of tariffs on inflation hits.

The Fed's hesitancy to decrease hobby charges creates a misfortune for the inventory market. Stocks observe earnings and earnings growth over time, and worries that inflation will sluggish household and industry spending significantly cap forward earnings and earnings outlooks.

As a consequence, some are struggling to justify the S&P 500's huge rally since April, given the benchmark's label has increased noteworthy sooner than forward earnings estimates, lifting valuation to worrisome ranges.

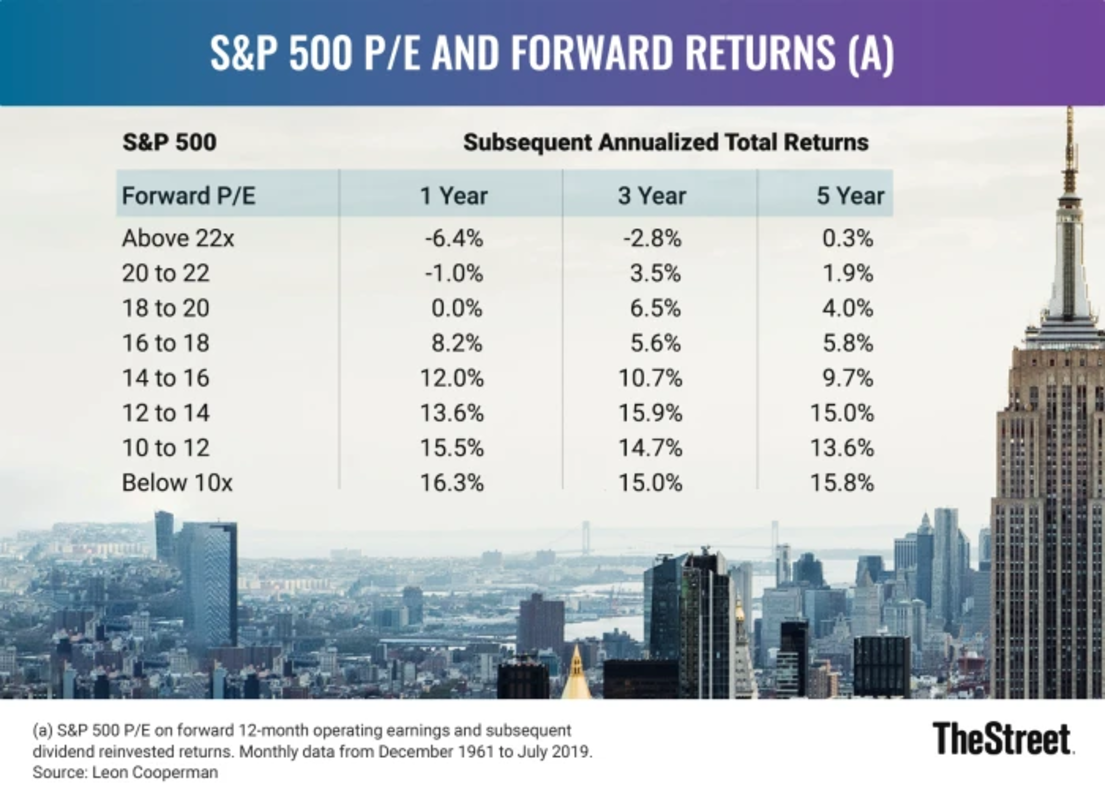

Analysts' forward 12-month earnings estimates gain increased by dazzling 1.2% since March, whereas the S&P 500 has won about 11%, inflating the S&P 500's forward label-to-earnings ratio to 22.2, in step with FactSet.

That's meaningfully greater than the S&P 500's realistic forward P/E ratio over the last five and ten years, which are 19.9 and 18.4.

Importantly, historically, the S&P 500 has struggled to generate returns within the 300 and sixty five days following a P/E ratio this high. Record supply: TheStreet

Monetary institution of The USA boosts its S&P 500 target

Whereas valuation is pertaining to, Monetary institution of The USA just isn't convinced that shares gain lunge out of steam. The novel Wall Road funding firm increased its S&P 500 target this week, citing company American resiliency.

Linked: Who saves money resulting from ‘Big Enticing Bill’ tax cuts?

"It is bad to underestimate Corporate The USA," wrote Monetary institution of The USA strategist Savita Subramanian. "The US just isn't unprecedented, but company The USA would possibly be."

The analyst concedes that without reference to progress on alternate deals, passage of the One Big Enticing Bill Act, and decrease recession risks, uncertainty remains high, propping up yields on Treasury bonds. Still, policy uncertainty hasn't translated into worrisome ranges of company uncertainty.

"Most co's gain persisted to files on income, and estimate dispersion (a measure of EPS uncertainty) is shut to put up-COVID lows," wrote Subramanian. "Volatility in forex, inflation and charges gain did not rattle S&P 500 margins since COVID -- corporates either adapted or dropped out of the index."

The flexibility to adapt would not mean risks don't exist, though, which can pronounce off rapid complications for shares.

The strategist charges the rapid outlook for the S&P 500 as "tepid to cool" resulting from an absence of catalysts. The medium-to-prolonged-timeframe outlook is "warmth," though, because whereas sentiment has improved, it is "nowhere shut to bad euphoric ranges."

"Deregulation and a pick-up in industry funding may buoy markets before mid-timeframe elections," wrote Subramanian.

Subramanian admits prolonged-timeframe S&P 500 returns may underwhelm thanks to the index's fresh valuation. Still, the analyst's hottest quantity crunching aspects to a greater, not decrease, label target.

After adjusting fairness ache top rate and bond yield assumptions, Subramanian comes up with a 12-month S&P 500 target of 6,600.

Linked: JPMorgan delivers blunt warning on S&P 500

What's Your Reaction?