Bank of America sends strong message on gold prices

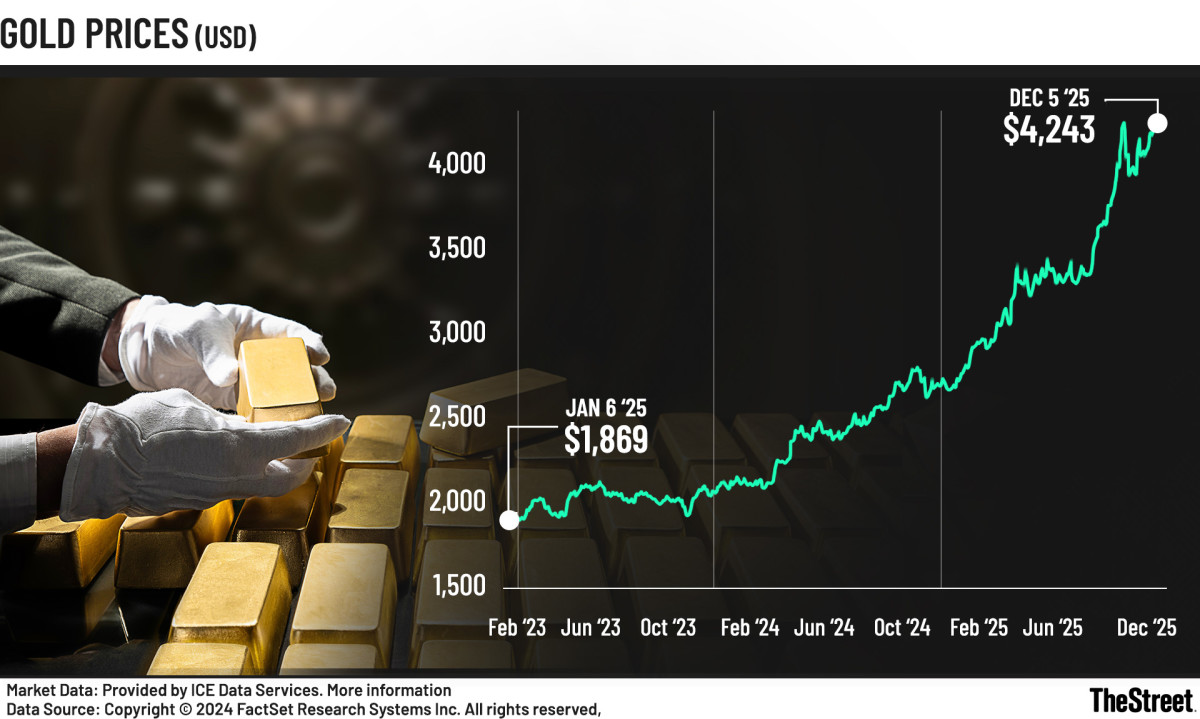

Gold has spent weeks consolidating in the $4,200 to $4,300 range, but Bank of America views it as more of a breather than a ceiling. Clearly, gold’s 2025 run has been insane. The shiny yellow metal started the year near $2,630/oz, and is currently trading at $4,282/oz, leaving it up roughly 63% ...

Gold has spent weeks consolidating in the $4,200 to $4,300 range, but Bank of America views it as more of a breather than a ceiling.

Clearly, gold’s 2025 run has been insane.

The shiny yellow metal started the year near $2,630/oz, and is currently trading at $4,282/oz, leaving it up roughly 63% year-to-date, its best performance since the late 1970s.

That said, we’ve seen some sluggishness of late, which, in his 2026 outlook, Bank of America Metals Chief Michael Widmer downplayed.

Widmer, in his annual webinar, argued that stretched prices usually end rallies, but it’s when the forces propelling the rally run out of gas, according to reporting from Kitco.

At this point, he feels those forces are alive and kicking.

Though the metal appears overbought, Widmer’s point is that it’s largely underinvested, especially by smart money that typically arrives late to the party.

That effectively leaves a significant amount of room for a run toward the much-discussed $5,000 level next year if investment demand comes nearly as close to what we’ve already seen. Photo by Bloomberg on Getty Images

Even after a 50% year, Widmer says gold isn’t owned enough

Widmer makes the case that the real driver of gold’s next leg isn’t just hype, but the simple fact that so many of the big-ticket investors still don’t own it enough.

Despite a 50%+ rally this year, the crisis metal still represents just a tiny slice of global portfolios, especially among high-net-worth investors (just 0.5% of their portfolios).

More Personal Finance:

- Estate planning tips every blended family needs to know

- Dave Ramsey sounds nationwide Medicare alarm

- After Your Death, Who Takes Care of Your Dog?

- What Medicare Part B price hike means for your 2026 Social Security

- Student loan forgiveness at risk for many

ICE Data Services/TheStreet/Shutterstock

That mismatch leaves a ton of fuel in the tank that most people assume.

“I’ve highlighted before that the gold market has been very overbought. But it’s actually still underinvested,” Widmer told viewers. “There is still a lot of room for gold as a diversification tool in portfolios.”

The BofA analyst notes that gold just needs a relatively modest 14% increase in investment demand to have a shot at $5,000, a pace the market has been matching of late.

The surge to $8,000, however, entails a significantly larger increase, nearly a 55% rise in buying.

Additionally, the rising interest in gold coincides with investors' growing skepticism of the traditional 60/40 playbook.

Widmer argues that the diversification of math has progressed sufficiently that gold could play a much deeper role in modern portfolios.

It’s important to note that BofA’s gold price target sits at an average $4,538 an ounce for 2026, with a reasonable upside path toward $5,000.

Much of the run to the upside hinges on the current macro tailwinds materializing in the form of rate cuts, dollar softness, and geopolitical tensions.

Other big bank calls on gold prices for 2026

Here’s how the rest of the Wall Street clusters around that:

- J.P. Morgan: Sees gold averaging at nearly $5,055/oz by Q4 2026, with a long-term bull case stretching to even $6,000/oz by 2028, calling gold their “highest conviction long” bet.

- Goldman Sachs: Targets $4,900/oz in 2026, while suggesting there’s tremendous upside given how underowned gold still is, like Widmer argued.

- Morgan Stanley: Jacked its 2026 forecast to nearly $4,400/oz, while in a separate outlook pegging mid-2026 near $4,500/oz, naming gold a top pick for the year.

- UBS: Rates gold “attractive” with a $4,500/oz target for mid-2026, crediting falling real rates, a sluggish dollar, along with persistent geopolitical pressure.

Gold’s 2025 rally broke every expectation

Gold’s 2025 run has been flat-out wild.

Up over 60% year-to-date, the World Gold Council says gold logged an eye-popping 50+ all-time highs while delivering “more than 60%” returns through November, a staggering move to say the least.

Related: Jim Cramer issues blunt 5-word verdict on Nvidia stock

Here’s how the past five years of annualized returns stack up (approximate):

- 2021: -4% – a consolidation year following the massive pandemic-led rally.

- 2022: roughly flat (near 0%) as gold mostly treaded water despite all the rate hikes.

- 2023: Nearly up +13% with central-bank demand reasserting itself.

- 2024: about +27% surge with heavy official-sector buying setting the stage for 2025.

- 2025: around +60% so far, turning out to be the strongest year in decades, with gold breaking above $4,000/oz.

Source:World Gold Council, LBMA gold price data (2021–2025).

Three forces did the bulk of the heavy lifting.

First, real yields and the dollar fell hard with 10-year inflation-adjusted treasury yields sliding from about 2.4% to near 1.6%, while the US Dollar Index tanked over 7% from its peak, adding umph to non-yielding assets.

Secondly, central banks continued to buy at an aggressive clip, with October marking the highest net purchases of 2025, as markets diversified away from the dollar.

Thirdly, hedging demand skyrocketed, which was enough for the BIS to warn of a potential “double bubble”.

Layer that on top of ETF inflows flipping positive amidst record demand (Q3 2025 alone witnessed a record $26 billion rush into gold-backed ETFs), and gold has effectively become the preferred macro hedge.

Related: Housing market hits a whole new problem

What's Your Reaction?