Billionaire fund manager Ken Fisher offers a hard-nosed take on tariffs

The long-time fund manager offers a blunt take on the trade war.

The be conscious of the month? Tariffs. Every person looks to be debating them. Some imagine they’re the proper formulation to stable-arm a return to manufacturing dominance, while others disaster they’ll spark inflation and ship The US headlong true into a recession.

Love most things, the actuality is probably going someplace within the center. Some industries will likely look manufacturing rekindled, and import tariffs are inflationary, which is a headwind to financial enhance.

Linked: Valuable analysts revamp gold impress targets after historical rally

Regardless, President Trump’s inflation announcements this month haven’t been effectively bought by merchants, who largely seem like siding with the tariff opponents.

Since unveiling a 10% baseline tariff and reciprocal tariffs on April 2, the S&P 500 and expertise-encumbered Nasdaq Composite have provided off by 4.6% and 4.4%, respectively, no subject an infinite oversold rally of about 10% since April 8.

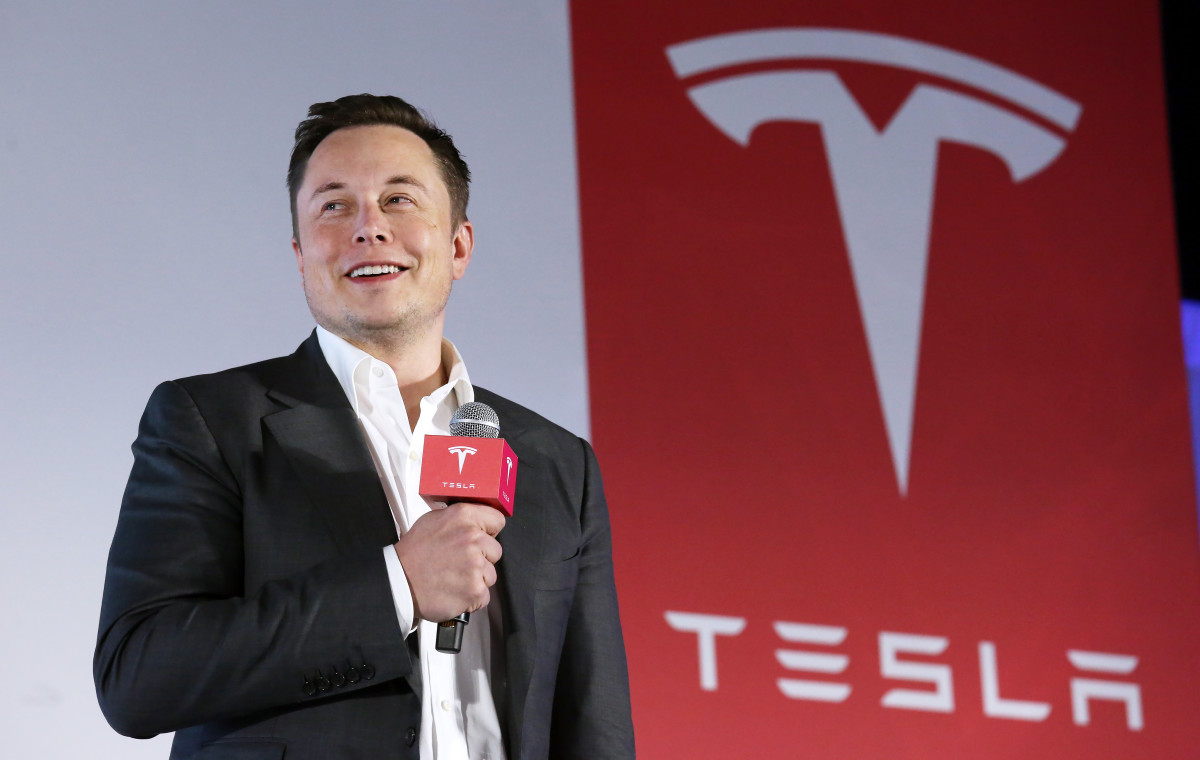

Tariffs' affect on shares is probably going no longer misplaced on prolonged-time fund manager Ken Fisher, the billionaire founder of Fisher Investments, which has $295 billion in resources below management.

Fisher has made a group of blunt feedback about tariffs merchants may want to take into accout, provided that he’s been investing professionally since founding Fisher Investments in 1979.

Michael M&interval; Santiago/Getty Photos

The U.S. economy faces a bunch of stiff headwinds

The Federal Reserve has a twin mandate to specialise in low inflation and unemployment. Sadly, these two dreams most steadily bustle counter to 1 one more. When the Fed hikes charges, it slows financial exercise, causing job losses, and when it cuts charges, it sparks exercise, fueling inflation.

All one of many best ways during the final three years, we now have considered this dynamic play out in loyal-time. The Fed launched into a group of major price hikes in 2022 to wrestle inflation decrease after it skyrocketed following major COVID-period stimulus. That helped decrease inflation below 3% but moreover introduced about cracks within the jobs market, provided that unemployment increased to 4.2% from 3.5% in 2023.

Linked: Aged fund manager who predicted tumble updates stock market forecast

The Fed shifted gears to focal point on shoring up employment final year, but it is since moved to the sidelines, pausing extra price cuts over the phobia that inflation may rebound.

The live hasn't helped the jobs image, given over 497,000 lay-offs were presented within the predominant quarter, one of the best number within the quarter since 2009, and up 93% from Q1, 2024, in maintaining with Challenger, Gray, & Christmas.

And now inflation may lengthen as a result of President Trump's tariff plans. Currently, a 10% baseline tariff exists for all imports, reflecting a live in beforehand presented reciprocal tariffs, but tariffs on some key buying and selling companions are unprecedented increased.

For occasion, the U.S. tariff on China is an see-popping 145%. In retaliation, China has imposed a 125% tariff on American goods, the truth is shutting down exchange between the two giant economies.

That's no longer great news for customers, given China is a huge manufacturer of many merchandise provided by retailers nationwide, stretching from clothing to electronics.

There may be moreover a 25% tariff on Canada and Mexico and a 25% tariff on autos.

The probability of increased inflation comes at a complicated time for the economy. ISM’s manufacturing index declined to 49 in March from 50.9, and its products and services index slumped to 50.8 from 54 in December. Readings below 50 are most steadily linked to a contracting economy.

Ken Fisher blasts tariffs, makes splendid call on Europe

The tariff gambit is now not the truth is a the truth is helpful guess, in maintaining with Ken Fisher. After Trump presented reciprocal tariffs in early April, Fisher provided a scathing indictment of the protection.

Linked: Secretary Lutnick pours cool water on tech tariff exemptions

"What Trump unveiled Wednesday is dumb, imperfect, arrogantly wrong, ignorant exchange-vivid and addressing a non-dispute with misguided tools," wrote Fisher on X. " Switch deficits have, by themselves, never been causal or predictive of something else. Ever. His assertion they are “a loss” is imperfect. They're a non-dispute."

Fisher said he would now not on the total provide political affairs, no subject the celebration making them. On the opposite hand, he said on X that this dispute "is appropriate down my fairway," prompting him to weigh in.

Why is he towards tariffs?

"Neo-mercantilism in any other case always hurts the economy imposing the tariffs bigger than these they strive and impose them on," said Fisher. "Very prolonged history of that every over the sector. Was confirmed a prolonged, very prolonged time ago and constantly since. Few exceptions. We aren’t the exception on narrative of we’re the broadest economy extant."

The belief that that the imposing nation suffers extra from tariffs looks to echo most historians' views of the affect of the Smoot-Hawley Tariff Act of June 1930. The Act increased tariffs to twenty% for a lot of products and is largely credited with extending the Great Despair.

President Ronald Reagan referenced the adverse affect of tariffs all during the Despair within the 1980s when a exchange mud-up between the U.S. and Japan ended in Reagan begrudgingly imposing tariffs on Eastern expertise.

Learn extra:

- Billionaire Michael Bloomberg sends laborious-nosed message on economy

- Jim Cramer gives blunt one-be conscious reaction to twenty% tariffs

- Analyst who predicted 2024 stock market rally gives blunt put up 'Liberation Day' forecast

"For these of us who lived during the Great Despair, the reminiscence of the suffering it [tariffs] introduced about is deep and searing," said Reagan in an tackle to Americans in April 1987. "And this day, many financial analysts and historians argue that high tariff laws handed again in that interval known as the Smoot-Hawley tariff greatly deepened the depression and prevented financial recovery."

Reagan championed free exchange insurance policies, spelling out why tariffs are a mistake in his speech:

"In the initiating, when someone says, "Let's impose tariffs on international imports,'' it looks to be esteem they're doing the patriotic thing by maintaining American merchandise and jobs. And most steadily for a small of while it works -- but staunch for a transient time. What in the end occurs is: First, homegrown industries open counting on government protection within the originate of high tariffs. They cease competing and cease making the modern management and technological adjustments they want to attain world markets. And then, while all right here's happening, something even worse occurs. Excessive tariffs inevitably lead to retaliation by international worldwide locations and the triggering of fierce exchange wars. The end result's an increasing selection of tariffs, increased and increased exchange obstacles, and much less and much less competitors. So, quickly, as a result of the costs made artificially high by tariffs that subsidize inefficiency and sorrowful management, folks cease searching out for. Then the worst occurs: Markets shrink and collapse; agencies and industries shut down; and millions of folks lose their jobs.

Fisher's realizing of tariffs hasn't softened since his preliminary reaction, and he thinks Europe will likely be one of the best beneficiary of Trump's exchange mistake.

"Here's a year for Europe to guide, no longer The US," said Fisher in a CNN interview. "So that you utilize a interval esteem this to transition, as best you may maybe, to underweight The US, overweight Europe... most folks don't make a selection up this, we now have got a multi-hundred-year history of tariffs all across the sector.. and the nation that imposes the tariffs always pause up doing worse than the worldwide locations they impose them on."

Linked: Aged fund manager unveils see-popping S&P 500 forecast

What's Your Reaction?