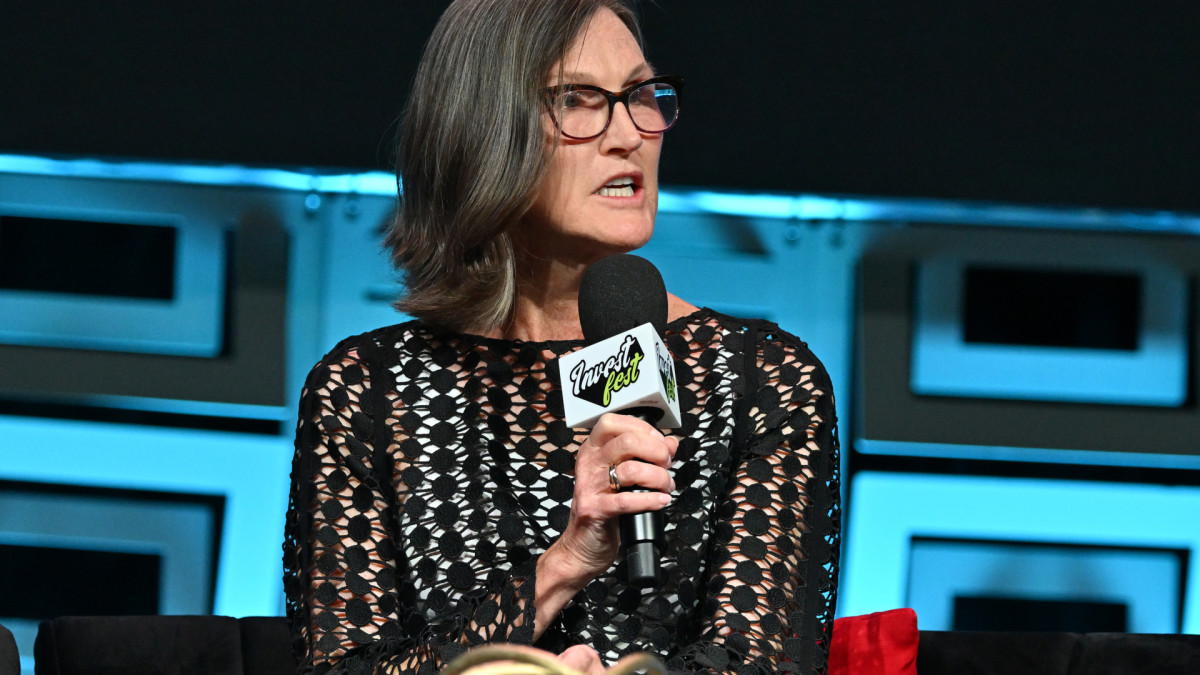

Cathie Wood buys $1.9 million of megacap tech stock

Cathie Wood, CEO of Ark Investment Management, typically focuses on small- and mid-cap technology stocks, but she occasionally ventures into megacap growth stocks. This approach can help add stability to her funds, while her entry timing often reflects market opportunities. That’s what she just ...

Cathie Wood, CEO of Ark Investment Management, typically focuses on small- and mid-cap technology stocks, but she occasionally ventures into megacap growth stocks. This approach can help add stability to her funds, while her entry timing often reflects market opportunities.

That’s what she just did, adding shares of one of the market’s largest technology leaders before its February earnings.

Wood gained a reputation after the Ark Innovation ETF delivered a 153% return in 2020. Last year, the flagship Ark Innovation ETF (ARKK) gained 35.49%, far outpacing the S&P 500’s return of 17.88% in the same period.

Wood’s style brings sweet wins in rising markets but also painful losses in bearish ones, as seen in 2022, when the Ark Innovation ETF tumbled more than 60%.

Those swings have weighed on Wood’s long-term results. As of Jan. 30, the Ark Innovation ETF has delivered a five-year annualized return of -11.29%, while the S&P 500 has an annualized return of 14.99% over the same period, according to data from Morningstar. getty images

Cathie Wood rejects “AI bubble” again

Wood focuses on emerging high-tech companies across artificial intelligence, blockchain, biomedical technology, and robotics. She thinks these businesses have great potential for big change and long-term growth, though their volatility often causes fluctuations in the Ark’s funds.

From 2014 to 2024, the Ark Innovation ETF wiped out $7 billion in investor wealth, according to an analysis by Morningstar’s analyst Amy Arnott. That made it the third-biggest wealth destroyer among mutual funds and ETFs in Arnott’s ranking.

Related: Cathie Wood buys $10.7 million of sinking AI stock

In a letter published on Jan. 15, Wood says the U.S. economy is storing up energy for a sharp rebound in 2026.

"Despite sustained real gross domestic product growth during the past three years, the underlying U.S. economy has suffered a rolling recession and has evolved into a coiled spring that could bounce back powerfully during the next few years," Wood wrote.

Wood also rejects the “AI bubble” talk, saying it "is years away" and "the most powerful capital spending cycle in history" is coming.

"What once was the cap in spending seems to have become a floor now that the AI, robotics, energy storage, blockchain technology, and multiomics sequencing platforms are ready for prime time," she said.

Not all investors agree with Wood’s optimism. In the 12 months through Jan. 28, the Ark Innovation ETF saw roughly $1.11 billion in net outflows, according to ETF research firm VettaFi.

The Ark Innovation ETF is down 3.85% year-to-date as of Jan. 30. The S&P 500 index rallied 1.37 over the same period.

Cathie Wood buys $1.93 million of Amazon stock

On Jan. 30, Wood’s ARK Blockchain & Fintech Innovation ETF (ARKF) bought 8,088 shares of Amazon.com, Inc. (AMZN), valued at about $1.93 million.

Wood’s move came right before Amazon’s fourth-quarter earnings, which are scheduled for Feb. 5 after market close.

Related: Cathie Wood sends blunt 3-word message on stock outlook in 2026

Three months ago, Amazon posted upbeat third-quarter earnings and strong cloud growth. Its stock jumped 9.6% on Oct. 31, the following trading day.

AWS (Amazon Web Services), the company's cloud computing segment, is “growing at a pace we haven’t seen since 2022,” Amazon CEO Andy Jassy said in a Q3 earnings statement.

"We continue to see strong demand in AI and core infrastructure, and we’ve been focused on accelerating capacity," he added.

Investment firm Wedbush has reiterated an outperform rating and $340 price target for Amazon shares.

"AWS growth was well ahead of expectations, and we are encouraged by the implied level of AWS demand given the pace of backlog growth and additional supply coming online over the next twelve months," the analysts wrote in a Jan. 29 research note sent to TheStreet.

Top 10 holdings of the Ark Innovation ETF as of Jan. 30, 2026:

- Tesla (TSLA) 10.14%

- CRISPR Therapeutics (CRSP) 5.63%

- Roku (ROKU) 5.13%

- Tempus AI (TEM) 4.98%

- Coinbase Global (COIN) 4.55%

- Shopify (SHOP) 4.47%

- Advanced Micro Devices (AMD) 4.08%

- Robinhood Markets (HOOD) 3.92%

- Beam Therapeutics (BEAM) 3.60%

- Teradyne (TER) 3.59%

Besides AWS growth, analysts also see "healthy trends" in Amazon's core retail business and "strong advertiser demand," adding that Amazon remains the firm's top eCommerce pick for 2026.

Amazon has been ramping up its investment in AI. It is reported to be in talks to invest up to $50 billion in OpenAI, which could make Amazon the biggest contributor in OpenAI’s ongoing fundraising round, The Wall Street Journal reported on Jan. 29.

In other recent news, Amazon on Jan. 28 confirmed 16,000 corporate job cuts, completing a plan for laying off around 30,000 since last October.

The roughly 30,000 layoffs amount to nearly 10% of its workforce and mark the largest job cuts in the company’s three-decade history, surpassing the 27,000 positions eliminated between late 2022 and early 2023, Reuters reported.

The job cuts were to strengthen the company by "reducing layers, increasing ownership, and removing bureaucracy," Amazon's top human resources executive, Beth Galetti, said in a post.

Related: Billionaire Dalio sends 2-word message on Fed pick Warsh

What's Your Reaction?