Comcast hopes bold offer will lure back frustrated customers

Comcast is betting on a new strategy to attract and retain customers after major losses.

Comcast, which sells phone, cable TV and internet services under the name Xfinity, is losing its grip in two vital areas of the telecom industry, despite recent efforts to outpace its rising number of competitors. However, it is betting big on a bold offer to help it take on recent challenges in its business.

In Comcast’s latest earnings report, it revealed that it lost 245,000 cable TV customers in the fourth quarter of 2025, contributing to a roughly 5.6% year-over-year decrease in cable revenue.

The loss of customers isn’t a surprise, since the cord-cutting trend has continued to grow legs over the past decade as the number of streaming platforms has multiplied. More consumers are leaning toward these options as they seek to pay less for entertainment.

A survey from All About Cookies last year even found that only 30% of Americans watch TV through a traditional cable or satellite TV service.

In the earnings report, Comcast also revealed that it lost 181,000 internet customers in the fourth quarter as broadband revenue declined about 1% year over year. Comcast has faced heightened competition from phone carriers such as T-Mobile, Verizon, and AT&T, which have successfully attracted new customers to their fixed wireless internet services.

Fixed wireless internet, also known as 5G home internet, is usually cheaper and available in more rural and underserved areas than traditional wired internet.

Early last year, Comcast faced backlash from customers after raising prices for its Xfinity services, which may have contributed to recent customer losses. Also, Comcast reduced Xfinity’s monthly autopay discount from $5 to $2 for customers who pay their bills by credit or debit card.

Comcast tried to retain its internet and cable TV customers by revamping its Xfinity internet offers in June, which included lowering prices and introducing a one-year and five-year price lock guarantee. It also added four new flagship speed tiers to its internet plans and began offering a free Xfinity mobile line for all new and existing internet customers.

In December last year, Comcast also refreshed its Xfinity TV package offerings, launching five new plans that have a new “everyday pricing structure.” Shutterstock

Comcast execs call out what’s contributing to customer losses

During an earnings call on Jan. 29, Comcast CEO Brian Roberts emphasized that the company is facing unprecedented levels of competition.

“We are at an inflection point, both in our industry and at Comcast Corporation,” said Roberts. “The business is changing rapidly, and competition has never been more intense.”

Related: Comcast adds generous offer for customers after major loss

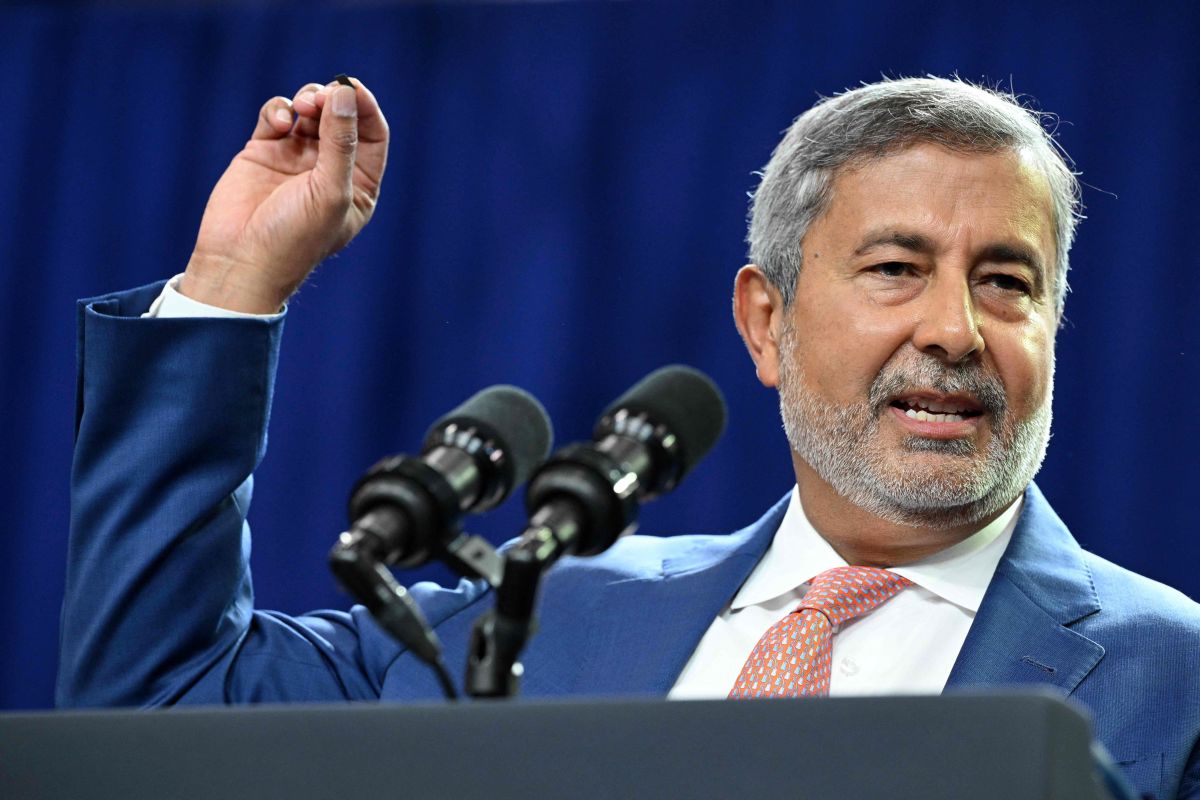

Comcast Connectivity and Platforms CEO Steve Crony said during the call that it is vital for the company to attract and retain customers by removing pain points that elevate churn.

“We must make it easier to do business with us and build a more loyal customer base through greater price transparency, more simplicity, fewer friction points, and consistently getting it right the first interaction,” said Crony.

Comcast bets big on a bold offer to fix customer struggles

This year, Comcast is doubling down on its investments to revamp its internet business after seeing increased competition from rivals offering fiber internet and consistent demand for fixed wireless internet services, which the company claims mainly contributed to recent customer losses.

“This will be the largest broadband investment year in our history, focused squarely on customer experience and simplification, with the goal of migrating the majority of residential broadband customers to our new simplified pricing and packaging by year-end,” said Comcast Co-CEO Michael Cavanagh during the call.

While Comcast claims it is already seeing lower voluntary churn, strong adoption of its five-year price guarantee, and a greater shift toward gig-plus tiers due to recent initiatives, it is heavily relying on its strategy of offering internet customers free phone lines, a tactic it began using last year.

More Telecom News:

- Verizon cracks down on internet customers violating key rule

- DirecTV makes harsh move as customers keep leaving

- AT&T to launch new service for customers as it takes on T-Mobile

“Our free line strategy is a logical and, importantly, a rational competitive approach for us,” said Comcast Chief Financial Officer Jason Armstrong during the call.

“It adds value to our core broadband product, builds familiarity in a tough-to-penetrate wireless market, and will convert to a paying relationship after one year in a product category where we are firmly profitable and one which delivers strong bundling benefits to our core broadband business.”

So far, Comcast has had success with this strategy, as more internet customers have accepted the free phone line offer. The company’s convergence revenue increased by 2% year over year during the quarter, driven mainly by 18% growth in its wireless business.

“We added 364,000 wireless lines, and similar to last quarter, nearly half of our residential postpaid connects came from customers taking a free line,” said Armstrong.

He reiterated that as customer loyalty grows, Comcast expects to “convert the vast majority of free lines” into paying relationships this year, which will further boost convergence revenue.

The move from Comcast follows in the footsteps of its rival AT&T. The phone carrier has high hopes that further leaning into bundling its internet and phone services will help it retain phone customers after seeing elevated churn during the fourth quarter.

“We expect total wireless service revenue growth in the 2% to 3% range annually over the next three years,” said AT&T Chief Financial Officer Pascal Desroches during an earnings call on Jan. 28. “The primary driver of this outlook is growth in consumer and customer relationships as we continue to gain wireless subscriber share through convergence in areas where we offer fiber and fixed wireless Internet services.”

Comcast’s new strategy is raising eyebrows

In an analyst note shared with TheStreet, Bank of America research analyst Jessica Ehrlich said her institution expects Comcast to lose about 563,000 internet customers this year, down from the 590,000 it previously predicted, due to the telecom giant’s recent turnaround efforts.

However, she said Comcast’s repricing efforts in its internet business will add “pressure” to its earnings, leading to additional “declines” in average revenue per user.

“Forward looking broadband commentary was constructive, citing lower voluntary churn, strong adoption of the five-year price guarantee, and a better mix into gig-plus tiers,” she wrote. “However, continued investment and re-pricing will weigh on 2026 results, particularly 1H26 (the first half of 2026).”

Comcast’s growing efforts to revamp its internet business come as it falls behind fixed wireless and wired internet competitors in consumer satisfaction, according to a recent J.D. Power survey.

U.S. consumer satisfaction rates for wired and fixed wireless internet:

- Six months before October 2025, wireless internet providers experienced a 15% increase in new sign-ups, while wired internet providers saw a 6% increase.

- The average satisfaction score for wired internet is 554 (on a 1,000-point scale).

- However, wireless internet takes the top spot with a score of 647.

- In the East Coast, Comcast’s Xfinity falls behind its wired internet competitors Verizon and Cox Communications with a satisfaction score of 537.

- In the North Central, Xfinity has a score of 551, coming second to AT&T, which has a 554 score.

- In the West Coast, consumers gave AT&T, Frontier Communications, and Spectrum higher scores than Xfinity.

- Also, in the South, Xfinity is beat by GFiber and, once again, AT&T.

Source: J.D. Power

“The internet landscape is clearly evolving, with continued rising customer satisfaction and continued strong customer service performance in wireless service,” said Carl Lepper, senior director of technology, media and telecom intelligence at J.D. Power, in a press release.

“The high satisfaction we are seeing in the wireless internet segment is attributed to internet speed, availability and the hassle-free ability to start, combined with a lower price.”

Related: Verizon cracks down on internet customers violating key rule

What's Your Reaction?