Dave Ramsey bluntly speaks on Social Security, Medicare

In my time reporting on personal finance concerns, I've found that Americans planning for retirement generally have at least a basic understanding that Social Security and Medicare are both federal programs designed to help them financially when they retire. Dave Ramsey, bestselling personal ...

In my time reporting on personal finance concerns, I've found that Americans planning for retirement generally have at least a basic understanding that Social Security and Medicare are both federal programs designed to help them financially when they retire.

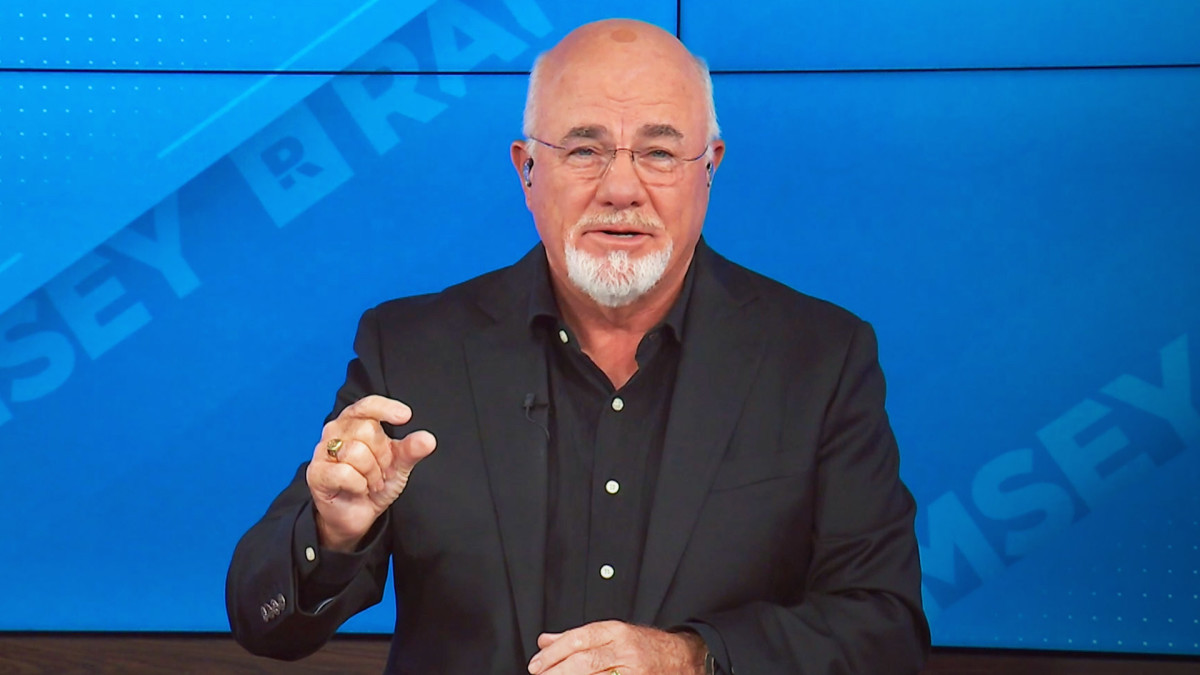

Dave Ramsey, bestselling personal finance author and host of "The Ramsey Show," has a clear message for people seeking to understand more about Social Security and Medicare.

"Social Security benefits are simply payments made to you when you retire or become disabled," Ramsey wrote on Ramsey Solutions. "These payments are designed to help replace some of the income folks lose when they retire or can’t work anymore because of a disability. Benefits could also be paid to your spouse, children and other qualifying family members when you die."

Related: Dave Ramsey bluntly warns Americans on 401(k)s

"Medicare is a federal government-run health insurance program for people 65 and older," Ramsey wrote. "It was created to help people who are no longer working get health insurance."

But those are the basics. Let's get into some specifics about the programs that Ramsey believes it is important to consider.

Dave Ramsey warns Americans about Social Security solvency

Social Security's Old-Age and Survivors Insurance (OASI) Trust Fund will be able to pay 100 percent of total scheduled benefits until 2033, according to the Social Security Administration (SSA).

"At that time, the fund’s reserves will become depleted and continuing program income will be sufficient to pay 77 percent of total scheduled benefits," the SSA wrote in a 2025 message to the public.

That means that, without legislative action, beginning in 2033 Social Security monthly paychecks would be reduced by 23% of their expected dollar amounts.

"If you end up getting retirement benefits when you decide to retire, that’s great," Ramsey wrote. "Any money you get from Social Security should be considered icing on the cake. But making Social Security the main ingredient of your retirement plan? That’s a recipe for disaster."

Ramsey recommends that, during one's working years, one should invest as much as possible in employee-sponsored 401(k) plans and Individual Retirement Accounts (IRAs), which over time can become the real foundation of a retirement lifestyle that people dream about.

Dave Ramsey explains how Medicare works

Most people rely on employer-sponsored health insurance during their working years because it tends to be the most cost‑effective option. After retirement, though, buying coverage on your own becomes far more expensive. Medicare was established to give retirees a more manageable alternative.

More on personal finance:

- Dave Ramsey warns Americans on critical Medicare mistake to avoid

- Finance author sends strong message on housing costs

- Scott Galloway explains his views on retirement, Social Security

Medicare is structured as a fee‑for‑service system. When you receive care, you’re responsible for paying part of the bill, similar to how deductibles and copays work with standard health insurance.

"As a government program, Medicare has worked out discounted costs with any provider that accepts Medicare patients," Ramsey wrote. "That means the Medicare-approved amount (price) for services will be lower than you’d see with regular, private health insurance." TheStreet

The parts of Medicare

Medicare is organized into several components, as outlined by medicare.gov.

Medicare Part A (hospital insurance)

- Pays for inpatient hospital stays.

- Covers care in skilled nursing facilities.

- Includes hospice services.

- Assists with certain home health care needs.

Medicare Part B (medical insurance)

- Covers care from physicians and other medical professionals.

- Includes outpatient services.

- Provides some home health care.

- Covers durable medical equipment such as walkers, wheelchairs, and hospital beds.

- Includes a wide range of preventive services, including screenings, vaccinations, and annual wellness visits.

Medicare Part C (Medicare Advantage)

- Private insurance plans approved by Medicare.

- Combines Part A, Part B, and typically Part D.

- Often requires using providers within the plan’s network.

- May involve different cost‑sharing than Original Medicare.

- Can offer additional benefits not included in Original Medicare.

- May require an extra monthly premium.

Medicare Part D (prescription drug coverage)

- Helps pay for prescription medications.

- Covers many recommended vaccines.

- Offered as a stand‑alone plan for those with Original Medicare.

- Frequently included in Medicare Advantage plans.

- Administered by private insurers that must follow Medicare guidelines.

Medicare Supplement Insurance (Medigap)

- Optional coverage purchased from private insurers.

- Helps pay out‑of‑pocket costs under Original Medicare, such as coinsurance.

- Standardized policies identified by letter (such as Plan G or Plan K).

- Each plan letter provides the same benefits regardless of the company offering it.

Dave Ramsey clarifies who is eligible for Medicare

"While there are a few different criteria of eligibility for different aspects within Medicare, the main criterion is your age," Ramsey wrote.

Eligibility for Medicare generally begins at age 65, though younger individuals can also qualify if they have a disability, end‑stage renal disease, or ALS. The program is open to U.S. citizens as well as people who hold lawful permanent residency.

Access to Medicare Part A without a monthly premium depends on work history. Individuals who have spent at least a decade employed and paying into Social Security typically receive Part A coverage at no cost.

Related: Dave Ramsey raises red flag on Social Security

What's Your Reaction?