Dave Ramsey warns 2025 homebuyers to avoid this major money mistake

Following these homebuying tips can set you up for financial success in the long run.

Attempting to search out a house is without doubt a few of the largest — and longest — financial commitments most People will assemble in their lives. Saving for a down price can rob several years, and the realistic dwelling label in general will increase with time.

Balancing the rising price of living, elevated mortgage charges, elevated rivals, and rising dwelling insurance costs have made homeownership more costly than ever.

Financial expert Dave Ramsey shares the correct down payments for dwelling shoppers and how mounting debt makes it bright for potential shoppers to place up adequate to aquire a dwelling.

Presidents Day Sale: Salvage Free collect entry to to TheStreet Authentic for 31 days – Claim your provide as we yelp time!

Even supposing making a small down price will seemingly be a tempting system to enter the housing market, it may collect financial strain within the long speed.

Prioritizing savings and finding a dwelling priced internal your budget will guarantee it is seemingly you'll presumably give you the money to your month-to-month mortgage payments.

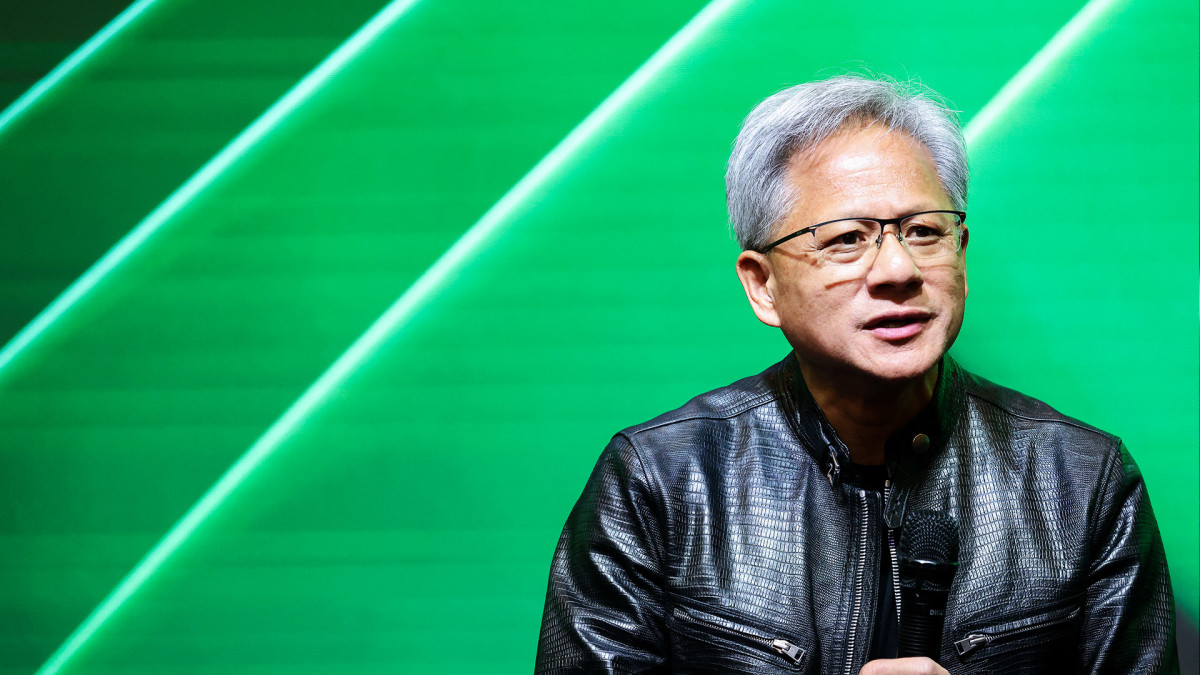

Ramsey explains the dos and don’ts of down payments below. Shutterstock

Cheap mortgage payments are key to financial steadiness

Even supposing the median homebuyer in general makes a down price of between 10% and 19% of the dwelling’s price, first-time dwelling shoppers tend to check down just 8%.

Aiming for 20% is a reliable rule of thumb, nonetheless it may now not be as life like for younger shoppers who are balancing rent, student loans, or assorted charges. Then again, within the event that they don’t have finally 5% of the dwelling label saved, it may now not be the categorical dwelling for them.

“Anything else lower than 5–10% is definitely a truly customary down price, to now not mention a obvious-fireplace system to pause up upside down on a dwelling,” Ramsey wrote. And you’ll waste a great deal of cash in ardour and charges over the life of your mortgage.”

Extra on homebuying:

- Dave Ramsey warns People on a homebuying mistake to bear up some distance off from

- Housing expert finds frightful ways to lower your mortgage rate

- People procuring for properties may uncover critical housing price modifications in 2025

- Finance old has a warning for People procuring a dwelling now

Dwelling costs have elevated 7% yr-over-yr, and the median month-to-month mortgage price reached $2,753 in January 2025. Committing to a decade or more of housing payments it is seemingly you'll presumably’t give you the money for can lead to further charges and even set up your private dwelling at risk of foreclosure.

Ramsey explains that the largest dwelling-procuring for rule is to assemble obvious your month-to-month mortgage payments don’t exceed 25% of your month-to-month earnings.

“It is rarely always definitely critical what, assemble obvious your mortgage price is rarely any more than 25% of your month-to-month rob-dwelling pay on a 15-yr fastened-rate venerable loan (the final, lowest full price mortgage),” he persevered. “In every other case, you’ll be charged so noteworthy further in ardour and charges. It’s now not worth it! You wish that further money to deal with dwelling upkeep and your assorted financial needs.”

Rising debt is making it bright for shoppers to place for down payments

Inflation has affected the label of meals, housing, and utilities particularly bright, driving up the final price of living and making it bright for many households to assemble ends meet. This financial hardship has made it bright for shoppers to place for a down price, particularly as dwelling costs hit file highs.

Zillow estimates that a median-earnings family would must verify down 35.7% of the dwelling’s price to give you the money for the realistic dwelling within the U.S. Here's double what the usual dwelling buyer saves as a down price, indicating how housing costs have some distance outpaced wages.

Connected: Warren Buffett's Berkshire Hathaway makes mettlesome 2025 housing prediction

Ramsey finds why down price quantities are declining and how debt will seemingly be a ingredient.

“Down price quantities have vastly lowered over time,” he outlined. “No longer to bore you with a historic past lesson, nonetheless around 30 years ago, the median down price for all shoppers used to be at a rather more healthy 20%.”

In step with the National Association of Realtors, 51% of all student loan holders present that their student debt has averted them from procuring for a dwelling. As housing costs continue to outpace wage sing, paying down debt and saving for financial milestones turns into more bright.

“The explanations as we yelp time’s shoppers dispute they battle to place a greater down price are all debt-connected: student loans (51%), bank card debt (45%), and automobile loans (38%),” Ramsey elaborated. “That’s why we voice folk to repay 100% of their user debt and place an utterly funded emergency fund sooner than saving for a dwelling. That plot, you’ll have adequate room in your budget to place for a large down price faster and have money to hide surprising dwelling repairs.”

Connected: Worn fund manager points dire S&P 500 warning for 2025

What's Your Reaction?