Dave Ramsey’s top 5 personal finance tips everyone should follow

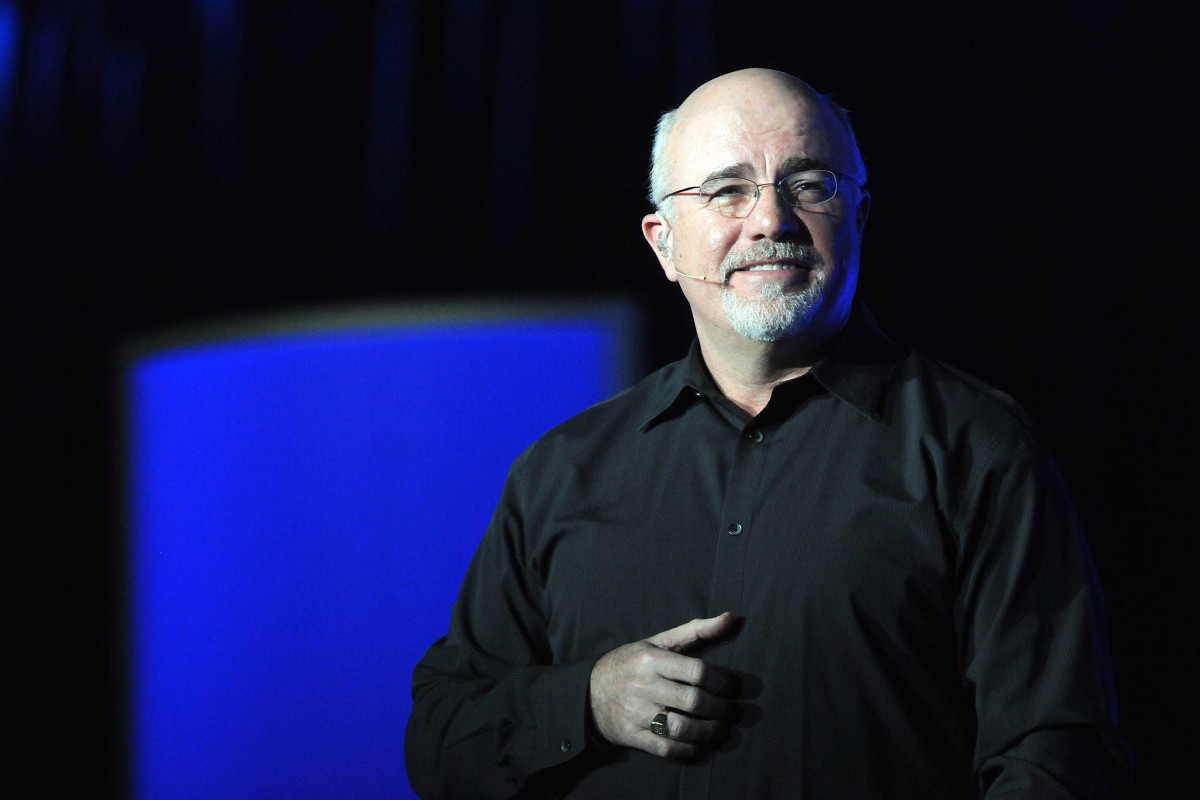

Pop finance expert Dave Ramseymay be characterized as “fiscally and culturally conservative,” but for those in debt, his appeal is broad. Ramsey honed his simple yet disciplined approach from some hard-earned life lessons: He enjoyed early success as a real estate investor, then suffered a ...

Pop finance expert Dave Ramseymay be characterized as “fiscally and culturally conservative,” but for those in debt, his appeal is broad.

Ramsey honed his simple yet disciplined approach from some hard-earned life lessons: He enjoyed early success as a real estate investor, then suffered a spectacular bankruptcy at age 28, before eventually rebuilding his wealth—all with God’s help.

In his darkest hour, Ramsey scoured the Bible for wisdom on money. He discovered 2,500 Biblical verses which offered “a clear, effective plan for financial stewardship.” This financial “blueprint” became the basis of Ramsey Solutions, a financial education business which emphasizes living simply, saving, and preparing for the future.

For instance, Proverbs 13:22 says, “A good man leaves an inheritance to his children’s children.” Ramsey interprets this to mean that people should build wealth through investments. (He also believes that God wants people to make money so that they can give it away through acts of generosity.) Jackson Laizure/Getty Images

How influential is Dave Ramsey?

Ramsey distills his advice to millions of people through bestselling his books, such as The Total Money Makeover and Financial Peace, courses like Financial Peace University, and live events and seminars. 18 million people a week tune into his self-titled radio show, The Dave Ramsey Show, which is the #1 business show on Spotify, making him one of the most influential voices in personal finance today.

Dave Ramsey’s top 5 personal finance tips

If you’re trying to build a healthier relationship with your money, Dave Ramsey’s insights are for you. These 5 financial principles form the basis of his philosophy:

Budgeting matters

Ramsey believes that maintaining a budget “tells your money what to do instead of wondering where it went.” He emphasizes that people should keep a monthly budget so that they know the “purpose” of every dollar they bring home.

https://qr.ae/pCWo3N

To Ramsey, budgeting isn’t optional; rather, it’s the cornerstone of financial success. Without a budget, it’s simply too easy to overspend and thus miss making progress on your financial goals.

Ramsey recommends using Everydollar, a free budgeting app which allows users to see their debt-reducing progress and even receive personal coaching.

Attack your debt

Eliminating your debt is a primary to achieving financial health, according to Ramsey. The way he recommends doing so is with the “debt snowball” method, where you list all your debts from smallest to largest, pay minimums on everything, and then get rid of the smallest balances first.

The psychology behind it is that paying off a smaller debt gives you a sense of accomplishment and creates the momentum that will motivate you to continue.

”When you pay off that smallest debt, it gives you a success, and you think you can make it,” Ramsey told GoBankingRates, “Then, when you pay off the next debt, you realize this is going to work, and you pay off the next debt.”

Wanna win with money? Act your Wage. Live on less than you make, a concept Congress cant grasp.— Dave Ramsey (@DaveRamsey) August 12, 2016

“Act your wage”

Ramsey believes that financial success boils down to living on less than you earn and resisting the urge to ‘Keep up with the Joneses’ and buy things to impress others. His phrase “act your wage” encapsulates this idea: Don’t spend as if you make more than you do.

By curbing your spending, you can liberate yourself from the shackles of debt and begin building savings. Living within your means also fosters financial peace, reduces stress and lessens your dependence on credit—another big no-no for Ramsey.

Build and maintain emergency savings

“Ever notice when you are broke everything is an emergency?” Ramsey asks wryly.

Ramsey suggests creating a source for emergency funding in two steps:

- Save up $1,000. This will protect you against those minor, unexpected expenses that can often crop up in life.

- Next, work on saving three to six months of your living expenses. This fund is designed to cover longer-term crises, such as getting laid off or medical issues. Three months’ worth of savings works for single people, while six months is better for married people or those with dependents.

Ramsey believes your emergency savings shouldn’t be locked away and earning interest; rather, they should be as liquid as possible, so a simple savings account or a money market account with check-writing privileges will suffice. And if you need to dip into these accounts, don’t forget to pause your other financial goals until you can replenish them.

Invest in the future

Once you’ve tackled your debt and your emergency savings are in place, Ramsey recommends investing 15% of your gross monthly income into retirement accounts, like 401(k)s and IRAs.

Ramsey suggests investing at regular intervals and never borrowing from these accounts to fund life expenses.

He regularly cites Albert Einstein, who called compound interest “the eighth wonder of the world,” saying that this will help you grow your money faster over time.

He also encourages people to stay as healthy as possible, as doing so will save you money on medical expenses later in life.

How much is Dave Ramsey Worth?

According to TheStreet, Dave Ramsey’s estimated net worth stands at $200 million in 2025.

Born on September 3, 1960 in Maryville, Tennessee, both of Ramsey’s parents were real estate developers, instilling in him the value of hard work. While a student at the University of Tennessee, young Ramsey began flipping houses, but after building a multi-million-dollar real estate portfolio, he tragically lost everything when lending standards tightened, and the notes on some of his more speculative investments suddenly became due.

More on building wealth:

- Mark Cuban’s 5 best financial insights every investor should know

- Robert Herjavec’s 4 best financial insights

- Warren Buffett’s most insightful investing quotes as he celebrates retirement

When a debt collector asked Ramsey’s wife why she would stay with a man who couldn’t pay his bills, Ramsey knew he had hit rock bottom.

What makes Ramsey’s story so compelling, however, is his personal narrative of triumph over hardship. He understood that crisis also creates opportunity, and so, after declaring bankruptcy, Ramsey started his own financial counselling business. He also wrote Financial Peace, a book that detailed his path out of debt.

Soon, his radio program followed, and then Ramsey Solutions, a financial education company devoted to Ramsey’s seminars and courses.

Ramsey also owns a sizable portfolio of commercial real estate.

What's Your Reaction?