Fed rate cut could boost your wallet, job, and portfolio

Lower interest rates could save consumers money and increase business investment.

Open up your wallets.

More money may be coming your way soon.

- The Federal Reserve meets Sept. 17.

- The independent central bank will decide whether to cut interest rates to shore up the weakening jobs market and support economic growth.

- Or the Fed could continue to hold rates steady to ward off higher-than-targeted inflation.

Long-term impacts of tariff inflation remain to be seen, and the wobbling job market is sending troubling signs once again.

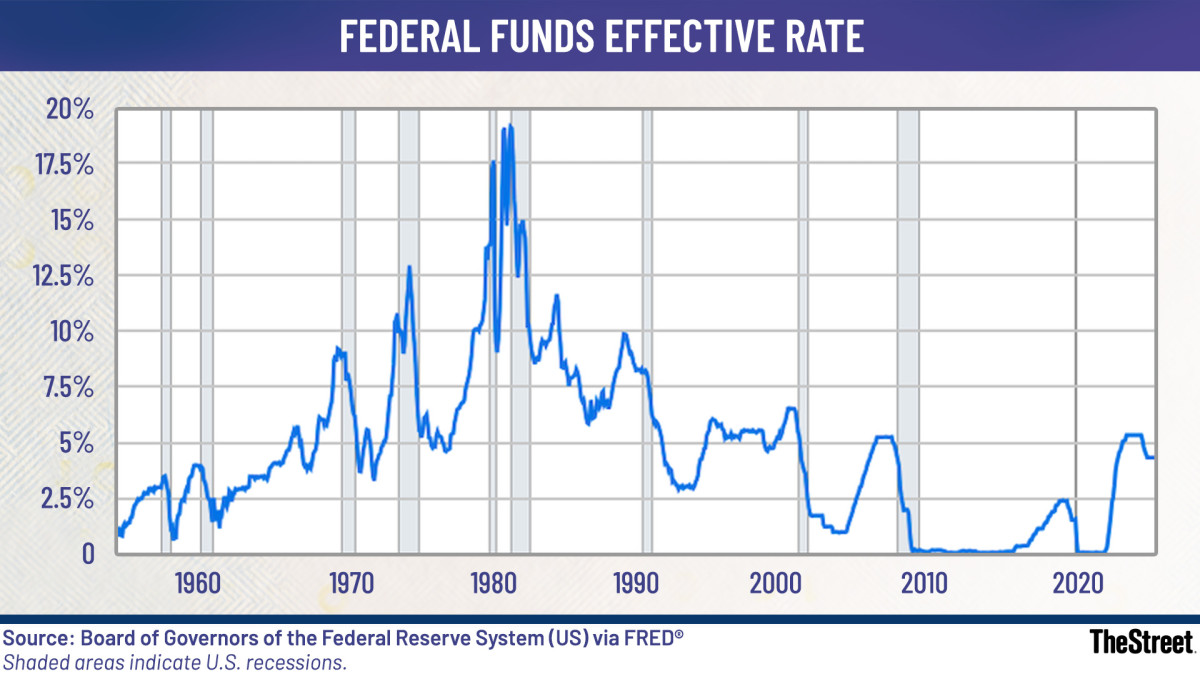

Economists and traders widely expect the Federal Open Market Committee will slash the benchmark Federal Funds Rate currently at 4.255% to 4.50% by a quarter point – the first interest rate cut this year.

Some Fed watchers are even saying the FOMC may opt for a jumbo cut and vote on a half-point cut.

But a rate cut, whatever the size, could also bring some economic risks to us all. Source: Board of Governors of the Federal Reserve System

Pros, cons of Fed rate cut for consumers and businesses

“We’ve got an economy that’s still growing,” said Nelson Yu, head of equities at active asset manager Alliance Bernstein told The Wall Street Journal.

“It’s not falling off a cliff, and I think it actually should be a pretty good environment for risk assets if the central bank can start cutting rates,” Yu said.

With many economists and market watchers expecting multiple interest-rate cuts in the months ahead, here’s a look at what such a move could bring: the benefits, the risks, and what experts are saying.

For consumers, cheaper borrowing boosts budgets

- A Federal Funds Rate rate cut could push student loans, home equity loans, credit cards, and auto financing lower, giving consumers relief on monthly payments.

- With cheaper credit and easing inflation, households may find it easier to afford big-ticket items, boosting confidence in the U.S. economy. Families have more cash to spend.

- Lower mortgage rates tied to the 10-year Treasury Bond yield could help first-time homebuyers. (Note: Although the Federal Reserve doesn’t control the nation’s mortgage rates, it does set them swinging into action.)

Consumer savings could shrink as home prices push up

- Lower interest rates reduce returns on savings and fixed-income products, cutting into household earnings from deposits.

- Cheaper borrowing can fuel higher prices, leaving consumers paying more at the store and the pump during these days of sticky inflation and already-accelerating prices.

- Falling mortgage rates may spark ugly bidding wars, pushing home prices higher and sidelining some buyers.

Related: Looming Fed interest-rate cut could mean cheaper mortgages

Businesses will be able to invest more

- Cheaper credit allows companies to invest more through additional hiring, expanding facilities, and buying new equipment.

- Reduced interest expenses improve cash flow, giving businesses flexibility and resilience.

- Stronger consumer demand supports sales growth for retailers and service sectors, both sectors that have sagged this year.

Inflation risks may squeeze company margins

- Input costs (materials, wages, energy) could escalate if inflation flares, squeezing profit margins.

- Businesses may find it hard to pass increased costs down the supply chain to consumers.

- Uncertainty due to volatility in fiscal policy, global markets, and labor shortages could reduce investment and delay expansion plans.

Impact of lower Federal Funds Rate on investors

Positive effects of lower interest rates

- Stocks may continue their upward trend, supported by corporate earnings boosted by lower rates.

- Real estate‐related investments (REITs, property securities) may benefit from cheaper financing and higher demand.

- Corporations servicing debt more affordably may improve bottom lines and generate higher returns.

Potential investment risks tied to Fed rate cut

- Bond yields are likely to be lower, meaning less income for fixed-income investors and retirees.

- Inflation risks could eat into real returns of both equity and debt portfolios.

- Overpriced assets might lead to correction if markets get ahead of fundamentals.

“The Fed now has four months of evidence of a slowdown in labor demand that appears more persistent in nature," Morgan Stanley Chief U.S. Economist Michael Gapen told Reuters.

“In short, ignore where inflation is today and ease policy to support the labor market,” he added.

Related: Mounting concerns rattle Federal Reserve watchers

What's Your Reaction?