Federal Reserve official blasts latest interest-rate pause

The Federal Reserve’s pause on interest-rate cuts in January — and its potential impact on your wallet — was expected by economists and markets. But, in its wake, not everyone agrees it was an appropriate monetary policy step for the U.S. economy. The Federal Open Market Committee voted 10-2 ...

The Federal Reserve’s pause on interest-rate cuts in January — and its potential impact on your wallet — was expected by economists and markets.

But, in its wake, not everyone agrees it was an appropriate monetary policy step for the U.S. economy.

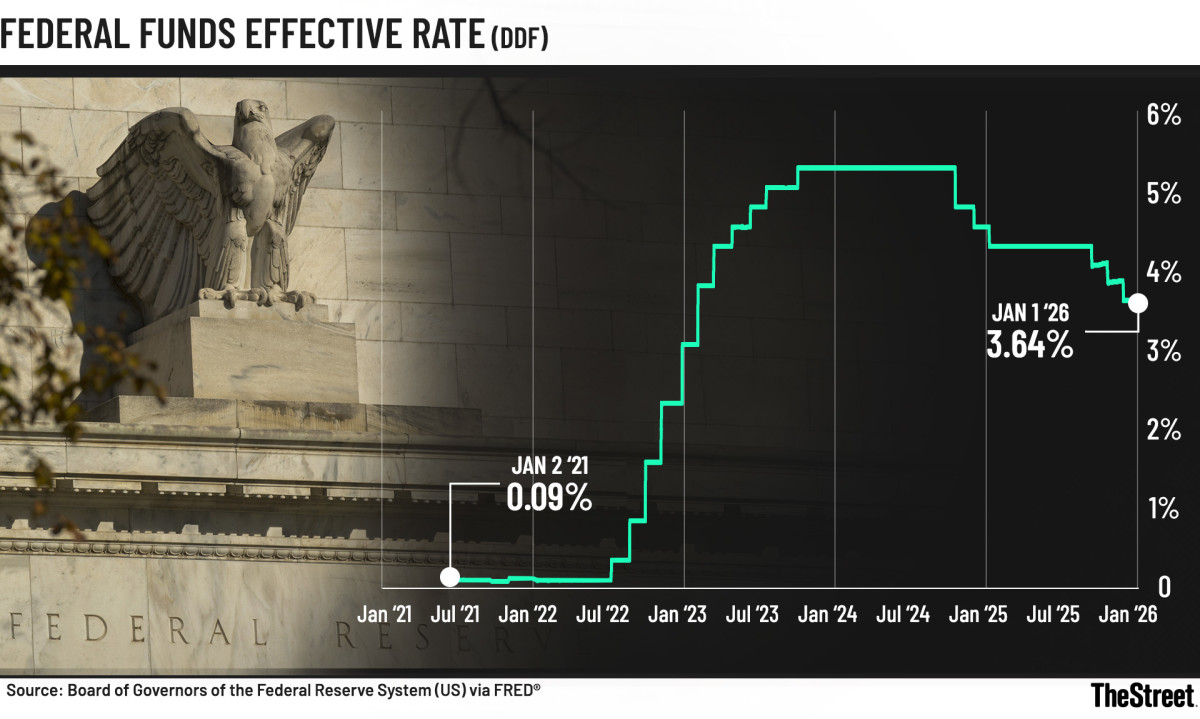

The Federal Open Market Committee voted 10-2 to hold interest rates steady at 3.50% to 3.75% after three continuous cuts of 25 percentage points in the last three meetings of 2025.

It was the FOMC’s first pause since July 2025.

“The outlook for economic activity has improved, clearly improved since the last meeting, and that should matter for labor demand and for employment over time,” Fed Chair Jerome Powell said at a press conference following the meeting.

Fed Governors Stephen Miran and Christopher Waller dissented. Both were in favor of a quarter-percentage point cut.

Miran told CNBC on Jan. 30 that “there was no inflation” and that the labor market was “stronger.”

But Waller gave a strongly different perspective on the labor market in a Jan. 30 statement.

“First, in contrast to the continued solid growth in economic activity, the labor market remains weak,’’ Waller said. “Despite ticking down in its most recent reading, the unemployment rate has risen since the middle of last year.” Board of Governors of the Federal Reserve System

How the Fed manages interest rates

The Fed’s dual congressional mandate requires it to balance inflation and job growth via interest rates.

- Lower interest rates support hiring but can fuel inflation.

- Higher rates cool prices but can weaken the job market.

The two goals often conflict, operate on different timelines and are influenced by unpredictable global events.

More Federal Reserve:

- Fed faces 2026 upheaval as economy shifts, Powell exits

After the December rate cut, Powell said that the lowering of rates brought monetary policy “within a broad range of neutral.” He repeated that stance last week.

A neutral rate neither stimulates nor restrains economic growth.

Latest inflation, job figures show slight uptick

- The Bureau of Labor Statisticsreported that the December 2025 jobs report showed slow job growth and a 4.4% unemployment rate.

- The January 2026 BLS jobs reporthas been postponed from Feb. 6 due to the partial federal government shutdown. No new unemployment or payroll figures have been published yet.

- The Consumer Price Index increased 0.3% in December, and over the last 12 months the CPI increased 2.7%, above the Fed’s 2% inflation target, the BLS reported.

Waller says additional interest-rate cuts are necessary

Waller said he dissented from the FOMC decision to hold interest rates steady because economic data are signaling additional cuts are needed.

“Monetary policy is still restricting economic activity, and economic data make it clear to me further easing is needed,” Waller said.

Waller’s dissent reflects his view that the labor market remains fragile.

He pointed to the rise in the unemployment rate since the middle of last year, along with a slowdown in job growth.

Related: Fed Chair Powell sends frustrating message on future interest-rate cuts

Upcoming data revisions will likely show there was no growth in payroll employment in 2025, Waller said.

“Let this sink in for a moment — zero job growth versus an average of almost 2 million for the 10 years prior to 2025. This does not remotely look like a healthy labor market,’’ Waller said.

“I have heard in multiple outreach meetings of planned layoffs in 2026,” Waller said. “This indicates to me that there is considerable doubt about future employment growth and suggests that a substantial deterioration in the labor market is a significant risk.”

Waller was a finalist to be the next Fed chair

Waller was one of four finalists to replace Powell as Fed chair when his term expires May 15.

President Doland Trump, who has been a vocal critic of Powell, named former Fed Governor Kevin Warsh as the nominee Jan. 30 after a monthslong search.

Trump has been demanding the independent central bank slash the benchmark Federal Funds Rate to 1% or lower to stimulate the stagnant housing market and reduce the size of interest payments on the nation’s debt.

Waller began calling attention to the cooling labor market over the summer of 2025, expressing concern that the pause on interest rates would further weaken the jobs data.

“With total inflation excluding tariff effects close to our target at just slightly above 2 percent and a weak labor market, the policy rate should be closer to neutral, which the median FOMC participant estimates is 3%, and not where we are — 50 to 75 basis points above 3%," Waller’s Jan. 30 statement said.

When might the next interest-rate cut happen?

Brian Mulberry, senior client portfolio manager at Zacks Investment Management, said the Fed’s Survey of Economic Projects in December — a quarterly update — showed GDP growth at a mere 2.0%.

The December SEP called for one, possibly two rate cuts in 2026.

Inflation "remains above target and has shown recent signs in both headline and core PCE/CPI that make the voting majority uncomfortable lowering rates; further progress is needed to continue the easing cycle,’’ Mulberry said.

The widely watched CME Group FedWatch Tool estimates the Fed’s next quarter-percentage point cut as follows.

- March 18: 10.9%

- April 29: 23.9%

- June 17: 47.0%

Related: Billionaire Dalio sends 2-words on Fed pick Warsh

What's Your Reaction?