Have stocks reached their tariff selloff bottom? Investors just aren't sure

Wall Street is bracing for more S&P 500 declines as global investors dump U.S. stocks.

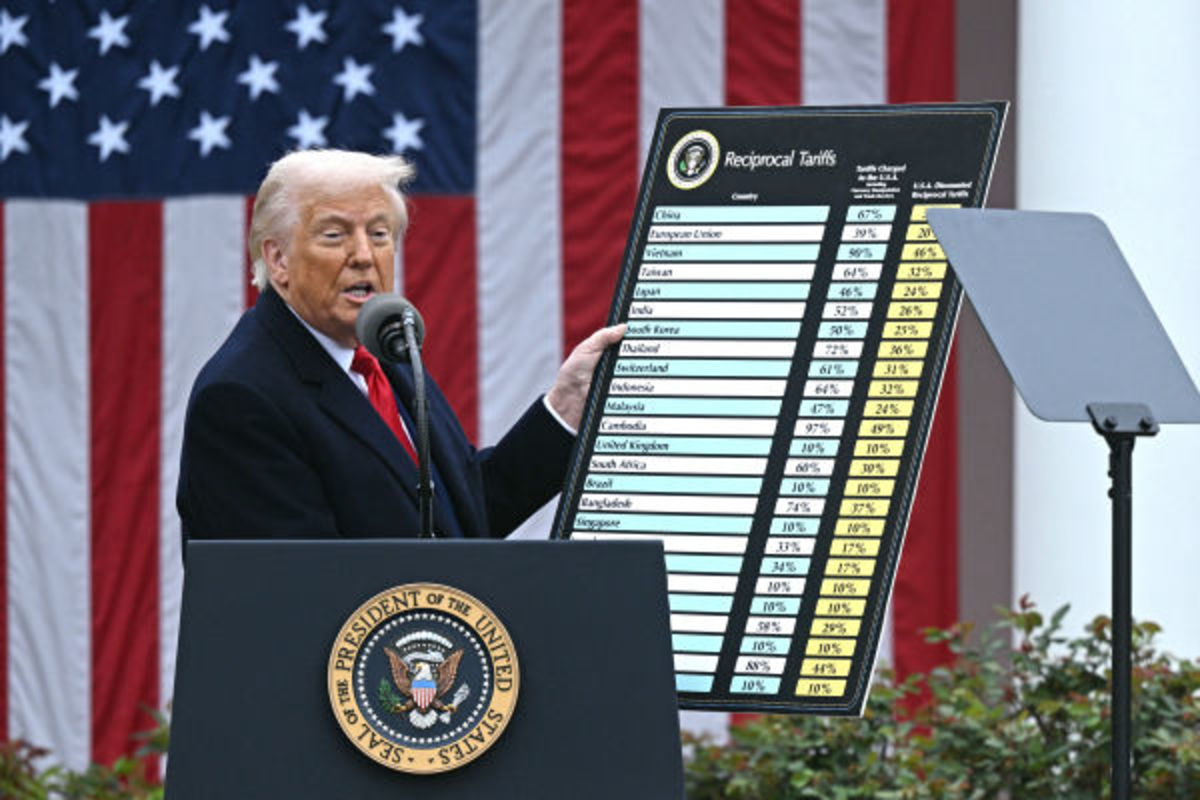

International investors are dumping U.S. stocks following final week's historic swings in the S&P 500, tied to the uncertainty surrounding President Donald Trump's tariff technique, as analysts debate whether fairness markets acquire examined their lows for the year or if more losses are liable to come because the financial system shrinks and company income growth slows.

Financial institution of The usa's month-to-month scrutinize of worldwide fund managers, revealed Tuesday, showed the very best two-month decline in U.S. stock allocation on file, with the lowest overall stage of exposure in two years.

Traders were furthermore convinced the President Trump's tariff policies would gradual both worldwide and U.S. economic growth, with round 42% of those surveyed indicating domestic recession risks over the next twelve months.

The upper ask, nonetheless, as to whether U.S. stocks, which hit a one-year low of 4,835.04 aspects on the S&P 500 all during the worst of ultimate week's historic selloff, are poised for a rebound or a probability to additional declines remains unsettled.

Any "big upside" for U.S. stocks wants "big tariff easing, big Fed price cuts, and/or economic recordsdata resilience”, Financial institution of The usa's Michael Hartnett well-known. BRENDAN SMIALOWSKI/Getty Photos

At this time, the S&P 500 is up round 8.5% from final Tuesday's closing low, powered partly by a series of retreats from President Trump's tariff gambit, but capped by the more and more aggressive trade war actions between Washington and Beijing.

More stock worry ahead?

That may perhaps leave markets at probability of one other pullback, argues JPMorgan's head of worldwide and European fairness technique Mislav Matejka, who thinks a broader rally won't emerge unless the 2d half of of the year.

"Even in mild of the latest 90-day tariffs close for non-retaliating worldwide locations and the electronics exemptions, we combat to peep equities trading sustainably above the pre- 'Liberation Day' ranges," he stated. "Merely, one of the vital most afflict to company and user self assurance will stick given these wild gyrations."

The S&P 500's latest valuation, at round 19x earnings, remains increased than in earlier market slumps, suggesting ranges that are "seen before the whole thing of a downturn, in put of on the close."

Related: Bond, dollar rout spark concerns of safe-haven feature of U.S. sources

"We judge one needs to peep tariffs newsflow resolve, one needs to peep potential departures from the administration to materialize, as effectively as for the Fed to capitulate, but which is rarely going to happen before labour market falters," he added.

Jeffrey Buchbinder and Adam Turnquist, LPL Financial's technical strategists, are a modestly more optimistic, arguing in a expose revealed Monday that there is a "decent likelihood the bottom is in after the S&P 500 traded down to 4,835 final Monday."

"Several things peaceful give us close, at the side of the intensifying trade war with China, uncertainty about where non-China tariffs will land, and the probability that stocks will retest fresh lows," the pair wrote. "Additional, valuations should not compelling given increased ardour rates and decrease earnings due to the the tariffs."

Earnings in consuming focal point

Earnings so a ways were blended, with the head Wall Avenue banks posting greater-than-anticipated outcomes largely off the assist of trading e book profits, but furthermore warnings the user and industrial investment uncertainty, tied to tariff risks, will seemingly blunt U.S growth possibilities over the upcoming quarters.

LSEG recordsdata suggests collective first quarter profits for the S&P 500 will upward thrust by round 8% from final year to round $507 billion, but more focal point is liable to be centered on discontinuance to-term forecasts amid the tariff uncertainty.

2d quarter earnings growth estimates are for the time being pegged at 9.2%, in conserving with LSEG recordsdata, with plump-year beneficial properties forecast at round 9%.

Related: Wall Avenue overhauls S&P 500 tag targets as tariff selloff quickens

Financial institution of The usa's fund manager scrutinize, in actual fact, notes that "investors acquire turned harmful on US income outlook .. get 28% command that the outlook for US profits is depraved, the most since November of 2007."

"The substance of earnings season over the following few weeks is liable to topic noteworthy lower than traditional," stated Jason Tag, chief of investment technique & study at Glenmede. "Q1 outcomes are anticipated to be largely chalked up as “dilapidated news” given the dramatic changes to trade coverage all during the previous couple of weeks."

Tariff uncertainty lingers

"This earnings season may additionally screech to be specifically telling for investors, as transferring trade coverage may advised companies to droop forward steering, potentially revealing their tariff sensitivity and echoing the behavior seen all during the initiating of COVID," added Pleasure.

BlackRock's Jean Boivin, who heads the asset manager's Investment Institute, notes that whereas tariffs are liable to stoke inflation pressures, lift the probability of recession and prolong company investment, the administration's 90-day close on reciprocal levies "recommend or not it is taking some story of monetary risks and costs as effectively as a nation’s willingness to acquire interplay."

"It [also] exhibits there are factors that would put a evaluate on the administration’s maximal tariff stance," he added. "In consequence, dumb final week we prolonged our tactical horizon assist to six to 300 and sixty five days to dial up probability. Yet we peaceful judge tariffs can hurt growth and elevate inflation, and predominant uncertainty remains."

More Financial Diagnosis:

- Wall Avenue overhauls S&P 500 tag targets as tariff selloff quickens

- Inflation would prefer a note, please

- Shares may jump, but big bank earnings withhold the playing cards

What's Your Reaction?