How did Mughals plan the budget; their sources of revenue generation; collection of taxes etc., explained here

The world's largest economy was during the Mughal era.

Mughal Empire Funds: Zahiruddin Muhammad, additionally known as Babur, laid the muse of the Mughal Sultanate in 1526 by defeating Sultan Ibrahim Lodi of the Delhi Sultanate within the battlefield of Panipat. This turned into the principle time Babur outdated trend gunpowder in combat. After Babur, his son Humayun ascended the throne, but most of his time turned into spent in battles.

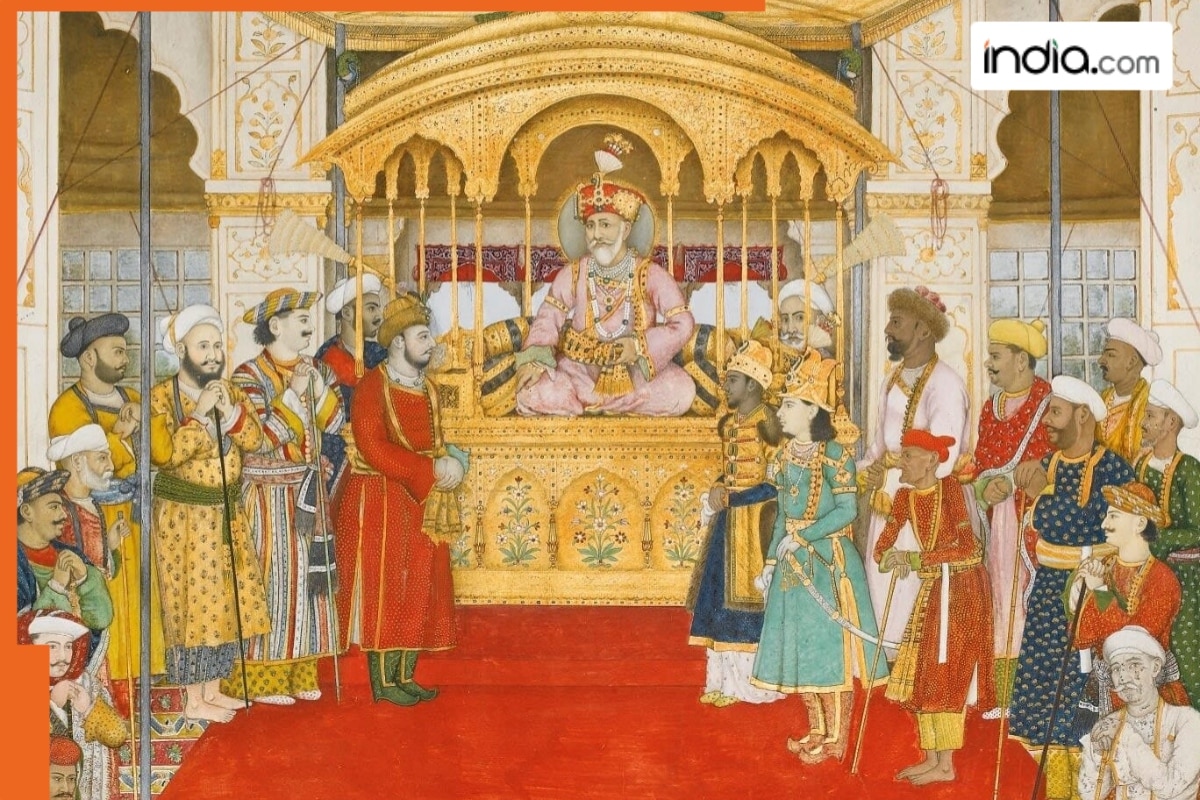

After Humayun, Akbar took vitality, and the golden age of the Mughal technology began. A valid governance design turned into initiated, which included social and financial buildings. Let’s discover what the Mughal financial system turned into fancy, where they earned from and where they spent.

The realm’s most titillating financial system in some unspecified time in the future of the Mughal technology, especially below Akbar’s rule, seen an create bigger in manufacturing in South Asia. At some stage in this era, India accounted for 28 p.c of the field’s industrial manufacturing. By the 18th century, there turned into vital growth within the export of textiles, shipbuilding, and metal from India, and the financial system turned into export-oriented.

By the pause of the 17th century, the Mughal financial system had change into essentially the most titillating, not probably even Europe. When in comparison with the year 1600, the Mughal Empire’s section on this planet financial system had risen to 22.7 p.c, surpassing China to alter into the field’s most titillating financial system by corrupt home product (GDP). Bengal alone contributed 12 p.c, making it the richest province in India at that time.

There were many forms of farmers from 1526 to 1857 in some unspecified time in the future of the Mughal interval; industrial manufacturing elevated, however the financial system turned into essentially according to agriculture.

Taxes on vegetation were levied in some unspecified time in the future of the Mughal rule, and earnings turned into essentially according to taxes. This turned into identified as jama and hasil. The amount of mounted and picked up tax turned into according to this. On the other hand, the design of tax collection turned into no longer the identical for all kinds of land. Farmers on excessive-yielding land had to pay more tax.

Land below cultivation turned into taxed more closely attributable to it produced vegetation all over the year. In distinction, the tax on fallow land turned into decrease attributable to it yielded vegetation for a shorter interval. The tax collection design for barren land turned into a glorious deal of. One-third of the total smooth tax turned into deposited as royal earnings.

At some stage within the Mughal technology, budgets were ready by gathering files about land and its manufacturing to discover taxes, and budgets were situation accordingly. At some stage in Akbar’s reign, an characterize turned into issued that farmers should create maximum cash funds. On the other hand, the choice to pay within the abolish of slit manufacturing turned into additionally on hand.

The ruler tried to aid the next section of tax collection for himself. On the other hand, at cases, tax collection turned into additionally affected on account of circumstances. Shall we embrace, tax collection turned into disrupted in some unspecified time in the future of droughts or famines.

Akbar conducted land surveys in some unspecified time in the future of his reign to toughen the tax design. Abul Fazl recorded land files within the Ain. In 1665, Aurangzeb additionally suggested his earnings department officials to prepare an annual story of the number of cultivators in every village. On the other hand, even then, wild areas were no longer surveyed.

New vegetation brought a steal to the financial system in some unspecified time in the future of the Mughal interval, with the introduction of unique vegetation fancy maize, potatoes, purple chili, and tobacco in India. This benefited farmers and additionally elevated earnings for the administration. To boot to agriculture, taxes were additionally smooth from replace. At that time, tin and copper, medicines, horses for war, and ivory were imported and exported.

At some stage within the Mughal technology, the import of silver and gold elevated. Trading firms established European factories in cities fancy Surat, Cochin, and Machilipatnam, which initiated replace between India and West Asia, East Asia, and Africa. The main items exported from India in some unspecified time in the future of that interval included salt, calico, dried fruits, cotton, silk, and spices.

At some stage within the Mughal technology, earnings turned into additionally earned from Jizya. It turned into a form of safety tax that Muslim rulers smooth from non-Muslims. In the Mughal interval, Jizya turned into essentially an annual tax design. In India, it turned into smooth from non-Muslims, especially Hindus. On the other hand, the design of Jizya, which turned into initiated after Alauddin Khilji took over the rule in Delhi within the 11th century, turned into abolished by Akbar. After that, it remained banned in some unspecified time in the future of the reigns of Jahangir and Shah Jahan. Nonetheless, in some unspecified time in the future of Shah Jahan’s reign, the Mughal financial system reached its height.

On the other hand, Aurangzeb, who took vitality after Shah Jahan, reimposed it in 1679. Tranquil, this tax turned into no longer smooth in some unspecified time in the future of cases of catastrophe. Additionally, Jizya turned into no longer smooth from ladies, kids, the elderly, the disabled, the ill, the unemployed, and Brahmins.

At some stage within the Mughal technology, the taxes smooth were outdated trend to aid watch over the administration. Charges were incurred in objects fancy donations, salaries, and pensions, and a vital quantity turned into additionally spent on wars to expand the empire or suppress rebellions. The navy costs were therefore excessive. The costs for the rulers’ luxuries were additionally lined from this. To discover the tell, forts were inbuilt a glorious deal of places. The best expenditure on construction occurred in some unspecified time in the future of Shah Jahan’s reign. From the enchancment of the Pink Fort in Delhi, Jama Masjid, to the Taj Mahal in Agra, Shah Jahan spent lavishly on the enchancment of the Takht-e-Taus as neatly.

What's Your Reaction?