Investors eye Fed rate cut timing as critical data releases loom

Investors are bracing for two important data snapshots to be released this week that could influence the timetable of the Federal Reserve’s next interest-rate cut. The Fed relies on employment and inflation data to set monetary policy that influences short-term interest rates, a key concern from ...

Investors are bracing for two important data snapshots to be released this week that could influence the timetable of the Federal Reserve’s next interest-rate cut.

The Fed relies on employment and inflation data to set monetary policy that influences short-term interest rates, a key concern from Main Street to Wall Street.

The release of the January jobs report on Feb. 11 and the Consumer Price Index on Feb. 13 were delayed due to the partial government shutdown.

The employment report will be a blockbuster. And inflation may show a clear picture of prices that was obscured from the last three CPI reports. Board of Governors of the Federal Reserve System

FOMC January meeting holds rates steady

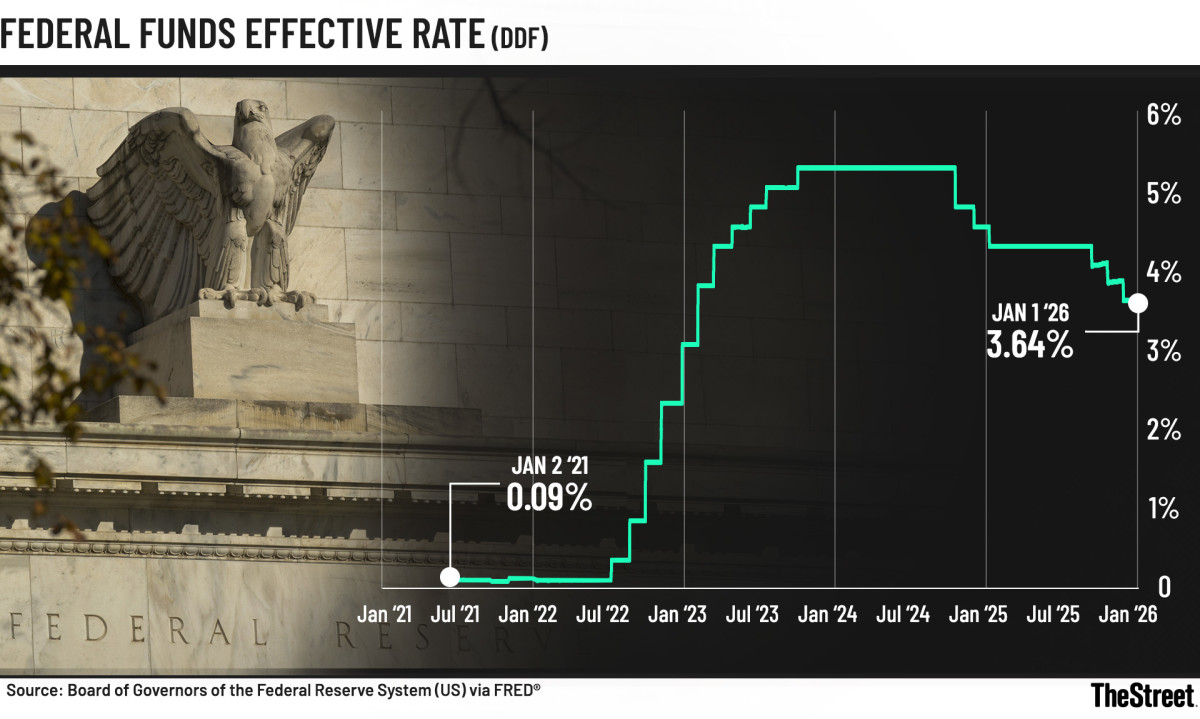

The Federal Open Market Committee voted 10-2 to hold the benchmark Federal Funds Rate steady at 3.50% to 3.75% in January after three continuous cuts of 0.25 percentage points in its last three meetings of 2025.

Fed Governors Stephen Miran and Christopher Waller dissented.

Both said they would have preferred a quarter-percentage-point cut due to softening in the labor market.

It was the FOMC’s first pause since July 2025.

How the Fed manages interest rates

The Fed’s dual congressional mandate requires it to balance inflation and job growth via interest rates.

- Lower interest rates support hiring but can fuel inflation.

- Higher rates cool prices but can weaken the job market.

The two goals often conflict, operate on different timelines and are influenced by unpredictable global events.

After the December rate cut, Fed Chair Jerome Powell said that the lowering of rates brought monetary policy “within a broad range of neutral.”

A neutral rate neither stimulates nor restrains economic growth.

When the Federal Reserve last paused interest rates

The Fed last paused interest rates in September 2023, holding the funds rate at 5.25% to 5.50% after a rapid tightening cycle aimed at curbing post-pandemic inflation.

The pause lasted nearly a year as policymakers wanted to see if the higher borrowing costs would tame inflation without dipping the economy into a recession.

During that pause, inflation gradually cooled and the labor market remained resilient.

The central bank resumed cutting rates in September 2025 once Fed officials became confident that inflation was moving sustainably toward the Fed’s 2% target.

January jobs report will include the benchmark annual revision

In addition to the monthly payrolls and unemployment numbers, each January jobs release by the Bureau of Labor Statistics reports the annual revision to the jobs count.

The so-called benchmark revision to the jobs count is expected to reveal a dip in payroll growth in the year through March 2025.

- The unemployment rate is expected to hold steady at 4.4%, near a four-year high.

- Economists forecast payrolls rose 69,000 in January.

- This would be the best in four months and offer some reassurance against further softening in the labor market.

Related: Goldman Sachs makes jobs prediction ahead of unemployment report

Bloomberg Economics estimated the benchmark revision will lower the level for March 2025 by about 650K jobs — somewhat less pessimistic than the consensus.

January’s jobs print may surprise on the low side, as the Bureau of Labor Statistics “modifies its ‘birth and death’ model to account for recent hiring weakness,” the Bloomberg economists said.

Updated inflation results eagerly awaited

As for the CPI data, economists expect core inflation — which excludes food and energy costs — to rise at the slowest annual pace since early 2021.

Speaking of government shutdowns, last year’s record-long one skewed inflation reports for the final months of 2025.

The December CPI number showed inflation rising at 2.6% year over year. The Fed has set a target of 2% annually.

Hence, the CPI data will be closely watched for evidence inflation is ticking down.

There are some hints that this week’s report could show hot January inflation yet again. Data tracked by software company Adobe showed sharp price increases for goods bought online in January.

“Tariff pass-through had been slow and gradual until December,” Aichi Amemiya, an economist at Nomura Securities, told The Wall Street Journal Jan. 9. “It’s very possible that retailers passed higher costs onto their customers through postholiday price adjustments.”

Fed official cites heightened inflation risk

Federal Reserve Governor Lisa Cook said Feb. 4 that elevated inflation was a greater risk to the economy than a weakening labor market, comments that indicate she could be skeptical of supporting a return to rate cuts.

Cook said the economy has remained resilient and argued that, while the labor market has slowed, conditions are still solid for most workers.

Inflation, meanwhile, remains elevated, and it is too soon to take comfort that price increases are cooling toward the Fed’s 2%-a-year target, Cook said.

Until greater evidence of calmer inflation emerges, “that is where my focus will be, in the absence of unexpected changes in the labor market,” Cook said, adding that after “nearly five years of above-target inflation, it is essential that we maintain our credibility by returning to a disinflationary path and achieving our target in the relatively near future.”

If the Fed were to lose credibility, Cook said “the cost may not be immediately felt, but it would be resoundingly and painfully felt when we need it the most, in an inflation crisis such as the one we experienced three years ago.”

So when is the next Fed interest-rate cut?

At the end of last year, the FOMC penciled in one further rate cut in 2026.

Wall Street traders don’t anticipate seeing more Fed easing until later in the year, as reflected by their bets in interest-rate futures markets.

The CME Group FedWatch tool reports the likelihood of a quarter-percentage point rate cuts as:

- March 17.7%

- April 32.5%

- June 50.4%

White House offers its jobs forecast

President Doland Trump has been aggressively demanding the Fed cut rates as low as 1.0%.

National Economic Council Director Kevin Hassett said Feb. 9 on CNBC that lower U.S. jobs numbers can be expected in the months ahead as population growth slows.

“I think that you should expect slightly smaller job numbers that are consistent with high GDP growth right now,” Hassett said. “One shouldn’t panic if you see a sequence of numbers that are lower than you’re used to, because, again, population growth is going down and productivity growth is skyrocketing.”

Softening labor market has multiple inputs

Tony Welch, Chief Investment Officer at SignatureFD, said in an email to TheStreet that labor market data reinforce an economic moderating narrative.

- Job openings have declined to their lowest level since 2020.

- The ratio of openings to unemployed workers continues to fall.

- Hiring plans have softened.

- Layoff announcements have increased.

“Labor demand appears to be cooling, which typically dampens wage growth and reduces inflation pressure, even if the unemployment rate itself rises only gradually,” Welch said, adding that the “softer labor backdrop is increasingly visible in consumer sentiment.”

For now, “we give the bull market the benefit of the doubt owing to contained inflation, stable interest rates, solid earnings, and positive economic growth," Welch said. "But we are cognizant of a weakening labor market.”

Related: After Rate Cut, Fed Chair Jerome Powell Credits Automation and AI For Contributing to This "Structural" Boom in the U.S. Economy

What's Your Reaction?