Key driver of U.S. stocks powers through tariff uncertainty

Stocks are looking to extend their post-tariff recovery on the back of at least one accepted form of U.S. exceptionalism.

World leaders may possibly now not have the option to foretell President Donald Trump's next switch on tariffs, and heaps enjoy hinted that dealing with the U.S. on policies connected to alternate, safety and immigration has change into increasingly more unreliable.

World merchants, on the opposite hand, know one thing stays particular amid the political turmoil: U.S. companies will always ranking a ability to ranking money.

Steady two weeks previously, the S&P 500 used to be deep in the throes of the worst efficiency in the key 100 days of a new president since the Nixon expertise, the financial system used to be at risk of sliding into an abrupt recession, and merchants had been fleeing even the safest of U.S. resources.

But while some analysts had been debating the "sell The usa' alternate, and European shares had been outperforming their American chums by basically the most attention-grabbing margin in a few years, S&P 500 companies had been quietly alongside side to their spectacular income gains.

With round three-quarters of the benchmark's constituents reporting first-quarter earnings up to now, collective earnings are location to upward push 13.6% from a year earlier to $533.1 billion. That's a $12 billion enchancment from earlier forecasts, powered by big gains in smartly being care, tech and utilities, and is derived amid a 0.3% contraction for the broader domestic financial system. BRENDAN SMIALOWSKI/Getty Footage

Megacap tech companies, meanwhile, enjoy largely reiterated their plans to spend billions on investments in artificial intelligence, even amid threats of most up-to-date levies on semiconductor imports and restrictions on gross sales to China. Capital spending on AI is on tempo to hit a staggering $325 billion this year by myself.

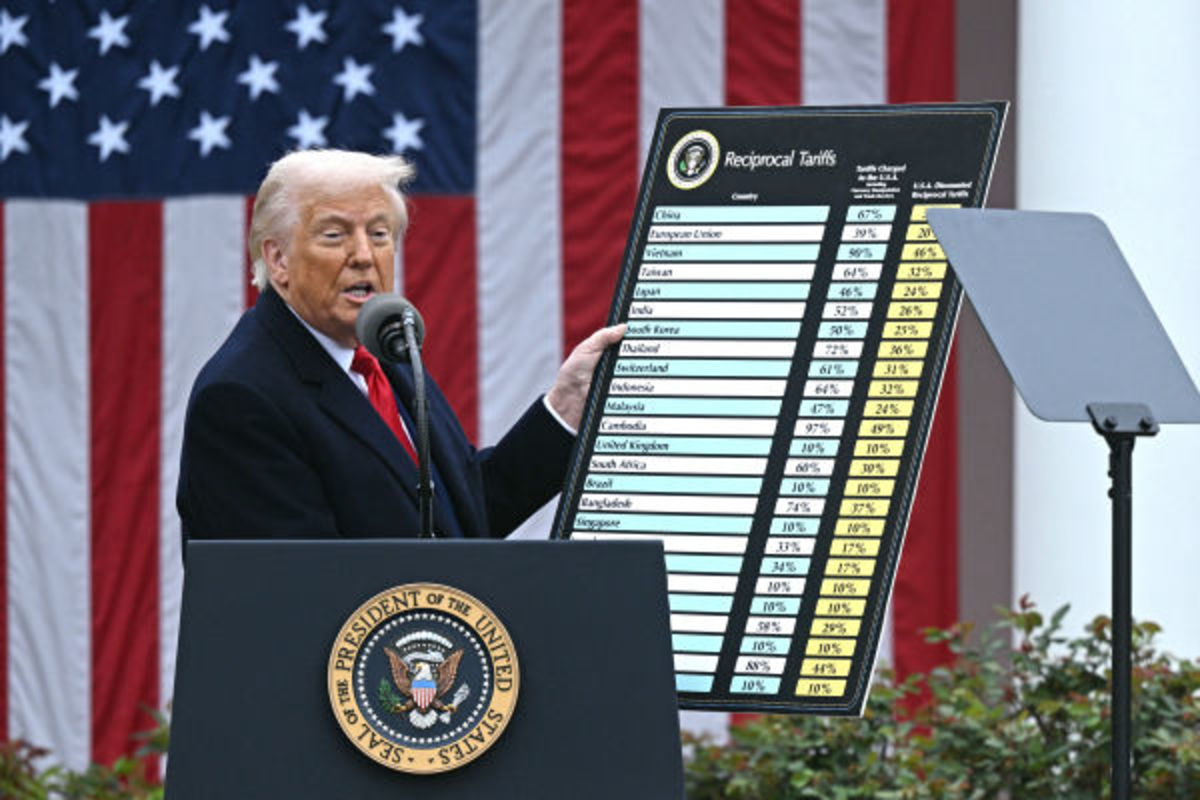

The spectacular earnings haul and buoyant tech outlook enjoy helped the S&P 500 rally 14% from its early April trough, the bottom ranges of the year, and lifted the benchmark again above its April 2 shut. That's when Trump unveiled what he known as Liberation Day tariffs on nearly each one of The usa's global trading companions, as adversarial to Russia.

Markets are searching for route

Or now not moreover it is a ways left markets searching for route now that the pretariff shut has been reclaimed, first-quarter earnings season is basically on the again of us, and two Federal Reserve rate choices and a host of potential alternate affords are looming on the horizon.

"The tempo of this rally has been important," stated Jay Woods, chief global strategist at Freedom Capital Markets. "On the opposite hand, to call it the staunch thing there could be a couple of important overhead resistance to ranking via before giving the bulls again the reins."

Firm bosses are cautious, with apt over half of the S&P 500 companies which enjoy issued stout-year income steering coming in below Wall Facet twin carriageway forecasts. Recession references, meanwhile, are running on the most effective ranges since 2023, per Bloomberg recordsdata.

Associated: Fed inflation gauge sets up stagflation dangers as tariff policies bite

"As merchants look against the arrival months, it’s clear this earnings season has equipped reasons for cautious optimism, yet also highlighted areas of predicament," stated Jacob Falkencrone, global head of investment diagram at Saxo Financial institution.

"The strength in corporate earnings, particularly in sectors resilient to financial uncertainty, is encouraging," he added. "On the opposite hand, caution stays valuable as tariffs, cautious corporate steering, and mixed financial alerts continue to manufacture uncertainty."

Earnings assert is in focal point

But many are also optimistic that a resilient job market can drive person spending and a deal-motivated president will soothe tariff predicament in coming months.

Wall Facet twin carriageway, nonetheless, has pared its 2025 earnings assert forecast sharply since the originate of the year, and it now sees collective earnings rising 8.9%, compared with its early January consensus of round 14%.

Composed, a host of factors may possibly see that resolve toughen sharply over the summer and former, potentially powering a solid 2d-half of rally for the S&P 500.

Associated: U.S. recession risk leaps as GDP shrinks for the key time since 2022

Financial situations, a time length frail to characterize a series of factors affecting person and company search recordsdata from, enjoy eased critically exact via the last five months.

World oil prices are trading shut to their lowest in four years, and sharper manufacturing increases from the OPEC cartel tend to stress them extra.

In the intervening time, Treasury bond yields enjoy tumbled, potentially stoking more cost effective mortgage rates and borrowing expenses, and the U.S. buck is down better than 8% this year, alongside side extra worth to the in a a ways flung places country earnings of S&P 500 companies.

The Fed is also expected to originate reducing its benchmark lending rate later this summer, with CME Community's FedWatch pricing in three consecutive quarter-point reductions starting in July.

That will possibly add to the easing of business situations, which may possibly support the U.S. financial system steer a ways from recession while alongside side a further boost to stock efficiency.

Succor will seemingly be on the formulation

And any dial-again of the president's tariff diagram -- be it via carveouts for varied sectors, a entire alternate address China, or a tax prick extension from Congress -- would provide even extra pork up for U.S. shares heading into the autumn.

"Despite a recent effective rate that is round 17%, consensus has centered on a 10% universal tariff," a level that Lisa Shalett, chief investment officer and head of the World Funding Place of job at Morgan Stanley Wealth Management, known as "negative" but "digestible."

"Although it could possibly possibly grab months for alternate affords to be signed, merchants seem sharp to search via tariffs with great hopes for resolution this summer of a debt ceiling/funds reconciliation bill and stimulative tax bill," she stated.

More Financial Diagnosis:

- Fed inflation gauge sets up stagflation dangers as tariff policies bite

- U.S. recession risk leaps as GDP shrinks

- Love it or now not, the bond market principles all

JP Morgan strategists on Monday estimated that a rally to 6,000 points for the S&P 500 used to be more seemingly than a stride to 5,000 points over the shut to time length as "markets overshoot with earnings season stronger than expected (and) alternate battle headlines tend to continue to come out positively."

Tom Lee of Fundstrat is also bullish, telling CNBC Monday that corporate-earnings efficiency is at risk of be the key driver for shares to retest their early-year highs.

"Firms enjoy proven themselves to o location up via shocks and I ruin now not judge merchants give them adequate credit ranking for that," he stated. "That came about with Covid; companies survived a bullwhip raise out on the financial system, a surge in inflation and the quickest Fed rate hikes on file.

"So I judge this tariff shock, while it is surprising, earnings will potentially outperform expectations," he stated.

What's Your Reaction?