Nvidia-backed stock sinks on unexpected deal

Here's why this AI company's shares are tumbling.

I am deeply skeptical about AI, however even extra so about crypto. Lib.rs best explains it: "A thriving market for magic beans would not earn the magic beanstalk proper."

That is no longer a random web set, however one connected to the Rust programming language, maybe the most popular one ancient in crypto-connected corporations.

Predicting the future of any tech bubble is no longer easy, however most frequently it's some distance no longer predominant.

Related: Analysts lift Micron stock stamp target, ship warning

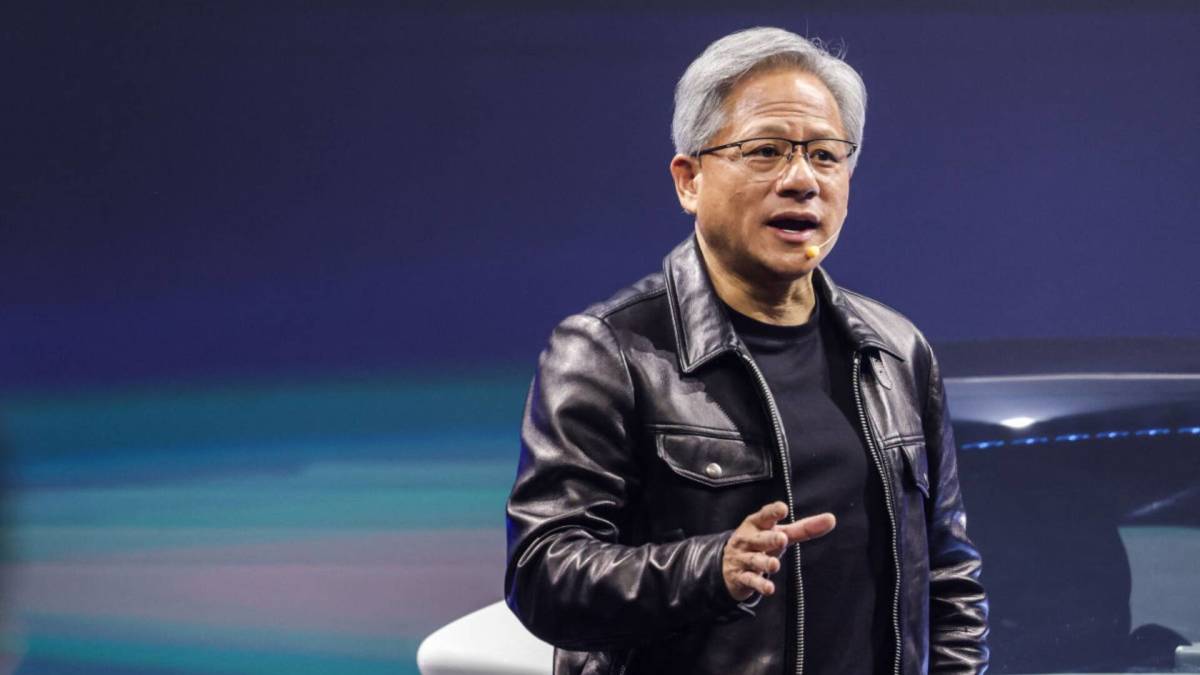

The main is having a flexible tech stack that allows the firm to pivot snappy to one other market. Upright mediate of Nvidia, which ancient the gaming yell to swap to the crypto yell, to snappy swap to the artificial intelligence hype tell.

You can not earn sure when the bubble will burst, however are trying to be ready.

Nvidia is no longer the very best one who pivoted from crypto to AI. But every other is Atlantic Crypto Corporation. It ancient to mine crypto ahead of changing its name to Coreweave and switching to a cloud computing and AI coaching replace. Erik Isakson/Tetra Photos through Getty Photos

CoreWeave is heavily backed by Nvidia

CoreWeave's (CRWV) replace mannequin lets in corporations to remotely "hire" its Nvidia GPUs for AI coaching. Nvidia's reliance on CoreWeave playing cards could be why Nvidia owns roughly 5% of CoreWeave.

The connection appears to be like to present CoreWeave certain market privileges, so it wasn't ravishing when CoreWeave presented on July 3 that it's the principle AI cloud provider to deploy the latest NVIDIA GB300 NVL72 playing cards.

Compared to the outdated generation of NVIDIA Hopper architecture, the chips offer a wide efficiency and energy effectivity jump for AI reasoning and agentic workloads.

Related: Analyst sends Alphabet warning amid search market shakeup

Rising inquire for AI coaching led CoreWeave to magnify its take care of OpenAI in Q1, bringing the total contract value to $15.9 billion.

The firm expects total income of $4.9 billion to $5.1 billion in 2025. On the different hand, capital expenditures could reach $23 billion.

Bank of The USA analysts nowadays downgraded CoreWeave's stock rating, arguing there is less room for shares to inch greater.

Corweave shares sink on merger announcement

CoreWeave presented on July 7 that this would have faith Core Scientific (CORZ) in an all-stock transaction.

Core Scientific is one other crypto mining firm known for "digital mining at scale." So, maybe merging with a firm that affords AI coaching and has the identical roots makes sense.

The merger deal is valued at roughly $9 billion. CoreWeave argues the deal will help verticalize its data heart footprint, ensuring extra income yell.

More AI Shares:

- Historical fund supervisor raises eyebrows with latest Meta Platforms transfer

- Google plans main AI shift after Meta’s ravishing $14 billion transfer

- Analysts revamp forecast for Nvidia-backed AI stock

Core Scientific stockholders will receive 0.1235 newly issued shares of CoreWeave stock for every allotment of Core Scientific stock in step with a mounted swap ratio. If the deal will get finalized, CoreWeave expects Core Scientific's stockholders' ownership of the combined firm to be no longer up to 10%.

CoreWeave will have faith 1.3 GW of nasty energy all over Core Scientific's national data heart footprint, with an incremental 1 GW+ of potential nasty energy available for expansion.

Advantages of this deal consist of:

- Cost savings through streamlining replace operations and attempting down hire overhead.

- Improved administration over the energy footprint and possibility for future energy capability.

- Elimination of over $10 billion of cumulative future hire overhead to be paid for existing contractual web pages over the next 12 years.

- Possibility to repurpose in opposition to high-efficiency computing

On story of this deal is an all-stock transaction, this would dilute CoreWeave's existing shareholders by reducing their ownership percentage. Core Scientific shareholders will additionally withhold a important smaller percentage of the combined firm.

CoreWeave and Core Scientific shares tumbled on the announcement. Finally test, CRWV shares were buying and selling 3% decrease shut to $160, and CORZ 17% decrease shut to $15.

Related: Oracle CEO sends blunt 2-phrase message on its replace

What's Your Reaction?