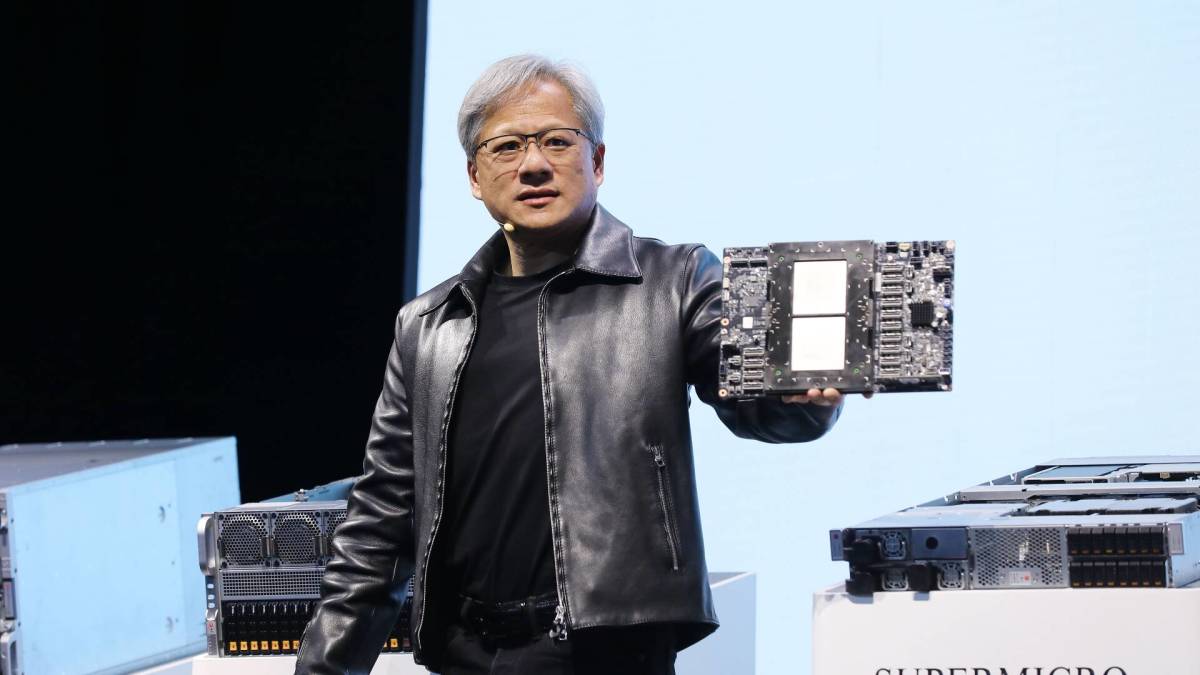

Nvidia CEO Jensen Huang could reboot AI trade with GTC address

The AI trade has stalled this year. Jensen Huang's speech today could change that.

Nvidia shares edged better in early Tuesday procuring and selling as investors looked to the tech big's extremely-anticipated GTC event this week in San Jose to kick-start a rally for the area's leading AI chipmaker.

Nvidia (NVDA) shares touched a six-month low leisurely ultimate week, and live deeply in the crimson since the start of the year, amid broader selloff in tech stocks and concerns that growing opponents and a pullback on AI funding spending will weigh on query of for its newly-launched line of Blackwell processors.

Merchants delight in been moreover spooked by the emergence of China-based DeepSeek's AI chatbot earlier this year, which the startup claims became as soon as built, knowledgeable and launched at a chunk of the cost of its US competitors the lisp of only lower-grade Nvidia 'hopper' line chips.

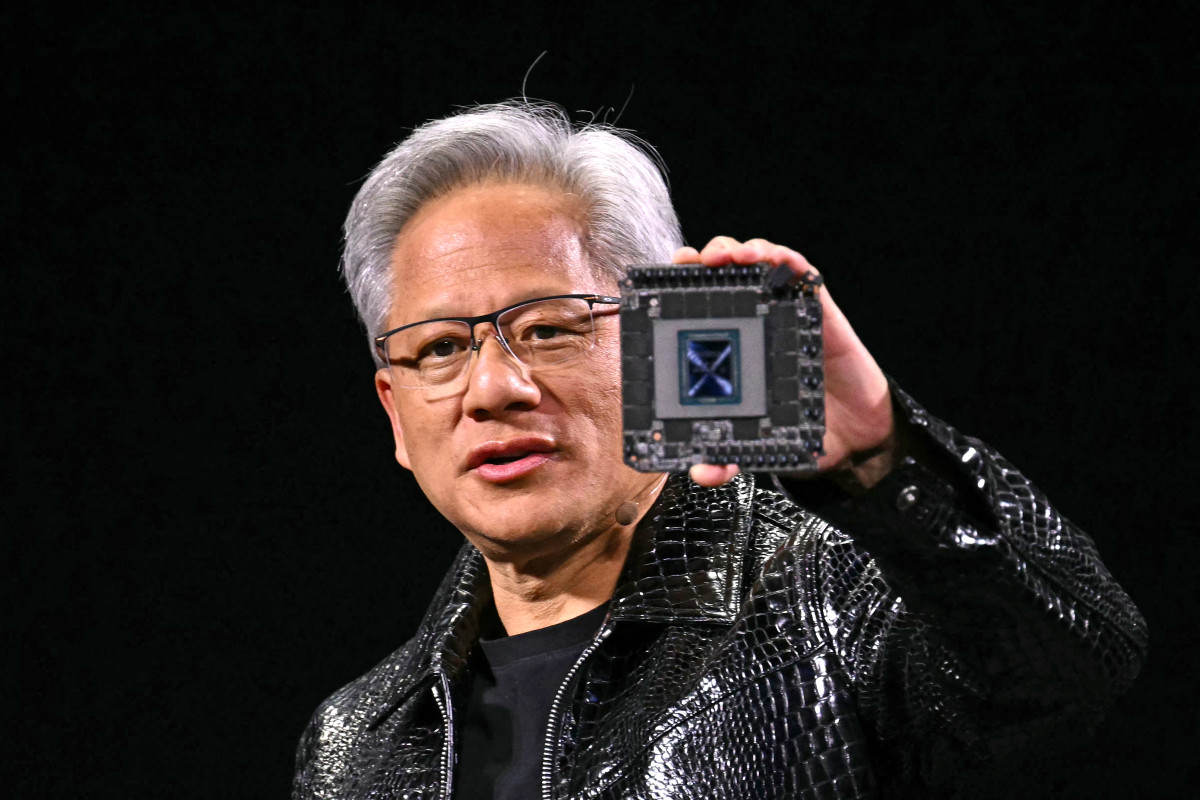

Nvidia CEO Jensen Huang will delight in a bet to communicate to all of those concerns, while seemingly unveiling the latest iteration of the Blackwell lineup, Blackwell Extremely, throughout his keynote deal with to the GTC convention on Tuesday.

The corporate says he'll deal with on the long term of agentic AI, robotics and accelerated query of, but investors are seemingly to focal level on his remarks tied to Blackwell query of, AI funding spending from Nvidia's best potentialities and the timing of Rubin, its next-expertise processor architecture.

Named after the American astronomer Vera Rubin, who is credited with discovering so-called darkish topic, the brand new Rubin systems are expected to be rolled out in 2026. PATRICK T&duration; FALLON/Getty Photos

“AI is pushing the boundaries of what’s which that that you can imagine — turning the day before this day’s dreams into this day’s actuality,” Huang acknowledged in Nvidia release ultimate week. “GTC brings collectively the brightest scientists, engineers, developers and creators to bear and salvage a larger future."

China, tariffs and Blackwell query of

He'll moreover seemingly should weigh in on politics, given the impact that tariffs on Asia-made items are seemingly to delight in on its industrial mannequin, which relies on a producing inferior in Taiwan, besides to the likelihood of stricter export guidelines on high-cease applied sciences to potentialities in China.

Nvidia remains essentially sound heading into the event, even supposing the stock's momentum has stalled noticeably over the final six months.

The community's fourth quarter earnings, published in leisurely February, integrated a 78% year-on-year surge in overall revenues, which topped $39 billion, as effectively a a stronger-than-expected $11 billion contribution from the these days-launched Blackwell line.

Connected: Fund manager sends blunt message on Nvidia stock sooner than convention

Nvidia moreover acknowledged it sees fresh-quarter revenues rising one other 10% sequentially, to round $43 billion, amid what the company described as "snappy rising query of for AI reasoning fashions and brokers."

That acknowledged, proof is beginning to mount that some of Nvidia's best potentialities, including Microsoft (MSFT) and Amazon (AMZN) , are slowing AI spending plans amid an extended-than-expected gap between building their new infrastructure and producing backside-line profits.

AI spending pullback?

Microsoft is reportedly canceling some leases with non-public records heart operators, and slowing the spin of converting reasonably about a agreements, while Amazon's come-time duration spending plans counsel an annual spin that's largely according to the $26.3 billion it spent over the three months resulted in December.

The sphere-centered VanEck Semiconductor ETF, meanwhile, is down larger than 6.5% to this level this year, round twice that of the S&P 500, with Meta Platforms (META) the single Just 7 stock in obvious territory.

Extra AI Shares:

- Nvidia-backed startup would per chance be most as much as the moment tech IPO of the year

- Apple blames title-calling glitch on its new AI characteristic

- Several AI leaders are interested a pair of deal that can save Intel

"We're to begin with of reasoning AI and inference time scaling," Huang advised investors in February. But we're appropriate on the start of the age of AI, multimodal AIs, enterprise AI sovereign AI and bodily AI are neutral round the nook."

"We are capable of develop strongly in 2025," he added. "Going forward, records amenities will commit most of capex to accelerated computing and AI."

Nvidia shares delight in been marked 0.14% better in premarket procuring and selling to showcase an opening bell label of $119.70 every.

Connected: Old school fund manager unveils seek-popping S&P 500 forecast

What's Your Reaction?